Will Silver Follow GameStop To The Moon?

Bullion.Directory precious metals analysis 29 January, 2021

Bullion.Directory precious metals analysis 29 January, 2021

By Adrian Ash

Head of Research at Bullion Vault

“[Let’s] corner the market [and] f**k the banks,” said the anonymous post late Wednesday, urging a repeat of the “short squeeze” forcing a surge in the price of a raft of US-listed stocks against which speculative hedge funds hold massive bearish bets.

The giant iShares Silver Trust (NYSEArca: SLV) gapped sharply higher at Thursday’s New York opening, leading a jump in Comex futures and options betting as well as spot silver bullion prices. But the fund in fact saw net liquidation by investors overall by last night’s closing.

Rising to $1873 per ounce Friday as the US Dollar struggled to extend its rally on the currency market, gold bullion cut its loss for the month to date below $20.

That still left New Year 2021 as the first January since 2011 when the gold price failed to make a monthly gain.

Silver prices meantime extended Thursday’s 5.3% jump to trade over one Dollar higher again at $27.50 per ounce, its highest since January 6th.

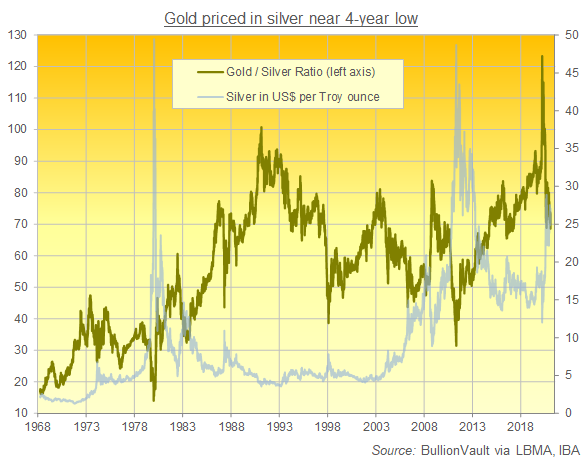

Together, that pushed the Gold/Silver Ratio – a simple measure of the two former monetary metals’ relative pricing – down below 69, its lowest since 2 March 2017 and only its second daily reading below the 70-level since April of that year.

“Going forward,” said specialist consultancy Metals Focus in a note published Wednesday, before the Reddit Ramp, “there is plenty of room for a further contraction toward the low 60s as we progress into 2021.”

Looking at the likely bump in silver’s industrial demand – led by new green energy and 5G telecoms installations – “Silver’s higher beta should also raise its investment appeal,” says the analysis, pointing to silver’s typically greater volatility than gold’s plus “abundant liquidity in financial markets and investors’ growing appetite for returns in the wake of low [bond] yields.

“Unlike gold, silver is currently trading well below its all time high in 2011 of over $50. Once the expected rally in the precious metals complex resumes, this may well encourage aggressive tactical buying from those who believe silver remains undervalued relative to gold.”

Peaking amid last March’s Covid Crisis at a record daily high of 125 ounces of silver per 1 ounce of gold, the ratio has averaged 80.6 across the last half-decade, and 61.4 across the 2 decades before that.

On an annual average, 2020 saw the gold price in terms of silver breach its all-time historic peaks of the 1930s’ depression and the early 1990s’ recession.

Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply