…And Also – What a Recession looks Like

Bullion.Directory precious metals analysis 22 June, 2022

Bullion.Directory precious metals analysis 22 June, 2022

By Paul Engeman

Director at Ainslie Bullion

The biggest threat to global economies right now is inflation that is non transitory or under control forcing central banks to tighten monetary conditions to stem demand for what is predominately a supply lead problem and into a rapidly weakening economy. Stopping QE, and indeed in the US deploying QT (reducing not expanding their balance sheet with printed money), combined with raising rates has removed liquidity from the market that has already seen a big plunge in shares and crypto and now threatening property as well. Raising rates when you have the biggest debt pile in history has far reaching consequences as well.

And so inflation is the core issue forcing their hand to tighten into this mess. Essentially EVERY modern monetary tightening cycle has ended in a recession.

The problem with inflation is that the fear of inflation begets inflation. What we are seeing now in Australia is evidence that people are trying to front run inflation by bringing forward purchases before the price goes up.

The irony of course, particularly whilst supply constraints remain, is that in itself raises inflation and we get this self reinforcing inflationary spiral. What happens on the other side of course is a higher likelihood of recession and a void of spending.

It is therefore completely logical that Philip Lowe would deploy ‘she’ll be right’, ‘nothing to see here’ jawboning to try and contain this phenomenon. He stated that he expects inflation to hit 7% this year and that it will be “some years, I think, before inflation is back in the 2-3 per cent range.”

Australia, more than most, will likely too feel the impact on the so called ‘wealth effect’ where higher house prices fuel confidence and mortgage redraws for discretionary purchases. NAB yesterday joined the list of forecasts seeing substantial house price falls ahead with their chief economist predicting 2.5% drops this year and a further 15% next year.

Combined with less discretionary spending capacity due to higher mortgage repayments, the great Aussie housing dream may indeed be a large contributor to our chances of a recession.

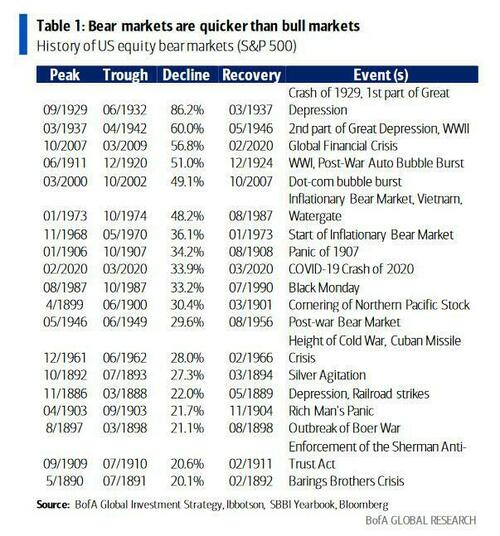

So what does a recession mean for investors? Whether you are personally invested in shares or not, unless you have a SMSF with a nice balance of uncorrelated assets, your super will likely be very heavy equities. The following table from Bank of America is a salient reminder of what happens in a bear market (most of which coincide with a recession).

Yes it is US based using the S&P500 but that is the largest index in the world and we largely follow their lead regardless. Indeed the world actually substantially lagged the S&P500 since the GFC and COVID so it paints a rosier picture. There are a couple of takeaways.

First, peak to troughs usually take well over a year. COVID was the deepest and quickest recession in history. It was a clear exception. The GFC saw a peak to trough of 17 months with lots of false rallies (maybe like last night…) along the way.

Secondly, the time then taken to get back to where you were previously (recovery in the table below) then usually takes many many more years from the trough. Relatively it is the elevator down, stairs back up analogy. Remember too the math of a 50% loss needing you to make 100% on what’s left just to get back to even…

Since the turn of this century, seeing 3 recessions, and 3 of the 10 worst equities bear markets in history, gold has returned capital growth on average of 8.6% each year…

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply