An Interview With Ronan Manly: The Bullion Barbarian

Bullion.Directory precious metals interviews 28 April, 2021

Bullion.Directory precious metals interviews 28 April, 2021

By Spencer Campbell

Founder / CEO at SE Asia Consulting

If you have anything to do with the precious metals industry, this week’s interview guest needs little in the way of introduction.

If you have anything to do with the precious metals industry, this week’s interview guest needs little in the way of introduction. As well as being Content Manager and Precious Metals Analyst at Singapore’s BullionStar Ronan Manly – aka Ronan the Destroyer – is one of the industry’s most outspoken critics, regularly releasing in-depth research examining the institutional corruption, market manipulation and shady practices at the heart of precious metals trading.

1. So Ronan I am sure a number of people have heard about your background from online podcasts and videos but can you give us a little background about where you are from and how you got into the bullion business?

I grew up in Dublin, Ireland and went to university there, beginning a financial career in various roles including stockbroking, then moved to Morgan Stanley in London (via a stint in Morgan Stanley New York) where I worked in the technology division.

I grew up in Dublin, Ireland and went to university there, beginning a financial career in various roles including stockbroking, then moved to Morgan Stanley in London (via a stint in Morgan Stanley New York) where I worked in the technology division.

Staying in London, I then moved to a buy side role managing equity portfolios at Dimensional Fund Advisors (DFA).

I became interested in investing in physical gold in the early 2000s and had a nice stack of gold Krugerrands which I used to buy a few at a time in various places in the City of London and West End, but still, at that time I just kept an eye on the gold market and I remember reading Jim Sinclair’s website religiously each day.

I came back to Dublin for a break in around 2012 and by that stage I had gotten to know the guys in GoldCore, Mark O’Byrne and Stephen Flood.

As Mark knew I liked to research, he asked me to write a few reports for GoldCore, which then became quite a lot of reports and website content. In around 2014, Koos Jansen who was working for BullionStar asked me if I’d like to do a blog on the BullionStar site, so that was how I got to know BullionStar, and then I subsequently began to do a consultancy role with BullionStar which turned into a full time role.

2. Can you tell us more about your title “Content Manager and Precious Metals Analyst” and what that entails?

A lot of people might know my name for writing my own blog / articles on the BullionStar website, and that’s certainly part of the role, but I also wrote content for other parts of the site, such as the ‘Inside’ BullionStar Blogs (which are more company and sector specific articles), and educational articles about why and how to buy precious metals and such things as the content for our ‘Gold University’.

I also provide content for help text, product descriptions and other parts of the site, pages that BullionStar customers would interact with when transacting on the website.

For my own blog subject matter, I like to look at current developments in the gold and silver markets, and sometimes, but not always, with a focus on country / central bank activities, LBMA, COMEX, ETFs etc.

As well as that I am active on some of our social media channels, such as Twitter, Telegram and Facebook, providing analysis and news and insight.

As well as that I am active on some of our social media channels, such as Twitter, Telegram and Facebook, providing analysis and news and insight.

At times, I also talk over email with a customers if they had a specific question they wanted my opinion on.

There are also administrative parts of the job behind the scenes which might include reviewing legal documentation, helping on analysing business development, or checking in-house tech changes.

I also talk to reporters from the financial media, providing commentary about the precious metals markets and at times helping a reporter with an article that they may be writings.

BullionStar has to date been cited in many of the leading financial newspapers and media sites including the Financial Times, Wall Street Journal, Straits Times, Bloomberg, Reuters, RT.com, Real Vision, and also in many country specific new sites, from Vietnam to China to Germany to the US.

As well as written content, audio visual content is critical in this day and age, and I also organise and host the video interviews that we create for the BullionStar Perspective series, in which personalities from the bullion world talk about topics relevant to the precious metals markets.

These interviews are published on the BullionStar YouTube channel. We are also making some pretty cool new documentaries on topics related to the gold market. So stay tuned for that also.

3. You are currently based in Brazil, what took you there in the first place?

I went to Brazil first for family reasons, and pretty soon got a full time visa, which meant I could stay and come and go anytime, which is great.

I went to Brazil first for family reasons, and pretty soon got a full time visa, which meant I could stay and come and go anytime, which is great.

The weather in Brazil is amazing and the beaches as good as you cold imagine, and the people relaxed. Its very normal in Brazil right now, despite what the mainstream scaremongering media would have you believe.

4. You joined BullionStar approx. 6 years ago now and was working along-side Jan Nieuwenhuijs who went by the moniker Koos Jansen, Jan has moved on now which leaves you alone which is a mammoth task, so one question I had is how do you pick your stories/articles?

When I started writing blogs for BullionStar, I had an interest in the central bank gold market because they are the biggest holders and the most secretive players behind the scenes.

That secrecy, which is something that the LBMA also practices, attracted me to cover those areas.

That secrecy, which is something that the LBMA also practices, attracted me to cover those areas.

I remember when Jan used to be with us, he’d specialise quite a bit in the Chinese gold market and did some great stuff on Fort Knox, and also on the central banks.

I seemed to become an LBMA specialist (probably much to the annoyance of the LBMA).

Nowadays, while I still write about the LBMA and the COMEX and the big bullion bank players in the market, but I like to also often cover new developments in the gold and silver market, so any topic is possible.

Recently, I did some interesting articles about the silver market, which was great for both me (as I learned a lot more about the silver market) and hopefully the readers also (who learned some new things about all the shenanigans with the CFTC, and bullion banks in the silver markets in London and New York.

I also like to get an instinctive feel for whether a topic will cause a stir in the market and drop some bombshells.

I’ve helped ZeroHedge out in the past and there were various very popular articles in the past which I sort of put together but which were anonymous, but that were cool to contribute to and that gained millions of views. I think the Tylers like me because I sort of helped them out at times and they help me by putting a lot of my articles on the main page, which gets tonnes of traffic.

On the BullionStar site, I also wrote all the content for our Gold University and also some of the inhouse BullionStar blogs. The BullionStar blogs can be about aspects of the company and also areas that are relevant to BullionStar’s business.

5. Your articles are always a deep dive in terms of data analytics, where did you pick up that skill?

I gained quite a lot of practice in London Business School researching for reports and mini theses, and I also did computer science for a while, and I used to be a research analyst in a stockbrokers.

My career in Morgan Stanley and Dimensional also involved a lot of analysis of both inhouse data and markets and stocks. So I guess all of that rubbed off on me. As did the need to add sources so people don’t think I’m spoofing when I mention ‘facts’.

There is a lot of stuff written in the bullion industry on the web where people make claims without backing it up, and I think it doesn’t look great if its just empty claims or one guy quoting another, neither of which have any sources. Maybe sometimes I go overboard with deep dives, but it’s a nice skill to have.

I have to though produce more stuff which is easier to digest … lolz

6. What can you say about the current situation re: PSLV vs. SLV?

The problems I see with the iShares Silver Trust (SLV) are that a) its closely connected with the LBMA bullion banks, and b) that it claims to source its silver in the opaque and secretive LBMA vaulting system in London.

Even though SLV produces a daily bar list of its silver holdings, there is little transparency on how it sources the silver that appears in vast quantities on that bar list, within the vaults of Brinks, Malca Amit and Loomis in London.

The Sprott Physical Silver Trust (PSLV) on the other hand goes out and buys silver bars on the market in Canada, New York and recently London. But it does not produce a daily bar list.

One thing that PSLV has to do better through is to start producing a more frequent bar list, that shows where exactly all of its silver is being held on each publication date. This would show, for example, how much of the silver it bought in London is still there, or is in transit to Canada.

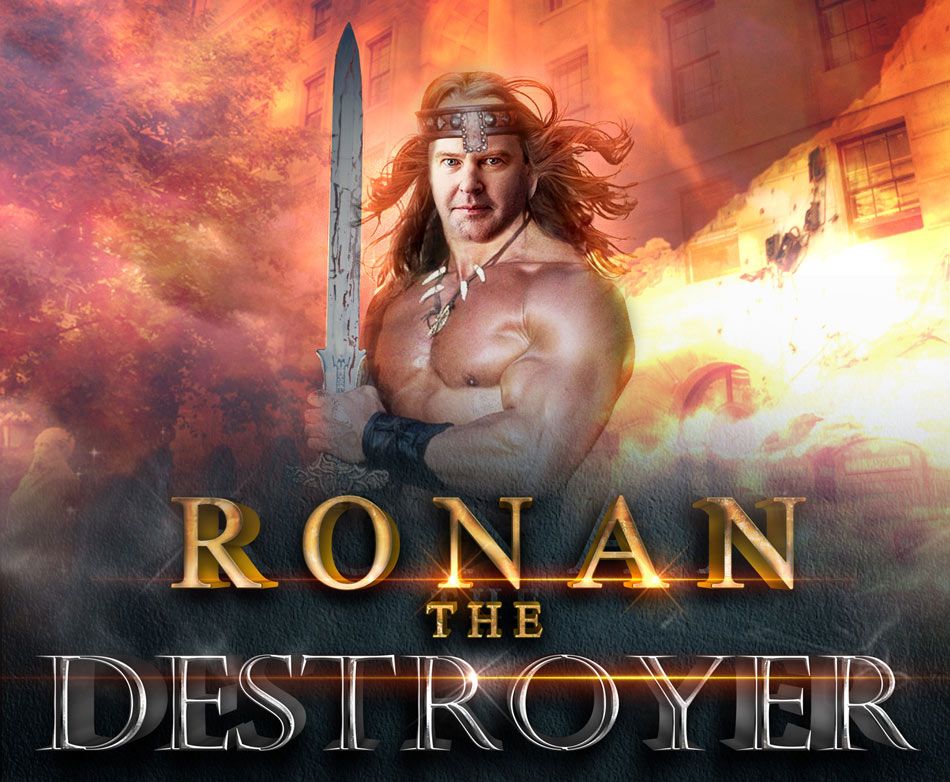

7. Any feedback to Chris Marcus from Arcadia Economics on his nickname for you “Ronan the Destroyer”?

I can see where Chris is coming from with that name.

I think with that name he is trying to capture the fact that my research can uncover facts about the precious metals markets which the establishment and bullion banks would rather nobody knew.

And also maybe that I can destroy BS arguments from some of the gold market apologists. In school sometimes they used to call me ‘Ronan the Barbarian”, so the memes which some silverbug people have created of Ronan the Destroyer using images of Conan (Arnold) with my face, maybe they are on to something.

8. What was your take on the JPMorgan to pay almost $1 billion fine to resolve U.S. investigation into trading practices and the on going DOJ Investigation into Former LBMA Board member and JP Morgan managing director Michael Nowak?

Its pretty obvious from COMEX precious metal futures price action that they are constantly manipulated to cap the prices, especially during New York and London trading hours.

And the biggest players in those markets are the LBMA bullion banks. The CFTC regulators spent years in an investigation (2008-2013) finding no evidence of COMEX precious metals price manipulation, and it was left to the US Department of Justice to bring the matter to a head over 2018-2020.

I think its disgraceful that any investment bank or its traders which has been found guilty of gold and silver price manipulation is still a member of the LBMA, let alone running the LBMA show, as is the case of JP Morgan.

I think its disgraceful that any investment bank or its traders which has been found guilty of gold and silver price manipulation is still a member of the LBMA, let alone running the LBMA show, as is the case of JP Morgan.

The conclusion must be that the LBMA Precious Metals Code of Conduct is a total joke.

That banks that signed up to that code allegedly continue to manipulate prices. Why have these banks not being expelled from the LBMA? And the investigation into JP Morgan’s Nowak, who was an LBMA Board member when he was charged by the DoJ, that’s the icing on the cake that shows the den of vipers operating out of the London “gold” and “silver” markets.

9. Despite these fines we can see that manipulation in precious metals continues, what can and should be done to mitigate this from your perspective?

The LBMA system should be disbanded. Outlaw the LBMA unallocated credit system. Close down the LBMA Gold and Silver Price auctions.

Close down the LBMA clearing system (which is called) LPMCL.

Close down the LBMA clearing system (which is called) LPMCL.

Establish a physical gold and silver daily price auction that has nothing to do with the LBMA.

Publish all outstanding gold lending positions of central banks. Publish all outstanding unallocated positions of the bullion banks.

Investigate the Bank of England for collusion with the LBMA. Have an independent investigate into the gold lending operations of the central banks and BIS.

Overhaul the COMEX and put it under an independent regulator which is nothing to do with the US Government. Prohibit any bank which has been prosecuted for precious metals manipulation from trading on COMEX.

10. Do you think the Bullion Banks should have a say in the Good Delivery status of the LBMA Gold & Silver as it’s a conflict of interest?

No, and furthermore, the LBMA should not be in charge of the Good Delivery List.

The LBMA was founded by and is controlled by a cartel of bullion banks. An organization founded by banks shouldn’t be in charge of anything to do with the physical gold market.

So that is the conflict of interest. And it’s a huge conflict of interest. On a practical basis, the influential banks in the LBMA can use their influence to block refineries in certain countries, such as the UAE, from becoming Good Delivery refiners or even from remaining on the COMEX Good Delivery list.

And all of that, as we’ve seen, is a problem.

11. Why do you think the LBMA is slow to react or fails to act against its members when they clearly breach the Global Precious Metals Code?

Because the LBMA is run by the bullion banks. The LBMA is like a sock puppet whose hand is the ventriloquist – the LBMA banks.

It’s like a puppet theatre. And so the LBMA would never discipline a banking member, as it would be like a Punch and Judy puppet disciplining the ventriloquist – “whose a naughty boy then?”

12. You covered the recent LBMA letter sent to the Global Bullion centres in your article “In Delusional Push, LBMA Threatens to Blacklist Entire Gold Trading Centres”, have you noticed how the website version has been toned down from that original letter & what is your take on this change?

I hadn’t seen that but its interesting and to be expected, as there was huge opposition and pushback from various gold trading centres about the LBMA sending the letter in the first place.

13. I am hearing from LBMA members that the membership price has doubled since 2020 price, given the conference organisers have been all online during Covid, what do you make of this?

It looks like the various LBMA conferences were cash cows and an important source of LBMA revenues.

Now that the conferences have been cancelled during this COVID hysteria, it looks like they are ramping up the membership fees to keep the show going. The LBMA offices beside the Bank of England in the City of London are not cheap you know.

14. Where do you see the future of price discovery in the global markets going forward?

The bullion bank cartel which runs the LBMA want the future of precious metals price discovery to be the same as the current structure of precious metals price discovery, i.e. a fractional-reserve unallocated synthetic ‘paper’ system controlled by them via the LBMA auctions, the LPMCL clearing system, their dominance of COMEX trading, and the entire infrastructure of trading, clearing, and vaulting which they control and dominate.

Likewise, the regulators in the Bank of England, FCA, CFTC, Fed and BIS want this status quo to continue, as it too is in their interest. But will it?

That depends on the actions of those in the world’s physical gold and silver markets, in a geo-political sense countries like China, Russia, and the UAE, and in an industry sense, the gold and silver mining companies.

The gold and silver mining companies, with a few exceptions, are pathetic in never calling out the price manipulation of the bullion banks.

So there’s not much hope there.

Beyond a coordinated shift to physical pricing by groups of countries, if real assets such as gold and silver were to enter a sustained mega bull market, the world’s retail public could potentially break the paper pricing system via sheer demand for physical gold and silver.

15. Where can people follow your work or interact with you and or Bullion Star online?

My blog articles are on the BullionStar.com website under the Research section https://www.bullionstar.com/blogs/.

In addition, the BullionStar website is a great resource for a wide range of other articles, charts, live gold and silver price data, the Gold University articles, and much more.

We also have a popular presence on Twitter at @BullionStar, and BullionStar accounts on Instagram. And we have a relatively new account on Telegram, which has got a good following.

On our BullionStar YouTube channel, you can check out the BullionStar Perspectives video series of interviews plus other interesting BullionStar videos

Spencer Campbell

Spencer Campbell is a Director at SE Asia Consulting Pte Ltd, and provides key advisory services across the Mining and Precious Metal Refining Sectors, working with a number of leading gold refiners and processors.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply