Stocks & Bond Yields Up, Gold Prices Down with Silver After 12-Month Record Comex Position

Bullion.Directory precious metals analysis 18 September, 2017

Bullion.Directory precious metals analysis 18 September, 2017

By Steffen Grosshauser

European Operations Executive at Bullion Vault

With US Treasury bond yields rising, non-interest bearing gold dropped another $7 per ounce from last Friday’s close of $1320, reaching its lowest level so far in September after touching 12-month highs only a week before.

The US Dollar stabilized ahead of the 2-day Fed meeting starting tomorrow, at which the US policymakers are expected to announce a plan for trimming their $4.5 trillion balance sheet of QE bond purchases, while keeping interest rates unchanged at 1.25%.

Traders now see a 53% probability of a rate hike in December, according to the CME’s FedWatch tool.

“Gold prices [have come] under some selling pressure,” says Australian bank ANZ’s analyst Daniel Hynes, “with investors dismissing geopolitical risks and instead focusing on the possibility of rate hikes from central banks.”

“The FOMC’s latest verdict will be of special interest,” agrees analyst Daniel Lenz at DZ Bank in Frankfurt.

“The Fed could well set the balance-sheet-reduction process in motion” when Janet Yellen’s team publish their decision on Wednesday.

Silver meantime tracked gold prices lower today, falling back below $17.40 per ounce – a near 3-month high when reached at the end of August, and some 4.5% below early September’s 5-month peak.

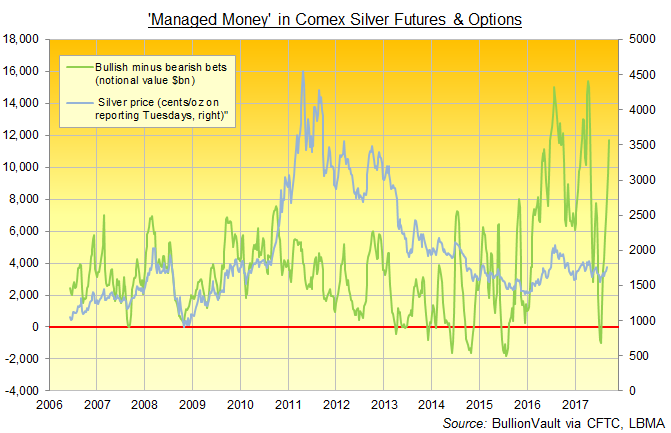

New data from US regulator the CFTC say that hedge funds and other professional speculators last week grew their bullish betting on silver prices to the highest Dollar value since April.

As of last Tuesday, and net of bearish bets, the so-called ‘Managed Money’ category raised its notional position in Comex silver futures and options to $6.7 billion, up more than one-fifth from the Tuesday before and the eighth weekly gain in succession.

The Managed Money’s net speculative long position on Comex gold prices also rose, expanding to a notional 12-month record above $35bn.

Holdings for the largest gold-backed ETF, the SPDR Gold Trust (NYSEArca:GLD), meanwhile expanded by 4.2 tonnes in the week-ending Friday, recovering most of the previous week’s small outflow to need 839 tonnes of bullion.

Friday’s new record highs in US stock markets today saw Asian shares hit their highest in a decade overall.

The pan-European Stoxx index also rose, led by Portuguese stocks after Lisbon’s credit rating was upgraded back to ‘investment grade’ for the first time in more than 5.5 years.

Brent crude oil today rose to $55 per barrel, just a few cents shy of the 5-month high it touched last Thursday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply