The reason our mantra is “Balance your wealth in an unbalanced world” is because in such unprecedented times it should be expected that experts can have such divergent theses on ‘what’s next’.

Bullion.Directory precious metals analysis 01 June, 2022

Bullion.Directory precious metals analysis 01 June, 2022

By Paul Engeman

Director at Ainslie Bullion

It will then be ‘risk on’ again and up go growth shares and crypto and gold as well on more monetary debasement. Today we talk to Crescat Capital’s thesis via their latest research letter of 2 days ago and it is in many respects starkly different. So what do they have to say?

“Too Soon to Buy the Dip, Unless It’s Commodities

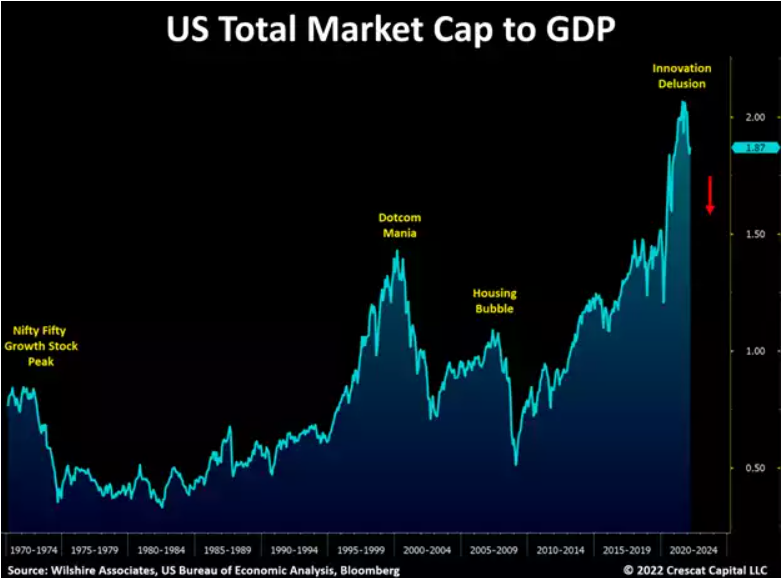

The valuation of the Wilshire 5000 US Total Stock Market Index reached a historic high of 207% of GDP in 2021 in the wake of the Covid-19 stimulus and record corporate earnings. We are now entering what in Crescat’s analysis is an inflationary recession. The index is off 15% from its all-time highs but still trading at 187% of GDP. During comparable stagflations of the early 1970s and 1980s, the associated equity bear markets did not end until the total stock market capitalization traded down to an average of 35% of GDP.

Even if nominal GDP were to grow a full 20% over the next two years, not out of reason in today’s historically high inflationary environment, there is the potential for a further 78% decline in stock prices from current levels to settle at the low multiples of the last stagflationary era. While the market could bottom at higher multiples this time around, we must acknowledge the downside risk if we are indeed in just the early stages of new stagflationary regime.

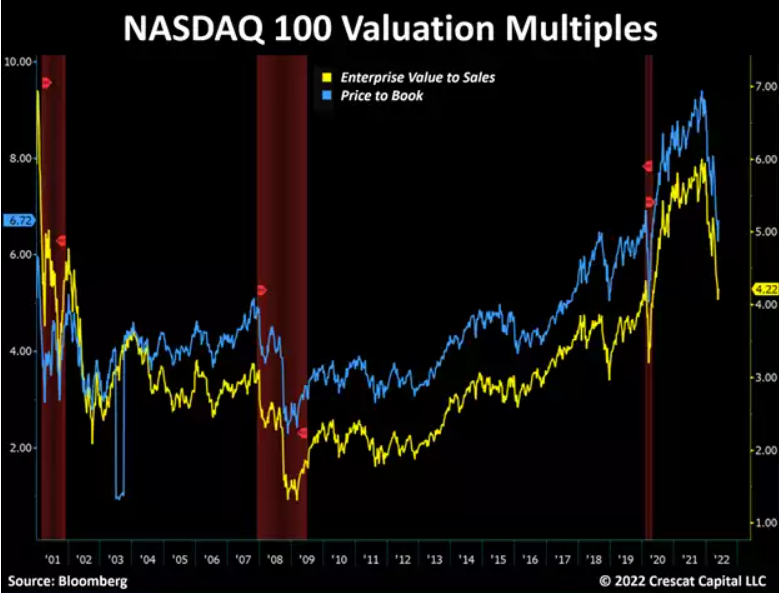

Similarly, the popular NASDAQ 100 Index is already 23% off its highs, but it is still trading at lofty valuation multiples with price to book and enterprise value to sales multiples of 6.7 and 4.2 respectively. If we look at comparable bear market regimes, there is still substantial downside risk for this large cap tech index.

For instance, after the tech bust in October 2002, the NASDAQ 100 bottomed with a price to book value of 2.7 and an enterprise value to sales ratio of 2.1. And, during the Global Financial Crisis, in March 2009, the index bottomed with multiples of 2.5 and 1.3 respectively.

Conservatively, if we assume flat sales and earnings over the next one to two years during a probable recession, there is another 50% to 69% downside risk. Sure, the market may bottom at higher valuations, but this is the eyes-wide-open risk based on math and history.

The Great Rotation

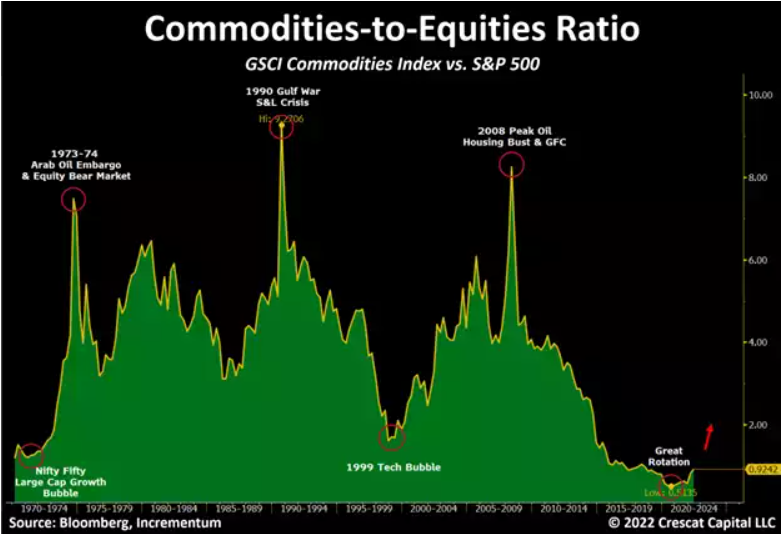

Despite the downside risk in the market at large, it is extremely important to note that there is tremendous value, medium-term growth, and upside appreciation potential in a narrow segment of the stock market today: commodity producers.

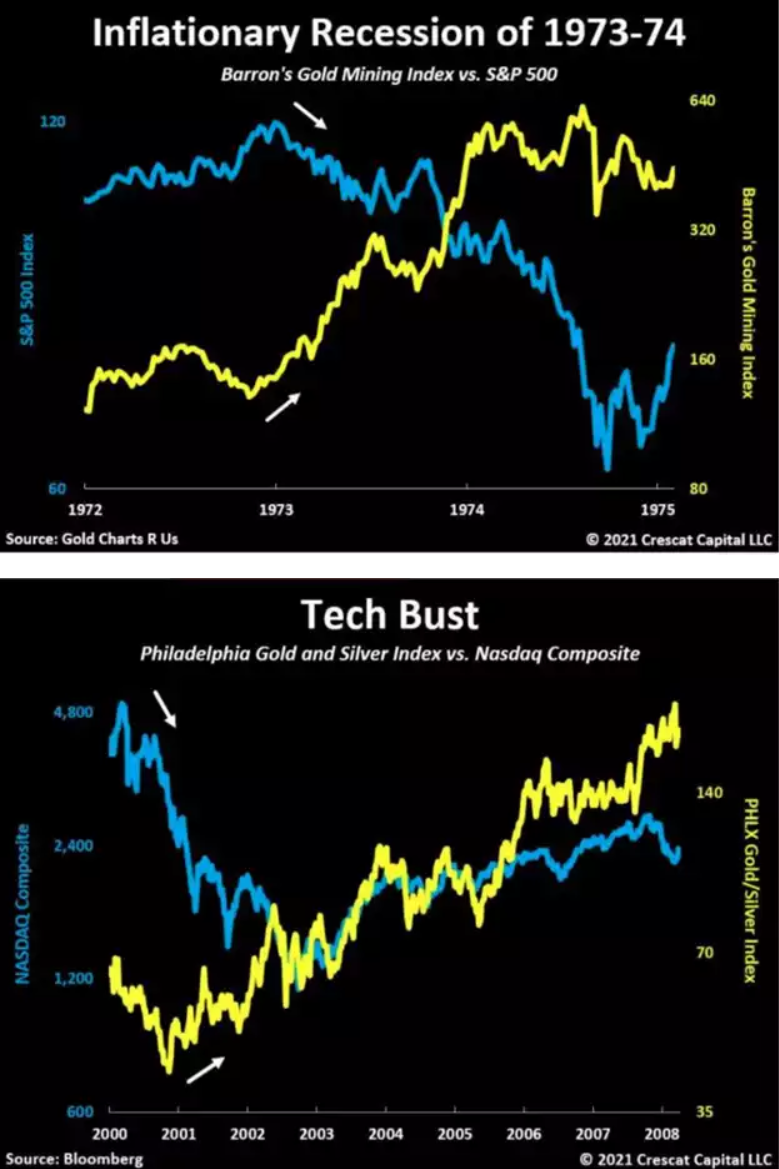

It is still very early, in our analysis, in the rotation cycle out of overvalued growth equites and low yielding fixed income securities and into commodities. It is just like early 1973 and early 2001 in our view the three charts below help make evident:

To maintain our promise of making our news articles reasonably short and sharp, we will continue tomorrow on why Crescat think inflation will stay high longer (in contrast to Pal’s reversal to disinflation thesis), why the Fed is trapped, and reinforce the tantalising setup for commodities including silver and gold.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply