2016 global gold mining production likely to fall with capex down 30%…

Bullion.Directory precious metals analysis 19 January, 2016

Bullion.Directory precious metals analysis 19 January, 2016

By Adrian Ash

Head of Research at Bullion Vault

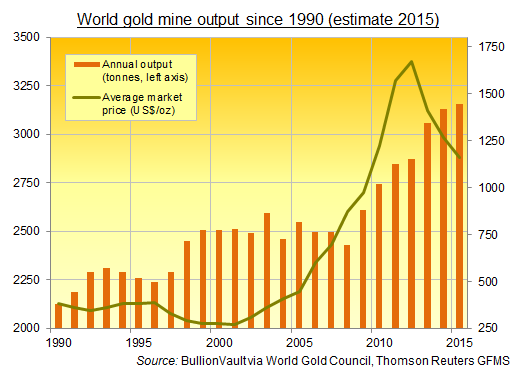

GOLD MINING output worldwide likely set a new all-time record for the 7th year running in 2015, according to industry-leading analysts, but 2016 will now see a drop.

Global gold mining output rose 1.6% in the first 9 months of last year according to Thomson Reuters GFMS in its third quarter report, putting 2015 on track for a total of 3,155 tonnes on the specialist analysts’ new full-year forecast.

That would make 2015 the seventh new annual record in a row.

Rising barely 0.7% from 2014 however, the predicted 2015 total would mark the slowest expansion since the drop of 2008, contrasting sharply with the 2.5% compound annual average of the previous 10 years.

“Falling grades and production levels, a lack of new discoveries, and extended project development timelines are bullish for the medium and long-term gold price outlook,” says Ross Strachan, a manager in the specialist precious metals research division of Thomson Reuters GFMS, speaking to the Financial Times.

Several gold-mining executives also expect global output to fall this year, thanks to their falling investment in exploration and development as the metal’s market price has dropped 40% from the 2011 peak.

US-based consultancy SNL Metals & Mining in a recent report estimates that across the entire mining sector, not just gold, total capital expenditure stood 30% lower in 2015 from the peak of 2012.

“However, if the previous bear market [in base and precious metals prices] is any guide, the mining sector faces two more years of falling expenditure,” SNL goes on, “with capex expected to decline a further 12% by the end of 2017.”

The third quarter of 2015 alone saw what SNL calls “a collapse in initial resources” suggested by new drilling results, with gold discoveries falling by two-thirds from the previous 3-month period despite a rise in total metals exploration across the industry.

But while lower gold prices deterred new investment, counter specialist analysts Metals Focus, “The weakening of many producers’ currencies relative to the Dollar [in 2015], alongside lower oil prices, is helping reduce mine site input costs, such as power, fuel and labour.”

That led in late 2015 to growth in output from many major gold mining producers, exploiting the greater profit margin created by lower local costs.

Gold mining shares listed in weaker-currency producer countries have meantime risen sharply already in 2016, with South Africa’s gold sector jumping 26% in Rand terms during the first two weeks of the year as the currency sank to new all-time lows against the US Dollar.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply