A ‘Short-Lived Spike’ in Gold Prices Sets New 7-Year and Record Highs

Bullion.Directory precious metals analysis 28 January, 2020

Bullion.Directory precious metals analysis 28 January, 2020

By Adrian Ash

Head of Research at Bullion Vault

Global stock markets, priced in US Dollars, closed Monday over 2.5% below last week’s new all-time high on the MSCI all-countries world index, while major government bond yields set 3-month lows.

Gold priced in the Euro today held €5 below Monday’s new all-time record LBMA benchmark of €1436 per ounce.

The UK gold price in Pounds per ounce meantime popped to 3-week highs, rising to £1216 – some 5% below last September’s all-time high – after Boris Johnson’s government said it will defy US demands and allow Chinese tech-giant Huawei’s equipment into Britain’s new 5G telecoms network.

“Brexit is not going to go away,” said European Union chief negotiator Michel Barnier last night, four days ahead of the UK’s official exit from the EU, and warning that a deal on future relations and trade deal will struggle for completion as scheduled this year.

“[While] uncertainty and global growth concerns due to coronavirus are still there, gold has been positive for the last few sessions and is witnessing profit booking now,” Reuters quotes analyst Jigar Trivedi at Mumbai stock-brokers Anand Rathi Shares.

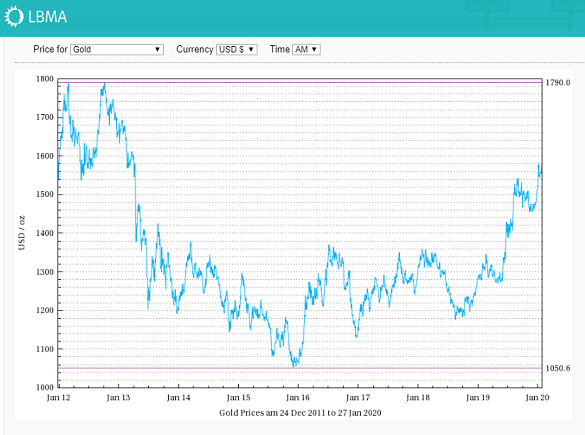

Gold bullion fixed Monday morning in London at $1583.45 per ounce, half-a-dollar above early January’s pop to new 7-year highs after Tehran fired rockets at US bases in Iraq to retaliate for the drone assassination of Iranian commander Qasem Soleimani.

Now a little over 4 years since gold bottomed at $1050 in December 2015, the metal has recovered almost two-thirds of its $825 drop over the prior 4.5 years from its all-time Dollar high of $1895 at London’s twice-daily LBMA Gold Price auction.

“Knee-jerk reactions to geopolitical events tend to be short-lived, so this rally could quickly fade,” says a 2020 outlook for precious metals from refining group Heraeus today.

But Middle East tensions, plus widening trade-tariff disputes and the 2020 US election could all support “safe-haven asset demand” the note says, calling this a “favourable backdrop” for bullion.

“US rate cuts and falling bond yields should [also] be gold price positive…[but] a high gold price and slow economic growth will restrain consumer demand.”

The new Chinese Year of the Rat could revive gold demand in Hong Kong, the city’s jewelers tell the South China Morning Post, because this animal sign of the zodiac “is auspicious to get married and have babies.”

Even before the coronavirus outbreak however, 2019’s pro-democracy protests and anti-government violence helped knock sales 40-70% lower, says Haywood Cheung Tak-hay, president of the Chinese Gold and Silver Exchange Society.

Crude oil prices meantime rallied weakly on Tuesday ahead of US President Trump’s pre-announced ‘deal of the century’ for Middle East peace, edging higher from Monday’s new 3-month lows but still down over $10 per barrel of European benchmark Brent from this month’s US-Iran conflict spike above $68.

“It is nothing but a plan to finish off the Palestinian cause,” says Palestinian Prime Minister Mohammad Shtayyeh of the US plan, due for release later on Tuesday by Trump and Israel’s Prime Minister Benjamin Netanyahu – like his host in Washington, now facing corruption charges in Parliament at home.

Claiming that the plan won’t remove Israel from the occupied West Bank, occupied East Jerusalem, or the besieged Gaza Strip, leaders of the Palestinian Authority say they weren’t invited to Washington and “no plan can work without them” says Al Jazeera.

Crude oil’s steep drop is “100% down to the coronavirus,” one trader tells the Wall Street Journal.

“I think we’re close to peak hysteria, so yes the move is justified. We’re in full panic mode.”

The outbreak has seen several data agency’s warn on downgrading their 2020 growth forecasts, with the Economist Intelligence Unit trimming up to 1 percentage point off China’s already slow 6% annual expansion, just below the impact on the world’s No.2 economy forecast by S&P Global Ratings.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply