The gold standard had a purpose, while no measure is perfect.

Bullion.Directory precious metals analysis 20 October, 2014

Bullion.Directory precious metals analysis 20 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

I was having a “friendly” debate with someone about why I hold gold. “Gold allows me to protect my purchasing power by hedging inflation, while serving as a means of insurance against a currency crisis. It’s not my only asset, but it’s there,” I said. The response was “gold is a barbarous relic and King Dollar is strong.” I was smiling on the inside.

Gold is a barbarous relic, right? The term is thrown around, but nobody seems to even know the origin. The term was coined by economist John Maynard Keynes, ironically the founder of the economical thought responsible for reckless central banking policy, but I digress. And he was referring to the gold standard not gold itself in “A Tract on Monetary Reform” in 1924:

In truth, the gold standard is already a barbarous relic. All of us, from the Governor of the Bank of England downwards, are now primarily interested in preserving the stability of business, prices and employment, and are not likely, when the choice is forced on us, deliberately to sacrifice these to outworn dogma, which had its value once, of 3 pounds, 17 shillings, 10 1/2 pence per ounce. Advocates of the ancient standard do not observe how remote it now is from the spirit and the requirements of the age.

Keynes may have thought the gold standard was old news, but it had a purpose as no monetary policy is perfect. The purpose of having a commodity backed currency is to limit the amount of currency printed. It retained its value and kept inflation at bay. The very reason why gold has maintained its value is because it was rare. You cannot print gold, click a mouse and create gold. But, the Federal Reserve can with dollar bills.

The US remained on some sort of gold standard since 1879, until the Bretton Woods system was eliminated in the US by President Richard Nixon in 1971. There are a few reasons behind this. French President Charles de Gaulle favored a monetary system backed by gold, and he loathed the dollar and American economic influence on the world. So, de Gaulle quickly began to deplete France’s dollar reserves in exchange for gold. Many speculate that the severance of the Bretton Woods system was needed to keep gold in the Federal Reserve system. Here de Gaulle’s view on the US dollar and gold here.

Nixon, also, wanted to print money and expand debt, largely for the Vietnam war. Previously, the Fed would need more gold in order to magically create dollars. No more standard, no more limits. Sadly enough, this is the primary disadvantage of the gold stand and why it receives so much criticism. It would be too much to ask from the US government to live within its means.

There are two primary advantages to a mode of a gold-backed currency (the first being no endless money printing). It protects against financial repression, too. This is a wealth transfer from creditors to debtors, primarily governments in the form of deficit spending. This is currently going on and is most successful when combined with inflation. This could explain central banking’s modus operandi.

Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statist’ antagonism toward the gold standard.

In the absence of a gold standard, there is no way to protect savings from confiscation through inflation.

– Former Fed Chair Alan Greenspan

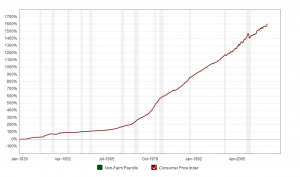

Inflation is categorized as the rise in consumer prices over a period of time, typically measured through the consumer price index (CPI). When inflation is present (it does not matter how much or little), each unit of currency now buys less goods and services as it did previously. Lets take a look at inflation since 1939:

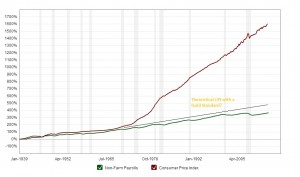

If a 1,602 percent increase in consumer prices over 75 years is not alarming, we can compare the rise in the CPI versus non-farm payrolls (the coveted report for economists):

It is important to note that consumer prices trended just slightly higher than job growth until the end of the Bretton Woods system. After the destruction of “sound” money, inflation went into hyperdrive. Inflation of 1,602 percent versus jobs growth of 354 percent. We can assume that consumer prices would follow a theoretical trend in line with job growth.

To further put this in perspective, we can use data from the Bureau of Labor Statistics. A dollar in 1913 would have the purchasing power today of $24.03. Unfortunately through inflation, a dollar in 2014 back in 1913 would yield a measly $.04 – yes, just four cents!

And, what was created in 1913? THE FEDERAL RESERVE.

![]() This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply