Last night saw more volatility on markets as the much anticipated US CPI figures were released and were hotter than expected.

Bullion.Directory precious metals analysis 12 May, 2022

Bullion.Directory precious metals analysis 12 May, 2022

By Paul Engeman

Director at Ainslie Bullion

Indeed that 0.6% core inflation reading, which strips out volatile items such as energy and food, was double the 0.3% in the prior month putting further doubt in the market’s mind that inflation has peaked and putting even further pressure on the Fed to hike more aggressively.

The tech heavy NASDAQ again took the biggest blow, down nearly 3.2% overnight and now down 30% from its highs. That saw its adopted correlation with crypto see big losses in crypto as well.

Gold, silver and platinum were all up strongly amid the carnage but bonds down and yields surging, particularly at the short end.

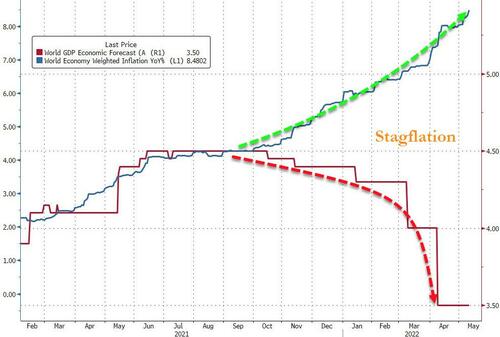

Stagflation at a global level certainly appears beyond doubt now.

Whilst gold has certainly taken a hit over the last weeks, it has held up in a dramatic environment that has seen bond yields spike, tech stocks meltdown, and trouble in crypto markets.

Addressing the health of the U.S. financial system during her testimony before the U.S. Senate Banking Committee BEFORE this CPI print, Treasury Secretary Janet Yellen indicated that everything [the selloff] is taking place in an ‘orderly manner’, but despite this, ‘valuations of some assets remain high compared with historical values.’ She is far from the only mainstream commentator hedging post the Fed’s tightening at the last FOMC meeting.

Former Fed Chair Yellen, also spoke about the risks facing economic stability include Russia’s invasion of Ukraine and China’s COVID lockdowns. As a consummate insider, who is unlikely to pick a recession until 6 months after it has started, any hint of negativity speaks volumes.

She isn’t the only one seeking to blame geopolitical conflict as the cause of market volatility. Fed Vice Chair Lael Brainard has echoed concerns.

Fed representatives are now actively sounding the alarms of a liquidity crisis: The central bank also said liquidity conditions have worsened notably elsewhere, meaning traders of key global assets are finding it harder to buy and sell without moving the market.

“While the recent deterioration in liquidity has not been as extreme as in some past episodes, the risk of a sudden significant deterioration appears higher than normal,” the Fed report said.

“Liquidity has been somewhat strained at times in oil futures markets, while markets for some other affected commodities have been subject to notable dysfunction.”

The calls for recession are creeping into the headlines and editorials of many news outlets, however, one of the few commentators not calling for a recession on the horizon was JP Morgan’s chief strategist, Marko Kolanovic. Speaking on Monday night after a brutal day on the equities markets: “The past week’s sell-off appears overdone, and driven to a large extent by technical flows, fear, and poor market liquidity, rather than fundamental developments”.

While we expect growth to soften, we continue to push back on a base case assumption that the global economy is headed for recession, an outcome that is increasingly being priced by markets.”

Last night did nothing to help his argument. So whilst the political talking heads are calling for calm and last night President Biden said inflation was now “the No. 1 problem facing families today” and “I want every American to know that I’m taking inflation very seriously, and it’s my top domestic priority,”, the horse has bolted.

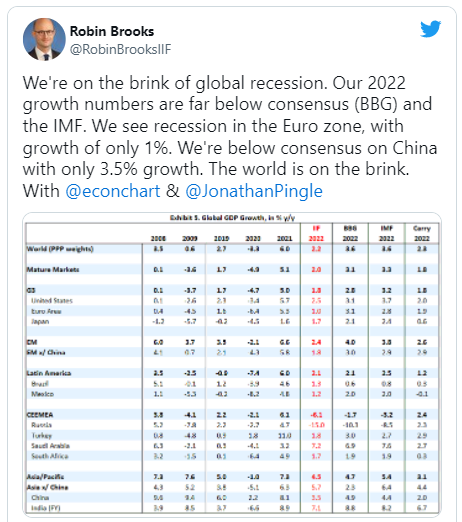

The more independent voice of the Institute of International Finance’s Chief Economist summed it up in a tweet last night…

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply