Well, low interest rates anyway. Because retiring now costs 8 times as much as it once did

Bullion.Directory precious metals analysis 25 January, 2016

Bullion.Directory precious metals analysis 25 January, 2016

By Adrian Ash

Head of Research at Bullion Vault

It finds that, adjusted for inflation, you need four times as much saved for retirement as you would 40 years ago to get the same level of investment income from low-risk assets today.

Blame this mess on the collapse in interest rates, of course. Plus the drop in household savings. Plus the slide in average personal income growth.

Upshot? US retirees “can no longer afford to live on investment-grade fixed income returns,” says the S&P note. Which may hardly be news. But it should be making headlines. Everywhere.

Check the UK situation, for instance…

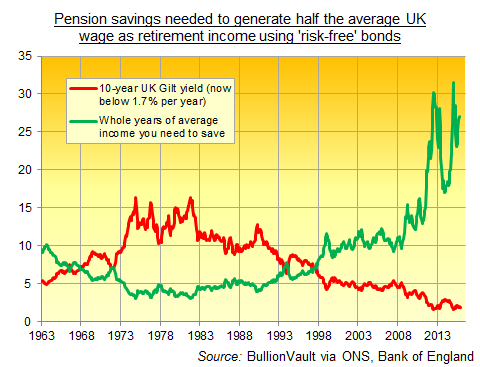

Yes, if you want to retire on half of the average UK salary, then generating that level of income from “low risk” government bonds would need you to have 27 whole years of the current average wage saved up today.

That, as you can see, has jumped from the last half-century’s low of just 3.5 years’ full income, an achievable level which retirees needed to have ready at several points in the 1970s and early 1980s.

Because back then, the rate of interest offered by “low risk” government bonds touched above 16% per year. But it’s since collapsed, down to the current miserly yield below 1.7% right now.

Upshot? Besides a lot of poor pensioners – secretly hoping they peg out before their money does – these record-low returns to “safe” investments like government bonds and cash are also sprouting a crime wave.

Upshot? Besides a lot of poor pensioners – secretly hoping they peg out before their money does – these record-low returns to “safe” investments like government bonds and cash are also sprouting a crime wave.

Because many savers are rightly looking for an alternative to bonds or cash, but few people have knowledge or experience of what to ask and what to avoid. So boiler-room crooks are pushing at an open door.

Hence the flood of Bordeaux wine scams, fake carbon credits, non-existent share deals, landing banking fraud, gold coin bait-n-switch learned from American conmen, and – of course – empty office safes not holding any precious metals, all now draining the UK’s would-be retirees’ tiny pension pots.

Given the current financial climate with low interest rates this type of fraud promising high returns is quite common.”

So said a Southwark police detective last September, commenting on the jailing of a gold investment con artist.

Blame the Bank of England, in short.

If you’re investing in high-value objects or goods, using specialist storage outside your home should be the smart option. Because professional care is safer – reducing your insurance costs – and it will ensure the quality of your property, maintaining its maximum resale value.

But how do you know the stuff really exists? How do you know it is of the quality promised?

Get independent proof that’s separate from your seller. That starts with getting storage at a third-party specialist, a business which is independent of your seller’s company. You can then check the custodian’s list of what they’re caring for, rather than taking your seller’s word for it. Also expect to get regular inspection reports from outside experts, double-checking the custodian’s list and the quality of the material they’re caring for.

This is how BullionVault works. Firstly we employ independent custodians to care for our customers’ bullion, entirely separate from our own operation. Secondly, we post the vault operators’ own bar lists on the internet for our users to see. Against that, we post in public a full list of each client’s holdings – all under anonymous nicknames to protect privacy – so you can check that the sum total matches with the independent bar lists down to the last gram every working day.

Independent assayers then visit all the vaults each year, counting and inspecting each bar and reporting back to the independent chartered accountants who audit BullionVault’s books and prepare our tax return. That report is then posted on the auditors’ website, a site we couldn’t hope to control.

The Queen’s Award for Enterprise recognised this innovation in the first of BullionVault’s two awards, back in 2009. Now it is being applied to verify customer holdings of maturing Scotch through our new, sister venture, WhiskyInvestDirect.

Whether or not you fancy investing in maturing Scotch whisky – appreciating in the barrel by 9% per year on average since 2005 – odds are you must look beyond the low-yielding shares and near-zero yielding bonds which financial advisors and pension funds would put you in.

Plenty of crooks are only too happy to help.

Do yourself a favour, and do your homework. But do also accept that “risk-free” retirement savings in government bonds and cash are a thing of the long-distant past.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply