Spot Gold Halves Post-2014 Recovery vs. Euro Ahead of Fed, ECB, BoE Decisions as Middle East Tensions Worsen

Bullion.Directory precious metals analysis 12 December, 2017

Bullion.Directory precious metals analysis 12 December, 2017

By Adrian Ash

Head of Research at Bullion Vault

Edging back towards $1241 per ounce today, the price of gold bullion for immediate delivery has now halved the 16% gains for 2017 reached at early September’s 12-month peak.

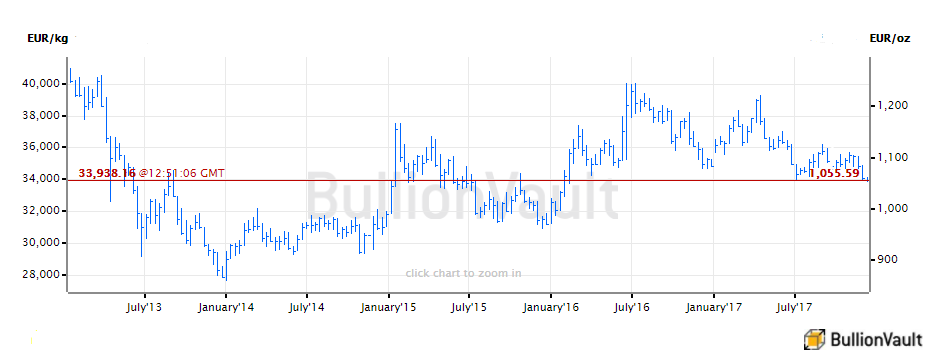

Priced in the Euro, spot gold yesterday touched its lowest level since February 2016 at the end of New York trade, falling to €1053 per ounce as the S&P500 stock index of US corporations set a fresh all-time record high.

For gold priced in the Euro, that marks a 50% retracement of the recovery to last year’s Brexit referendum peak from its 4-year lows of end 2014.

The European Central Bank will stress the 19-nation currency zone’s solid growth but won’t announce any major change to its sub-zero rates and QE money creation scheme at its meeting on Thursday, according to analysts.

“Bullion staged a modest recovery during Asian trade,” says the daily note from Swiss refining and finance group MKS Pamp, “as demand out of China underpinned price action.”

Spot gold prices in Shanghai fixed more than $10 per ounce above comparable London quotes, near the strongest incentive to new imports to the world’s No.1 consumer market of the last month.

“Interest out of the Far East took the metal toward $1245 as participants slowly re-enter the market with spot now around five month lows,” says MKS, but the rally “lacked follow-through interest to make a meaningful break higher [before] the FOMC rates decision.”

The latest US consumer-price inflation data are due on Wednesday, shortly before the Federal Reserve’s widely-expected hike in interest rates to 1.50% – the highest US cost of borrowing since the collapse of Lehmans Brothers in the fall of 2008.

UK inflation last month rose to 3.1% per year, the fastest increase in the cost of living since March 2012.

Expected to leave rates unchanged at its decision on Thursday, the Bank of England will delay the open letter it is now obliged to send the UK finance minister – explaining its plans for getting inflation back to the 2% target – for two months.

HM Treasury today tweeted a chart showing how the official forecast “expects inflation to fall…in the coming years.”

The price of Brent crude held Tuesday near 2.5-year highs above $65 per barrel as production from the UK’s North Sea oil rigs was cut back while engineers try to repair a crack in the main pipeline linking the Forties field to the Scottish mainland.

Vladimir Putin – president of No.5 oil producer and No.2 gold mining nation Russia – yesterday announced victory over Islamic terrorists ISIS in Syria and ordered his military to start withdrawing.

US president Donald Trump will not challenge Syrian president Bashar al-Assad’s “continued rule” until the war-torn country’s 2021 elections, according to a report in the New York Times.

World No.5 gold consumer nation and Nato military alliance member Turkey will meantime “finalize” the purchase of a Russian missile defense system this week, President Recep Tayyip Erdoğan said Monday.

Reporting a 30% rise in bilateral trade between Russia and Turkey so far this year, Erdoğan said co-operation between Ankara and Moscow is “getting stronger day by day,” reports the Hurriyet newspaper.

Erdoğan was a target in the Turkish police’s 2012-2013 investigation into bribery and money-laundering linked to neighboring Iran’s sanction-busting export of oil for gold, a former officer yesterday testified in the New York trial of a leading Turkish banker.

Both Putin and Erdoğan have condemned the US decision to recognize Jerusalem as the capital of Israel of by moving its embassy there from Tel Aviv.

“I am not used to receiving lectures about morality from the leader who bombs Kurdish villagers in his native Turkey, who jails journalists, who helps Iran go around international sanctions,” said Israel’s Prime Minister Benjamin Netanyahu on Sunday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply