Peter Thomas – One Mans’s Journey From Silver Pit to Silver Screen – to Silver Shot

Bullion.Directory precious metals news 18 September, 2020

Bullion.Directory precious metals news 18 September, 2020

By Spencer Campbell

Founder / CEO at SE Asia Consulting

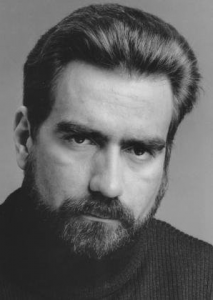

This week I chat with Peter Thomas who is a Senior Vice President at Zaner Precious Metals, a division of Zaner Financial Group LLC.

This week I chat with Peter Thomas who is a Senior Vice President at Zaner Precious Metals, a division of Zaner Financial Group LLC.

As a former licensed Floor Broker, he was a filling Broker in the silver pit back in the days when silver ran to $50 an ounce. He currently manages a global cash metals desk which handles refiners, recyclers, mining operations, and coin & bullion companies.

His insightful opinions are drawn from his 38 years of metals trading and are frequently in demand by Bloomberg News, MarketWatch, The WSJ, The Guardian, Hard Assets, US World and News Report, Kitco News, Futures magazine and other news outlets. His Podcast is on YouTube every Friday.

Once voted the most interesting man in the world, Pete has been in the business for 4 Decades and it looks like he is not leaving anytime soon.

We are going to reveal things about Pete that not many industry folks know so sit back and be prepared to be astounded!

We are going to reveal things about Pete that not many industry folks know so sit back and be prepared to be astounded!

Who knew Peter Alun Thomas is an actor who starred in such movies/TV show as The Untouchables (TV Series), Best of the Best 3, no turning Back?

1. So Pete what decade did you start in the precious metals business and how did you get into the game in the first place?

My father was on the New York Mercantile Exchange, CBOT – Nymex trading floor.

I used to do his charts by hand before I could go out to play baseball when I was 11 years old. I was a runner for four years in undergrad school and was sponsored to my membership 40 years ago where I was an independent floor broker filling paper for FCM’s .

I was fill paper and then meet the Hunt Brothers.

2. How many times have you retired and do you ever see that ever happening in the future?

I retired twice. First time I bought a BMW motorcycle with a side car and toured Europe. I got on the A list and hit a few parties , saw lots of fantastic attractions as well as enjoying terrific restaurants.

I retired twice. First time I bought a BMW motorcycle with a side car and toured Europe. I got on the A list and hit a few parties , saw lots of fantastic attractions as well as enjoying terrific restaurants.

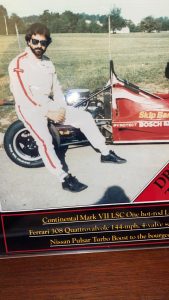

The second time I raced a lower class of formula car. I followed the races during my stay in Europe and always loved the racing scene so I took out after my passion. It turns out I was pretty good but not good enough.

I’ve got no plans to stop again because I’m just having too much fun. My team at Zaner Metals is such a great group of guys that it is a pleasure to go into the office.

Also it’s just the right size of a company and if we see something innovative we can implement it without 6 months of committees voting on it.

I love to create and make things better and the CEO Matt Zaner is really open to new ideas. I’m not going anywhere at present.

3. What can you tell us about your dealings with the Hunt Brothers?

I got an order from them that was a spread. It was inverted, an order desk error, and it would have cost them a fortune if I filled it.

Instead I had the desk call them and I explained how to Nelson ‘Bunker’ Hunt how to fix it. I also told them how to layer orders in so they would get better fills.

Bunker took me on to fill some of his order on the spot and I watched silver run up $4.00 from that day. Bunker past away aged 88, you can read the eulogy here.

4. You are super connected across the global industry with your experience, where do you see prices being set in the next 10 years given the price manipulations we have seen from the bad actors in the industry?

Right now Spencer I see the possibility of an inverse market where we might have a shortage of silver.

We are close now and it will be driven by the supply chain side. The next 2-3 months will tell me if it’s going to happen.

5. During Covid what was the biggest challenge for the precious metals industry and why?

I tried to order multiple tons of silver shot out of Peru for a Client. I was told the Air Force would not grant me landing privileges.

Then Mexican Miners Union would not deliver to me for the safety of the Miners. It went on and on like this and I still need product and then the US Mint announced it was cutting its production by 50%. This is all supply side driven.

There is a major shortage of workers to move metal. Without the independent Scrappers America would be in trouble. This invisible killer has hurt everyone and we are not excluded.

6. What problems will the precious metals industry face in the near term when prices continue to rise?

The US Mint is facing a worker shortage. This is really hurting us all in the field.

The US Mint is facing a worker shortage. This is really hurting us all in the field.

It will continue to drive prices higher if demand stays strong this year. The real problem will be shortages of product to sell. We have relationships with miners, scrappers, refiners and bullion producers and we still are having a hard time keeping up.

7. What is your take on the attempts to digitize of the gold industry?

The problem Spencer as you of all people know – you are the watchdog I call The Bulldog – it is this question; is it (the book entry) really backed by gold?

The product has to be there, otherwise they are just printing gold. Blockchain seems to me to be a ways off, so I don’t see it as an answer yet. Bitcoin is not gold and no it will never replace gold.

No I don’t believe in it yet.

9. We both know Gold is going up but the real question is when will gold break to the upside?

The second quarter of Trumps next term along with the Covid-19 vaccine release.

Gold will break with this one-two punch.

9. Tell us how people can connect with you and follow your market commentaries?

Follow our YouTube podcast on the weekly recap of metals.

I usually have it posted by Saturday. Metalzaner on Twitter will get you market blasts on current events.

My own personal LinkedIn Pete Thomas, I post my Bloomberg interviews and radio broadcasts when I do them.

Market Watch releases my thoughts on the metals in the WSJ when I do something with them.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply