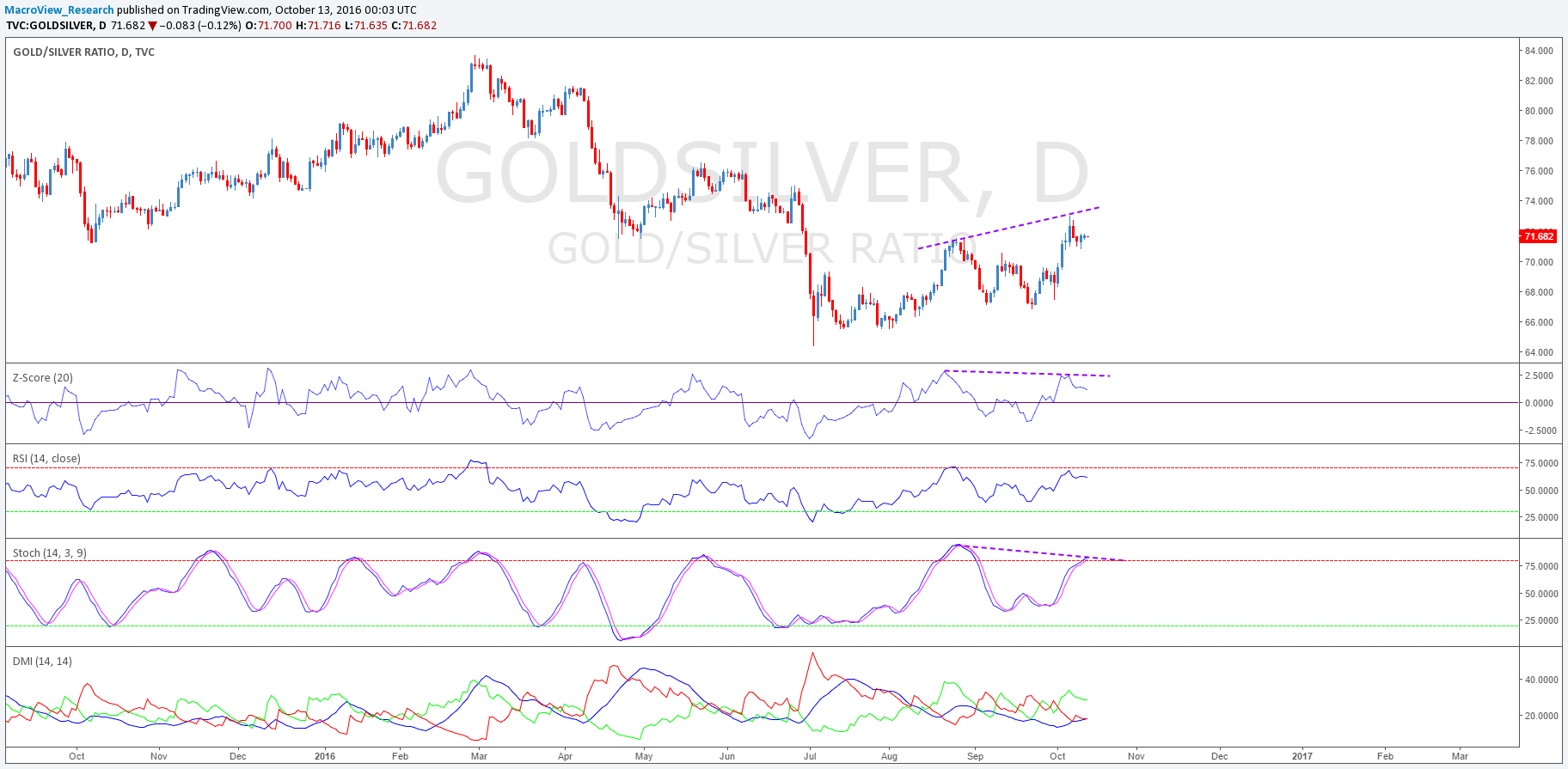

Gold/Silver Ratio

As MarcoView has been implying for nearly 12-months, additional tightening would only be seen as “saving face,” essentially as a bid to remain credible – if that’s even possible.

Most notable, the minutes provided supporting evidence to this:

Several participants expressed concern that continuing to delay an increase in the target range implied a further divergence from policy benchmarks based on the committee’s past behavior or risked eroding its credibility”

The dollar is overextending near-term with a z-score of 2.11, down from 2.70. Additionally, the daily RSI is above 75. We feel that a DXY at 98/99 will make it extremely hard for the Fed to hike while maintaining its current inflation outlook.

#dollar hits 97.21 • resistance may be found near 97.60.

Again at 98/99 essentially takes away any chance of hike. #fed won't risk +100

— Christopher Lemieux (@Lemieux_26) October 11, 2016

The gold-silver ratio is showing a negative divergence from price action.

We believe that this will bode well for silver, which has been down nine percent in October alone.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply