Inflation – The Elephant In The Room

Bullion.Directory precious metals analysis 17 August, 2014

Bullion.Directory precious metals analysis 17 August, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

In 2014, traders are using gold as a hedge against increasing headline risk, due to global geopolitical tensions – However, gold has not received many bids on the potential for increasing inflation.

The largest central banks are binging on neo-Keynesian monetary policy and generating trillions in new currency. Although there is the possibility for Argentina-like inflation, financial markets are complacent and believe the Federal Reserve has their best interests at heart.

As measured by the Fed’s go-to index, the personal consumption expenditure (PCE) index hit the highest annual rate in three years during the second quarter, reaching 2.3 percent opposed to 1.4 percent in the first quarter.

Higher inflation will likely deter the meager growth in the US, but the Fed pushes it aside as “noise.” What’s troubling is market participants gobble up anything that comes out of the central bank.

Keep in mind: the Federal Reserve, by its own admission, could not see the worst financial cataclysm coming since the Great Depression in 2008/9.

So, would you leave the Fed to forecasting inflation?

The Fed has kept their near-zero rate interest policy, known as ZIRP, since 2008. Financial markets are growing wary of when the Janet Yellen & Co. will begin to raise rates in order to somewhat normalize monetary policy.

Unfortunately with trillions of dollars printed out of thin air, the Fed may need to raise rates quicker and in larger chunks to combat inflation.

Many analysts see raising rates as negative for gold, but precious metal analyst Peter Grant pointed out that “if you look back over time, there are plenty of instances where rates have risen and gold has risen as well.”

From 2004 to 2006, gold prices climbed by 57 percent as the Fed bumped rates higher.

Conversely, the other scenario is much more likely. Fed Chair Janet Yellen said that even if the US economy grew of positively, she would continue to embark on ultra-low rates and accommodative monetary policy. The opportunity cost for gold is next-to-nothing, according to Money Morning’s Peter Krauth.

Inflation in the US is moderate, but the trouble would be keeping a lid on it because it is a beast that is hard to tame.

Look at the Bank of Japan (BoJ), which implemented a similar program as the Fed. In one year Japan went from deflation to inflation over three percent. The national core consumer price index (CPI) went from 1.4 percent in April to 3.2 percent in May, which lingering there for three consecutive months.

The BoJ has singlehandedly destroyed the yen and lower purchasing power is starting to show in the economy data. For the second quarter, Japan’s economy contracted 1.7 percent.

In a nutshell, gold helps protect an investor’s purchasing power and hedge currency risk directly linked to central bank policy.

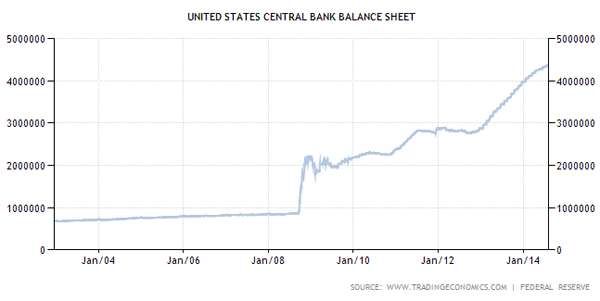

Federal Reserve’s “Operation Endless Balance Sheet”

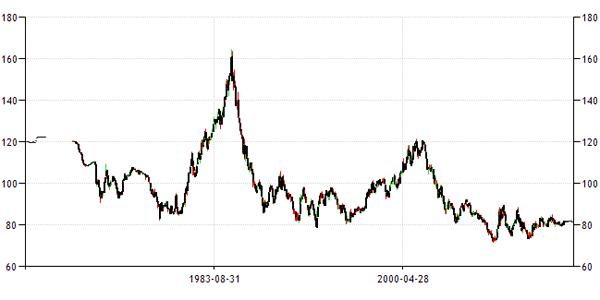

The US dollar index hovering near multi-year lows and well below the average:

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply