Gold Z-Score

However, due to the potential U.S. election upset by Donald Trump, the decline in the U.S. dollar and general market turmoil, the gains in the yellow metal have come quickly.

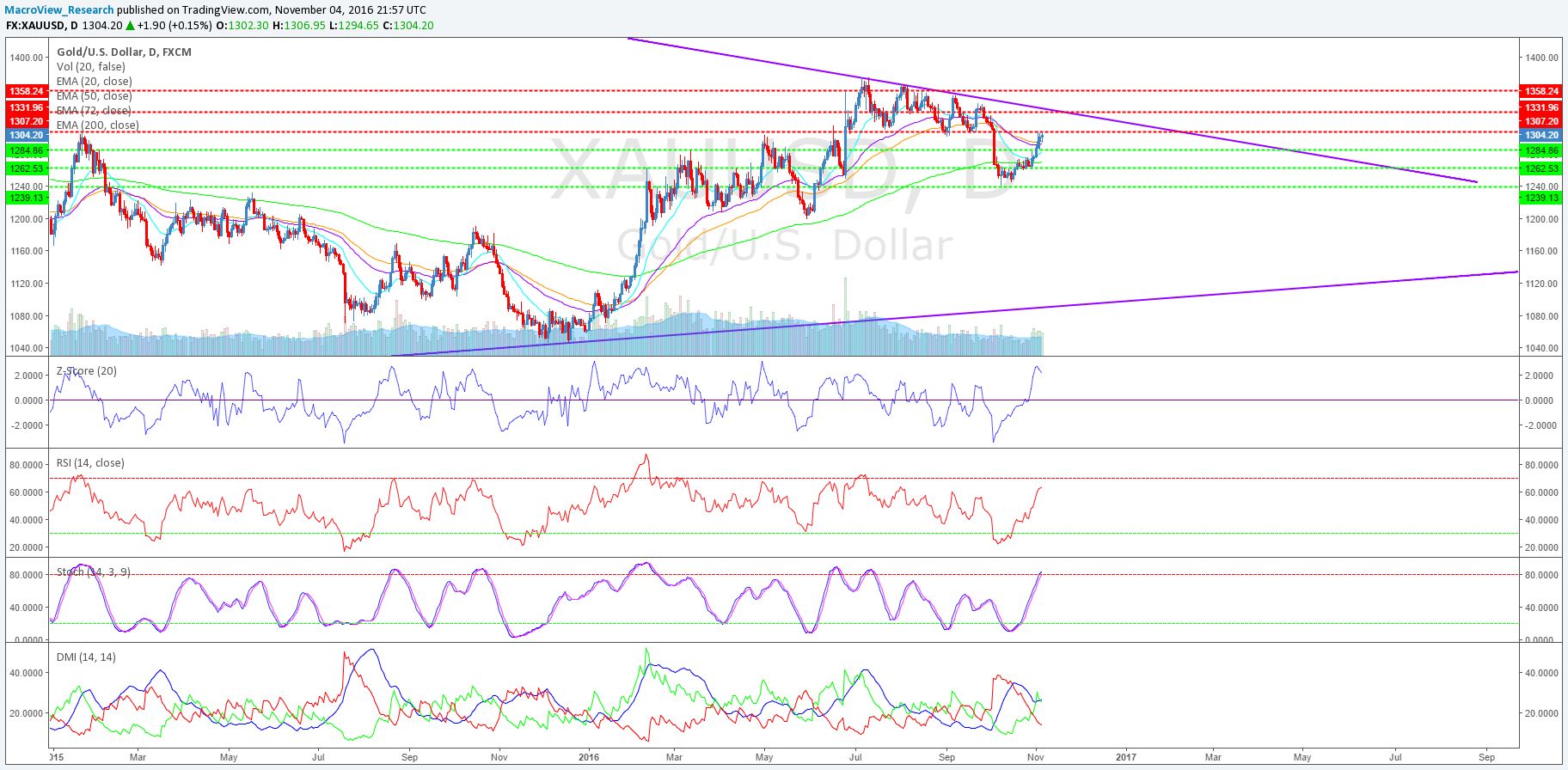

Near-term, the z-score of daily price action is 2.19 (down from 2.5) with the stochastics showing a potential for an overbought sell signal.

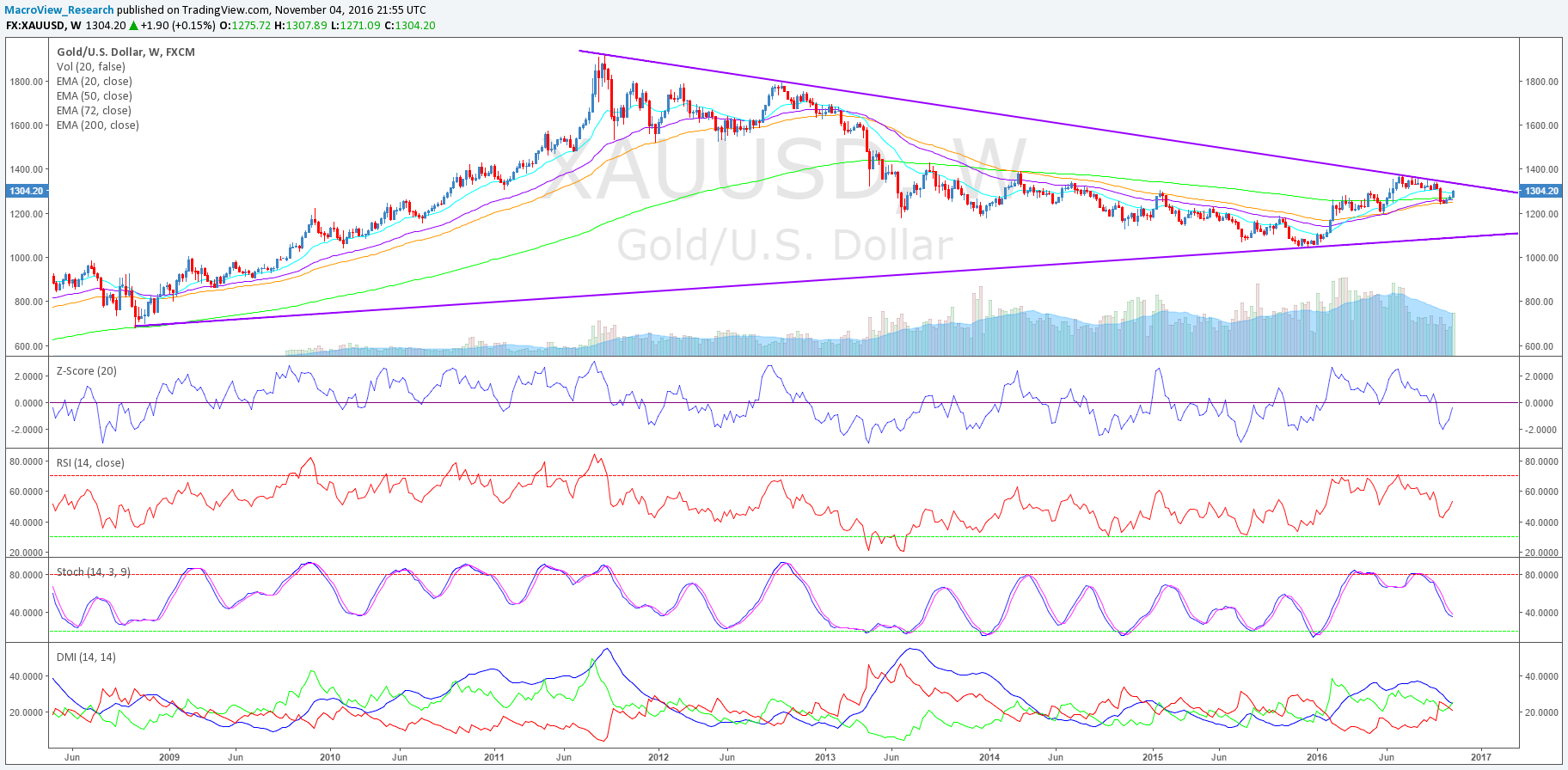

On the other hand, the z-score on the weekly price action is -.39 and is combined with a healthy RSI and increased + DMI activity.

*Note: the pricing z-score measures current pricing in relationship to the mean. A measure of +/- 2 is a great indication of a counter-trend, pullback or correction point.

Translation: gold has the potential to pullback near-term, especially is Hillary Clinton wins the White House on Tuesday. But, the longer-term trend still remains intact and healthy for further upward extension.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply