After 75-plus months of ZIRP, Federal Reserve cuts both growth and inflation forecasts.

Bullion.Directory precious metals analysis 18 March, 2015

Bullion.Directory precious metals analysis 18 March, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

Markets went wild following the FOMC minutes, which was more dovish then expected. Those interest rate bulls must wait another day as equities, bonds, and commodities rallied hard and rates fell sharply. The dollar, well, it crashed even harder, losing three percent before slightly rebounding.

The EURUSD squeezed the “sure” trade by 431 pips – ouch.

@Lemieux_26 would be damned if it went to parity. Unlikely. #Dollar will continue to put deflationary pressure on #Fed

— Chris Lemieux (@Lemieux_26) March 6, 2015

What was more shocking than the Fed dropping “patience” from their language was that their growth outlook was cut.

No longer is growth moving at a “solid pace,” but it has “moderated somewhat.”

That’s Fed talk for the economic data has been crap. Fed Chair Janet Yellen backed that up by telling markets during her press conference, that payrolls data is no longer a reason to push for a rate hike.

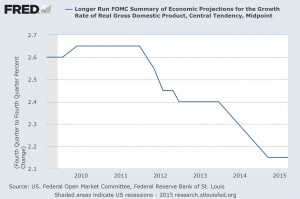

The FOMC minutes showed that growth projections slipped from 2.6-three percent to 2.3-2.7 percent GDP growth, and inflation forecasts remain muddled.

The longer-run FOMC economic projection of the growth rate for real gross domestic product (midpoint) looks meek. Is there supposed to be a recovery in there somewhere?

It came down to the dollar’s never-ending surge.

With eight, going on nine months, of consecutive monthly gains, the US dollar has wrecked havoc both on corporate profits and exports. It has been the byproduct of global central banks waging a currency war and the assumption that the Fed will tighten sooner than later.

The Fed has now entered the currency war, as language was designed to talk the currency lower – a move out of ECB president Mario Draghi’s playbook.

On March 11, I mentioned that the Fed would have no other option but to join the currency war:

The new normal: the #dollar is up 10.68 percent since Feb. The #federalreserve will be FORCED into the #currenywar

— Chris Lemieux (@Lemieux_26) March 12, 2015

The effective Fed funds rate will unlike be increased with the dollar as these levels, which I tweeted on March 10:

#dollar strengthens as the effective #Fed funds rate rises. The effective rate increases with a rate hike boosts $DXY pic.twitter.com/1xSa7d40BC

— Chris Lemieux (@Lemieux_26) March 10, 2015

The dollar will continue to increase given the QE programs across the globe. It’s only a matter of time before the Fed does more than jawbone.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply