With gold teetering at the edge near $1,200.00, will it fall back to the $1,100’s?

Bullion.Directory precious metals analysis 23 February, 2015

Bullion.Directory precious metals analysis 23 February, 2015

By Terry Kinder

Investor, Technical Analyst

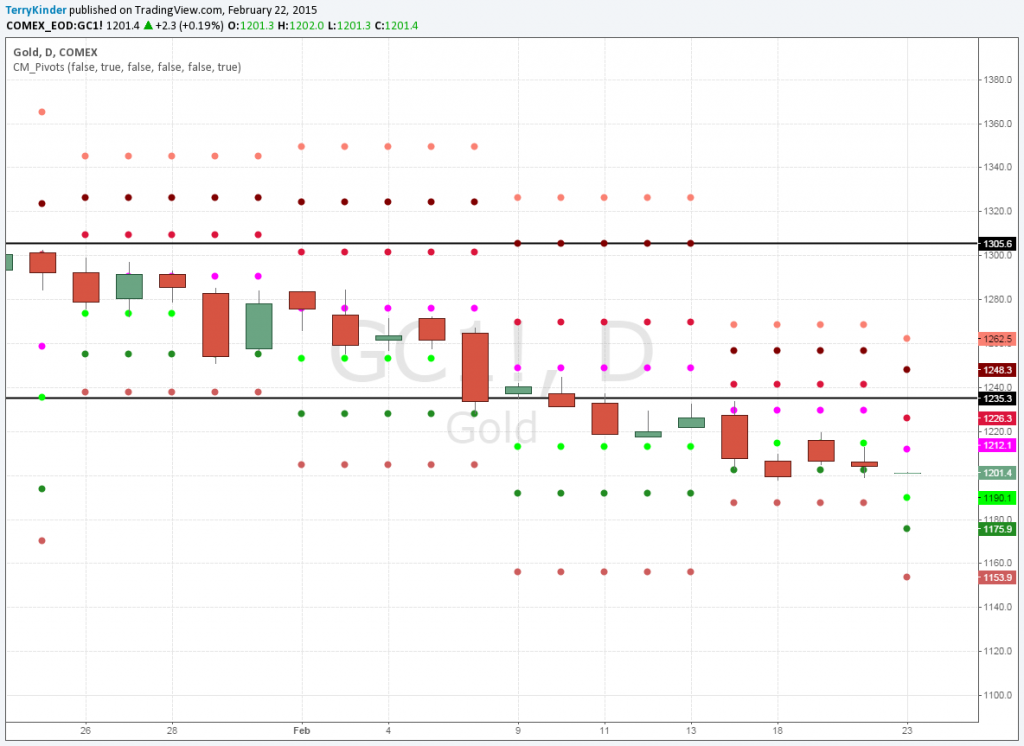

Martin Armstrong of Armstrong Economics pointed to last week as a possible turning point for gold. Gold did turn lower after starting last week at $1,227.70 it closed at $1,204.40. In between the yellow metal moved as high as $1,234.00 and as low as $1,197.80.

Current relevant weekly gold price pivots are:

1) $1,212.10 which represents overhead resistance;

2) $1,190.10 – support;

3) $1,175.90 – support;

4) $1,153.30 – support

The gold price doesn’t have any immediate support below the current price until $1,190.10 and will need to break above $1,210.10 if it hopes to establish upward momentum

Gold has been unable to maintain upward price momentum as demonstrated in the chart below.

Click to enlarge image

After initially breaking out of the first Andrews’ Pitchfork, the price of gold stalled, unable to break above the price trigger line established by the first pitchfork. The 0.382 Fibonacci level, or $1,235.30, has also proven problematic. Additionally, the price recently fell back under the red median line of the pitchfork, indicating again gold having difficulties maintaining any upward price momentum.

Gold appears to be within a triangle formation. Should it be unable to break above the triangle then gold might face a re-test of $1,130.40. A failure to hold that level would set up the possibility of a visit to the 0.764 Fib level or $1,078.00.

Barring a convincing move higher above the $1,212.10 level, there is better than even chance gold slips below the $1,200.00 level for the week.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.