Data watchers beware!

Bullion.Directory precious metals analysis 14 November, 2015

Bullion.Directory precious metals analysis 14 November, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

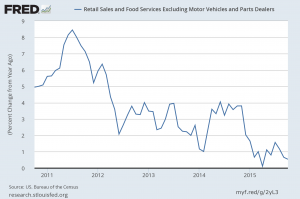

What was most notable is that the 1.7 percent year-over-year print was the second lowest since the financial crisis, and the ex-autos retail sales figure was a mere .5 percent. The lackluster retail sales were broad-based with every major category declining.

Since 2011, retail sales have not been able to muster any growth as seen here:

(no sign of those strong consumers via gas “savings”)

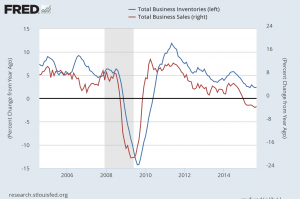

Business inventories surprised to the upside. Economists were expecting the already record-bulging inventories to come in with no change, but to their dismay, inventories were up .4 percent. The inventories-to-sales ratio is at a recessionary 1.38, which I first began to bring to the forefront back in during the first-half of this year. Business sales growth have not been this low since the financial crisis.

Let’s pretend the Fed is not market-dependent for a moment. Going by the myriad of horrendous data points that show the U.S. clearly slowing down, how could the Fed ever hike rates into a slowing economy? So, in essence, they could be data-dependent after all.

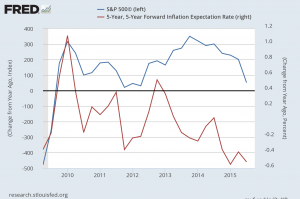

Furthermore, deflationary pressures are still mounting. Price action is looking for 100 on the dollar index on the idea the Federal Reserve will hike interest rates, a 70 percent chance in December according to the Fed fund futures.

But when inflation is the name of the game, Janet Yellen surely will not add kerosene to the wild fire by hiking rates even by a marginal 25 or 50 bps. The very thing Ben Bernanke worked so hard for (higher stock prices) is at stake, not to mention any hope of inflation near two percent.

I have been saying it going on two years now: the Fed cannot hike without sparking a eurozone-like deflation. What would be even worse is if the Fed were to hike only to reverse course as the volatility Kraken awakens, which is probable according to New York Fed President Dudley. When deflationary pressure takes a hold of the U.S. economy, the Fed will have no choice but to weaken the dollar.

Other key data points are also supporting the idea that disinflation is here to stay. The University of Michigan medium-term inflation outlook remains at 35-year lows, or the second lowest ever, at 2.5 percent. Moreover, producer prices declined the most ever on a year-over-year basis to a deflationary -1.6 percent. Analysts cannot blame volatile energy prices, either, with gas prices jumping 3.8 percent.

If inflation expectations is a leading indicator, the S&P 500 could be in for a rude awakening:

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply