Silver Auto-Demand Seen 4x Higher by 2040 as Trump ‘Reprieves’ Europe, Platinum +6% in 1 Week

Bullion.Directory precious metals analysis 26 July, 2018

Bullion.Directory precious metals analysis 26 July, 2018

By Adrian Ash

Head of Research at Bullion Vault

Trump overnight claimed his meeting with the EC president showed that the US and EU “truly love each other”, with both sides wanting to strengthen their “$1 TRILLION bilateral trade relationship – the largest…in the world.”

“China should really start to worry about Trump,” writes Financial Times columnist Edward Luce, saying that Europe’s “reprieve” will intensify US pressure on Beijing.

Looking at global silver demand, “2018 will be a challenging year for China’s solar market,” says the latest weekly note from specialist analysts Metals Focus, “as it takes steps to ultimately becoming a subsidy-free industry.”

Such “turmoil” is hitting the global photovoltaic market because other leading consumer nations are also looking to end ‘feed-in tariff’ subsidies, says Metals Focus.

“The slump in [solar cell] prices caused by oversupply will also force PV companies to restructure and accelerate their cost reduction roadmap to help survive during this transition period.

“[That means] for the short-term at least, silver PV demand may have peaked.”

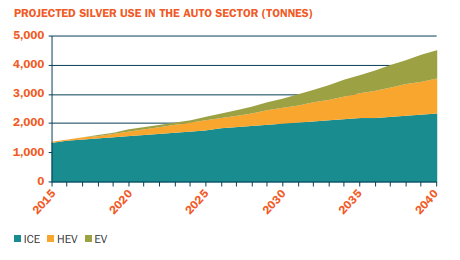

Automotive silver demand in contrast could quadruple over the next 20 years, says a new analysis from Thomson Reuters GFMS Rhona O’Connell, driven by “stellar growth” in demand for electric vehicles.

2040 represents a “keystone” for government promises worldwide to ban sales of traditional internal-combustion engine vehicles, O’Connell notes.

By then, automotive use of silver could jump from 3% in 2015 to 15% of the metal’s total annual offtake according to GFMS’s analysis.

The European Central Bank meantime held its key deposit rate negative once more on Thursday, vowing again to press ahead with reducing and then ending its program of additional QE bond purchases by the end of 2018.

That left the Euro currency unchanged after losing half-a-cent to the Dollar on news of the Trump-Juncker meeting overnight.

Gold fell back to show a $1 loss for this week so far in Dollar terms at $1228 and also erasing yesterday’s 0.5% rise versus the single currency Euro to stand back at €1048.

Platinum prices have now risen 5.8% from last Thursday’s plunge to new 14-year lows in US Dollar terms.

Silver has risen 2.4% from that day’s 3-month low, while gold has gained 1.4%.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply