While Dennis Gartman says, “I wouldn’t be surprised if oil went down to about $15 a barrel”, crude bounces above $45

Bullion.Directory precious metals analysis 20 March, 2015

Bullion.Directory precious metals analysis 20 March, 2015

By Terry Kinder

Investor, Technical Analyst

It seems there is always a fundamental, or not-so-fundamental reason for the price of oil to move higher or lower. Today’s reason, according to CNBC is that German Chancellor Angela Merkel opened her mouth and said something positve about Greece.

Merkel said on Friday payments to Greece could begin in slices if the country’s list of reforms is approved.

Apparently a more patient Fed Chair Yellen, combined with a more chipper Merkel have “caused” the oil price to move higher. There’s but one small problem with this theory – reality. CNBC, amongst others, is a purveyor of correlation equaling causation. “A” happened before “B”, therefore “A” caused “B”. Merkel made nice with Greece and the Greeks like olive oil, therefore the price of crude oil went higher because Merkel made nice with the Greeks. At least if CNBC is going to commit the error, they could make their story sound more plausible. Oh well.

Much of the correlation equals causation fixation that the financial media and punditry has, owes to a fundamental mis-understanding of how prices work. History is full of cycles. There are cycles of war, revolution, business cycles, seasonal cycles, generational cycles and more. The whole universe runs on cycles. Prices have their own internal cycles as well which are based on the laws of mathematics, physics and geometry.Ironically, cycles are dealt with in polar opposite manners, depending on who is dealing with them. Central banks pretend they can manipulate the business cycle, attempting to smooth out the highs and lows. Others ignore cycles altogether, pretending they don’t really exist, or acknowledge them to some degree but claiming prices are random and therefore impossible to predict. All of which helps explain why CNBC, and others, will swing wildly between pushing news stories of $15 oil while, at the same time, explaining that Angela Merkel and Frau Yellen are the cause for every little blip in the value of the dollar or oil.

There is a third way. Acknowledge that prices are cyclical and can be understood. While price movements can sometimes appear tricky, especially over shorter time periods, the seeming mystery often owes to analyzing them within the wrong time frame, not considering the dominant trend, letting personal biases enter the analysis, etc. On 16 March I wrote this about the price of oil:

When will the oil price reverse? If the calculations have been made correctly (we aren’t going to get into how they were made just yet, perhaps another day), then a low in the oil price should be made around Thursday the 19th of March. Yes, it’s that close, despite much speculation to the contrary. One thing we can’t know yet is whether the low represents “the low” or an interim low. We won’t know for certain until we can look backwards at some point in the future.

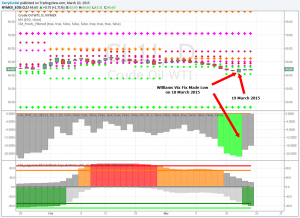

So, where are we now? Since that was written, the oil price hit a new bottom on 18 March of $42.03. So, what about 19 March? Let’s look.

Oil, for the moment, seems to be following the script. It hit a new low price on 18 March and bounced higher on 19 March. It remains to be seen if 18 March will be an interim low or the pivot low before oil reverses and begins a march higher. This is something that we obviously can’t know until we are able to look back a certain amount of time.

It’s rather interesting how quickly markets can turn. Looking at the chart above, the Williams Vix Fix Indicator (directly below the price pivot chart) had four down days marked by the light green bars. Then, on March 19, the indicator suddenly reversed as the oil price moved higher.

Conclusion

If we want, we can continue to listen to and believe the explanations of price movements emanating from CNBC and others. We can rely on Dennis Gartman’s prediction of $15 oil and believe that, on a daily basis Merkel, Yellen or whomever, moves the price of oil, gold, etc. simply by opening their mouth.

Or, after we tire of being whipsawed by contrary points of view and explanations, we can study the cyclical nature of prices and come to understand that, not only are the explanations as to why prices move expressed by the financial media wrong, they may, in fact, be deliberately wrong.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply