King Dollar’s Global Currency Destruction Continues

Bullion.Directory precious metals analysis 26 September, 2022

Bullion.Directory precious metals analysis 26 September, 2022

By Paul Engeman

Director at Ainslie Bullion

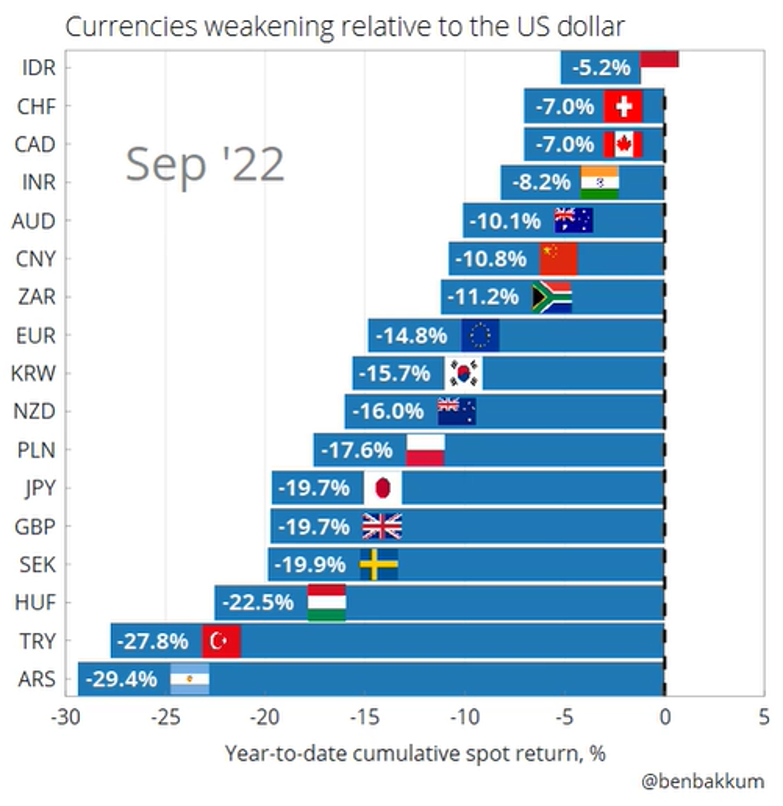

A few “highlights” of Friday’s trading session:

- AUD – down 1.7% (down 10.1% year-to-date)

- EUR – down 1.46% (down 14.8% year-to-date)

- GBP – down 3.74% (down 19.7% year-to-date)

- JPY – down 0.65% (down 19.7% year-to-date)

Gold, meanwhile, has not cracked under the weight – with the price currently at the same as where it started the year. As we are now, in late September 2022, the US dollar is at a 20-year high, while gold hasn’t made any gains. That is in part because transactions of commodities, including gold and other precious metals, usually happen in dollars.

A stronger currency makes it more expensive for foreign investors to buy in and can reduce demand, pushing down prices.

The fact that gold has remained steady even during these truly extreme times of USD strength is a testament to the precious metal’s resilience.

While the dollar remains the single most potent force in international finance, its strength is becoming its biggest downfall. Cracks in the structure of US financial domination are beginning to show – because the world has been forced to look for an alternative.

Significant amounts of money are being moved by institutional investors, like banks and retirement funds as well as retail investors. They are all looking for a relatively stable place to park that money – the US Dollar.

Additionally, the sheer amount of dollar debt that exists outside the United States domestic economy due to the dollar’s world reserve currency status is the reason that global economic slowdowns and a strengthening dollar come hand in hand.

This dynamic has led us to a range of real complications. A stronger dollar is usually not great for consumers in other countries. It means American goods and services are more expensive.

It also means that international companies are hurt. Multinational corporations like Apple and Tesla get so much of their revenue from consumers in other countries – where the products are increasing in price. These big shifts in the exchange rates could also influence where and how they do business.

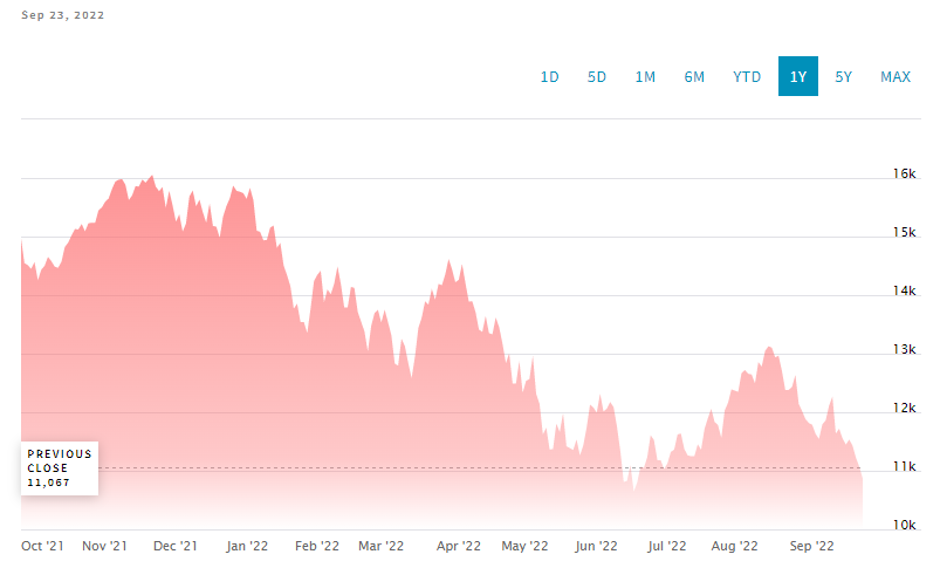

The poor conversion rate will also hit the bottom line of US companies that do a lot of their business in foreign markets, like the U.S. tech sector, which generates 60% of its revenue in foreign markets. Want to see the effect of this? Check out the NASDAQ…

None of this is great, especially for emerging market economies. This is also why we saw global stock markets take a plunge on Friday – S&P and ASX sinking back down, almost printing new yearly lows.

More seriously for the USD, significant global transactions are beginning to take place in other currencies. Back when Nixon took the gold standard out of the equation, US foreign policymakers were careful to secure an understanding from Saudi Arabia that oil trades would continue to be denominated in US currency.

That continues to be the case – for now…

An example of countries searching for USD alternatives in India who are doing some hydrocarbon deals with Russia in a currency other than the dollar. And that China is experimenting with a range of alternatives when it comes to the purchase of the multi-varied commodities suite that it needs to keep its huge economy running.

Russia has been pushing hard for payment in rubles from its European customers – and why not? – it has the product to sell and a currency it wants to be paid it.

And that’s why, although the dollar is running rampant against the other major currencies in the world, the same can’t be said of gold.

“If something breaks” seems to be turning into a “when something breaks” when it comes to the USD.

If or when this does occur, you might want to have some gold tucked away.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply