Gold Price Drop Spurs ETF Selling, Physical Investor Buying as Trump Warns Over Trading with Iran

Bullion.Directory precious metals analysis 07 August, 2018

Bullion.Directory precious metals analysis 07 August, 2018

By Adrian Ash

Head of Research at Bullion Vault

With gold prices barely $10 above last week’s 12-month lows, world stock markets followed Wall Street higher, adding over 2.9% to China’s main equity index as the Yuan extended its rally versus the Dollar on the currency market.

The UK gold price in Pounds per ounce meantime ticked a 2-week high just below £938 as Sterling fell after both the National Farmers Union and the Association of Police & Crime Commissioners warned against a “no deal” Brexit – now 60/40 likely according to trade minister Liam Fox, “uncomfortably high” odds according to Bank of England chief Mark Carney.

Trump’s warning to other countries over the re-applied US sanctions was met by what the White House called “propaganda” from Tehran, where Iranian President Hassan Rouhani said “I don’t have preconditions [for talks]. If the US government is willing, let’s start right now.”

Despite the rise in trade and geopolitical tensions, investment in gold-backed trust funds shrank by 1.6% in July new data showed today, pulling their value down to $94 billion, the lowest in 12 months.

“Gold price performance was a large contributor to [those ETF] outflows,” says the mining-backed World Gold Council, posting the figures as a PDF, “as it fell over 2% in US Dollar terms.”

Private investors, in contrast, grew their physical bullion holdings at the fastest pace since December according to data from BullionVault this morning, with major coin fabricators also reporting a sharp rebound in business during July’s price drop.

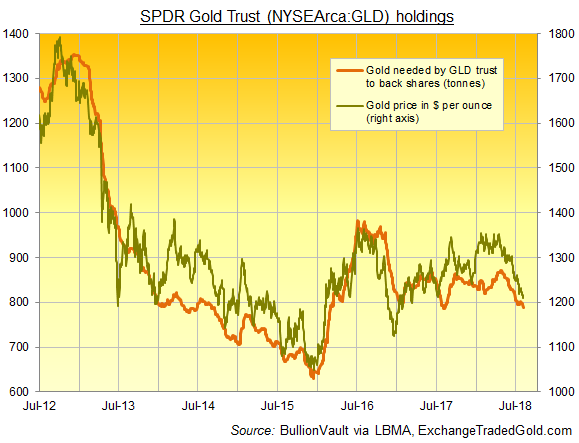

The largest gold-backed ETF, the giant SPDR Gold Shares (NYSEArca:GLD), yesterday shrank again, reduced by 0.8% as investors sold once again.

That took the amount of gold needed to back the GLD’s value down to a new 12-month low at 788 tonnes.

The GLD peaked in size with 1,353 tonnes at end-2012.

Silver’s largest ETF product has also bucked the trend in gold-backed trust funds, with the iShares Silver Trust (NYSEArca:SLV) ending Monday at its largest size in almost a year to need 10,274 tonnes of bullion.

Silver outperformed gold prices in London on Tuesday, edging above last week’s finish to trade at $15.46 per ounce.

Platinum prices also recovered Monday’s drop, adding 1.9% to near last week’s peak around $840.

The Chinese Yuan meantime extended its rally from Friday’s new 15-month low, adding 1.0% versus the Dollar on the forex market.

Shanghai prices held unchanged in Yuan terms, showing a premium to London quotes of $4 per ounce – less than half the typical incentive for new bullion imports into the No.1 consumer market.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply