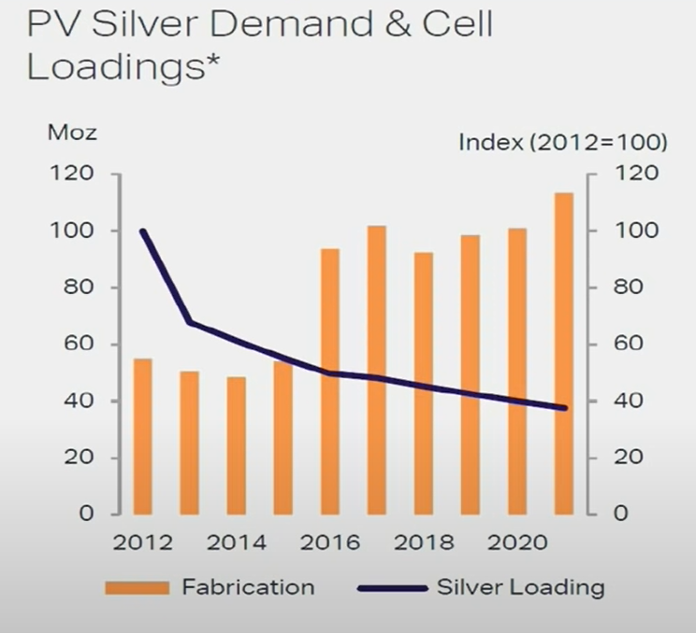

Overall global solar panel production has been growing over the last 10 years while the actual amount of silver in each panel is set to increase.

Bullion.Directory precious metals analysis 12 August, 2022

Bullion.Directory precious metals analysis 12 August, 2022

By Paul Engeman

Director at Ainslie Bullion

The Silver Institute’s 2022 report showed global silver demand sitting at just over 1 billion ounces, which we covered in April.

Of that total demand, 13% was for solar panels – not an insignificant share of the total global demand for the white metal. However, from 2012 until 2020, the total loading of silver for each solar panel was dropping, despite increasing overall production of the renewable energy source.

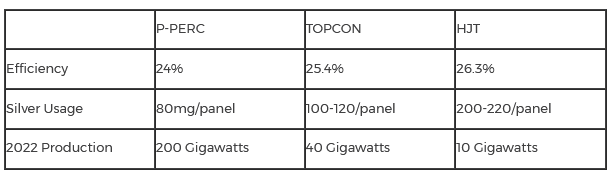

Global solar panel manufacturing output is based primarily in China. In a recent interview, Chinese family office portfolio manager Chen Lin has outlined the current and emerging dominant technologies in the solar industry with data from Chinese manufacturers. There are three existing models of solar panels that have differing absorption rates and amounts of silver used: they are the P-Perc, TopCon and the HJT.

The P-Perc solar panels use 80mg per solar plate and this style is currently the most common, accounting for 200 gigawatts per year. However, the trend is for solar panels to be produced in the TopCon style which is more than 1% more efficient, but uses 100-120mg of silver for each unit.

The TopCon is an emergent technology taking market share from P-Perc, but industry insiders see the HJT model as the best medium-term as it is yet another 1% more efficient, but requires 200-220mg per unit. HJT is still in its infancy, but is set to grow rapidly as it is the most efficient option on the market.

Historically, solar panel farms set up in deserts, over the water or snow, have been single-sided. However, in recent years solar farms have increasingly been attaching solar panels to the underside, to capture an additional 20-40% of the sun’s rays that are reflecting off the sand or water.

By having an additional panel facing the snow, the additional energy can be as high as 80%. In particular, solar farms set up in the desert are increasingly enabling their panels to flip over at regular intervals, to remove built up sand deposits.

The double panel “flippable” design won’t work on a regular suburban roof, but it will work for the major solar farms around the world. This increasing emphasis on the second side of the panel is doubling the total amount of silver needed.

The increase in efficiency by adding more and more silver to solar panels is set to grow exponentially over the next 10 years. Conservatively, even assuming that solar doesn’t become any more significant part of the global energy mix, we are set to see a tripling of silver utilisation in the industry purely due to changing trends in the prevailing technology.

At current production levels, solar would be eating up north of 30% of all supply, with monetary demand (bars and coins), jewelry, photography, silverware and general industrial usage all fighting for a reducing supply.

We have heard talk of individual customers wiping out large portions of retail silver in the United States with more institutional money making their way into the physical space.

As rosy as the industrial supply demand fundamentals are, silver is a safe haven in times of crisis and is one half of the bimetallic monetary standard that human civilisations return to when paper currencies have lost the faith of the bagholders.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply