What can the platinum gold ratio tell us about the future price of gold?

Bullion.Directory precious metals analysis 20 March, 2015

Bullion.Directory precious metals analysis 20 March, 2015

By Terry Kinder

Investor, Technical Analyst

The platinum gold ratio isn’t necessarily something most of us think about or follow from day to day. However, in conjunction with other indicators, this ratio can tip us off to important trend changes in the price of gold.

Some of the best work on the platinum gold ratio has been done over at Zeal LLC. If you want to learn about the ratio in detail I highly recommend you read the following article on their web site in its entirety.

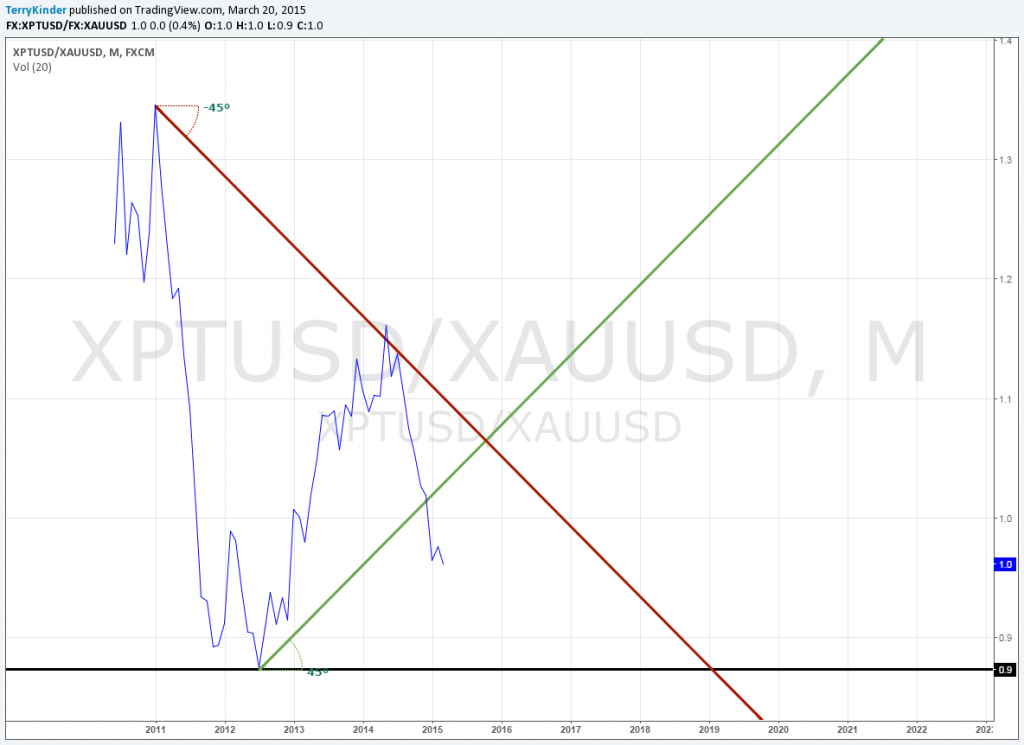

Like many ratios, the platinum gold ratio is a good way to see when either platinum or gold have reached price extremes in relation to each other. Below is a chart of the ratio.

When the platinum gold ratio reaches an extreme high, as it did in early 2011, that’s a potential signal that the gold price is about to move higher, perhaps dramatically so

A good example of how to use the platinum gold ratio can be seen clearly near the beginning of the chart. In January 2011 the ratio reached 1.4, meaning an ounce of platinum could buy 1.4 ounces of gold. At the time, the gold price was around $1,333.80. By August of the same year, a mere eight months later, the price of gold was $1,829.30 – almost $500.00 higher.

The opposite proves true as well. In July 2012 the platinum gold ratio dropped to around 0.9 meaning an ounce of platinum was only worth 0.9 ounces of gold. That same month the gold price was $1,610.50. By July 2013 the platinum gold ratio moved to 1.1 and gold was $1,223.70. In less than a year the price of gold dropped nearly $400.00.

Currently the platinum gold ratio is hovering around 0.96. Should it continue to move back toward the 0.9 level, the gold price would likely move higher (or the platinum price could simply drop much faster than the gold price).

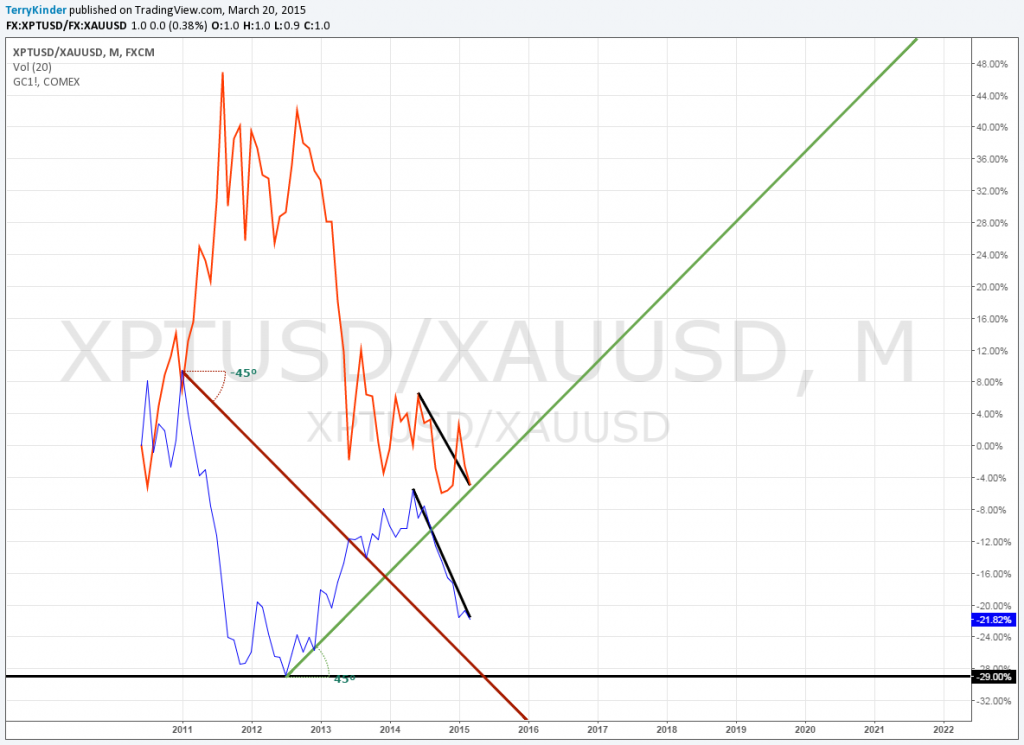

Normally, the platinum gold ratio (blue line) and the gold price (red line) would move in opposite directions. Currently, they are running in the same direction.

Before we finish, let me point out one more interesting detail that can be seen in the above chart. Normally, the platinum gold ratio and the gold price, over longer time periods, move in opposite directions. However, except for a move higher in gold that later reversed, the ratio and the gold price are moving the same direction. This tends to reinforce the idea that the recent gold price bounce may have legs, at least until the ratio draws nearer to 0.9.

Conclusion

Despite gold’s fairly steep price decline since 2011, a return of the platinum gold ratio to 0.9 would imply a further push lower in the gold price. Why is this so? The gold price should move higher, relative to the platinum price as the ratio approaches 0.9. Then, as the ratio moves back above 1, the gold price will move lower (or at least lower in relation to the platinum price). It will ultimately take another extreme in the value of platinum versus gold to signal the next bull cycle in gold.

While you don’t want to use price ratios by themselves to make buying, selling or holding decisions, when used in conjunction with your favorite other technique or techniques, they can reinforce other data, and provide signals when price extremes are near or have been reached.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

I never thought to use Pt:Au as an indicator Terry, learn something every day thanks. I just took platinum being below gold as a buy signal for platinum… Guess that’s why I’m no analyst!