Gold Price Hits $1230, Silver Comex Bets Jump, as France’s Le Pen + Ukraine ‘Add to Trump Risk’ on Iran

Bullion.Directory precious metals analysis 6 February, 2017

Bullion.Directory precious metals analysis 6 February, 2017

By Steffen Grosshauser

European Operations Executive at Bullion Vault

Silver rose alongside, but lagged the new highs in gold prices to hit $17.66 per ounce – some 6 cents short of Friday’s new 12-week peak.

Proposing a 10% cut to France’s income tax rate for lower-earners, plus retention of the 35-hour working work, Le Front National’s 144-point manifesto says Le Pen would begin 6 months of “radical” renegotiations on France’s membership of the EU if elected in May.

Fearing a loss of access to the EU’s 500 million consumers, more than half of UK business leaders believe the British economy has already suffered from last year’s Brexit vote, despite the actual process of leaving the EU not having begun, according to the Ipsos Mori opinion pollsters.

With European shares inching lower – and French bond yields doubling so far in 2017, rising sharply above comparable German rates – gold added 0.8% for the week so far to reach the highest Dollar price since mid-November.

“Gold and silver [could] continue to move higher in February,” reckons brokerage INTL FCStone analyst Edward Meir, “largely on account of the continued weakness in the Dollar, coupled with geopolitical developments.”

While new US president Donald Trump and Nato alliance chief Jens Stoltenberg discussed the escalating violence with pro-Russian separatists in Ukraine‘s easterrn Donbass region with at the weekend, “The [US] standoff with Iran is the most problematic,” says Meir, because “if tensions escalate…one side or the other could pull out of the nuclear accords.

“We could see an immediate spike in gold.”

Looking further ahead, “gold will climb about 6%” in 2017 due to “the amount of political risk being created by this new US president,” reckons Independent Strategy analyst David Roche.

Winner of the London Bullion Market Association’s 2016 Forecast competition, Swiss bullion bank UBS’s analyst Joni Teves now sees gold prices averaging an 8% gain this year in Dollar terms, citing “elevated macro risks” to other investment assets.

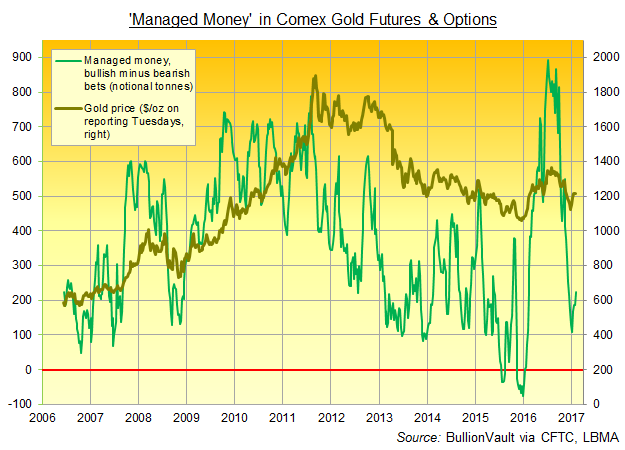

Money managers betting on gold prices through Comex futures and options grew their bullish positions and cut their bearish contracts as a group last week, new data showed late Friday.

Altogether, that raised their ‘net speculative long’ position on gold prices by more than one-fifth to an 8-week high, still only 60% of the last 10 years’ average.

Comex silver contracts meantime saw the Managed Money category extend its net speculative long betting another 14% according to positioning data reported to US regulator the CFTC.

Reaching a 17-week high, the net spec’ long amongst money managers in Comex silver stands 176% larger than its 10-year average.

The giant iShares Silver Trust (NYSEArca:SLV) in contrast shrank last week, cutting the exchange-traded trust fund’s holdings to a new 7-month low.

Holdings of the world’s largest gold-backed ETF vehicle, the SPDR Gold Trust (NYSEArca:GLD), grew around 0.4% to 814 tonnes on Friday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply