Gold Bullion Up on Sinking Bond Yields, Comex Volume Hit by NY-Lon Arb Blockage

Bullion.Directory precious metals analysis 15 May, 2020

Bullion.Directory precious metals analysis 15 May, 2020

By Adrian Ash

Head of Research at Bullion Vault

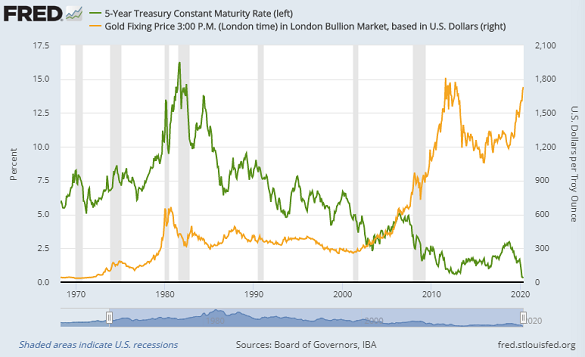

With US Treasury bond prices rising yet again, yields fell to fresh all-time lows on 2-year and 5-year debt, offering new buyers just 0.13% and 0.28% in annual interest.

Crude oil meantime trimmed its overnight gains – made after new data said China’s energy demand rebounded in April, while a separte report said members of the Opec+ exporters’ cartel are slashing production faster than expected – but still hit 1-month highs for European benchmark Brent at $31.70 per barrel.

The UK gold price in Pounds per ounce today broke above £1435 per ounce, gaining some 23.3% for 2020 to date, while the Euro gold price tested its record high of late-April at €1611.

Gold priced in the US Dollar meantime touched $1742, just $5 below last month’s new 7.5-year peak, after President Trump said the US-China trade deal looks in jeopardy following Beijing’s failure to stem the outbreak of novel coronavirus back in January, saying that “The ink was barely dry [on the trade deal] and the plague came over.

“They should have never let this happen. Right now I don’t want to speak to [President Xi].”

For gold bullion, “The break out of the triangle formation is now starting to define a gradual upward trend,” says brokerage INTL FCStone’s Rhona O’Connell in a note, “aided by a minor weakening in the Dollar on the back of renewed Sino-US trade tension and despite resilient equities.”

Looking at bond yields and rates meantime, “The fact that the futures market is implying negative rates does not necessarily mean that the Fed will follow through on these cuts,” says the latest weekly note from specialist analysts Metals Focus, commenting after Federal Reserve chair Jerome Powell this week rejected Trump’s call for negative overnight rates.

“[But] market expectations of interest rates themselves can have a meaningful impact on financial markets, including gold…[and] in the unlikely event that the Fed takes policy rates below zero next year…this will act as a strong tailwind for gold [as] the opportunity cost of holding gold will diminish further, making it even more attractive to both retail and institutional investors.”

Over in China on Friday, wholesale bullion traded on the Shanghai Gold Exchange closed the week $28 per ounce below London quotes, suggesting a strong surplus of supply over demand in the world No.1 gold consumer nation, but marking the smallest discount in 5 weeks.

New York futures prices, in contrast, extended their premium to London bullion back to $10 per ounce, sharply down from late-March’s record spike to $100 for Exchange for Physical, back when the UK went into lockdown, but still pointing to tight supplies of metal for making delivery against Comex derivatives contracts.

“Despite the narrowing of the EFP, we are still far from being back to normal,” says strategist John Reade at the mining industry’s World Gold Council.

“Comex gold futures open interest increased slightly over the past couple of sessions as the price headed higher, but volumes remain disappointingly low.”

“The ability to make physical delivery is the essential condition for arbitrage trading,” says Bruce Ikemizu, formerly of ICBC Standard Bank Tokyo and now CEO of the Japanese Bullion Market Association, pointing to the global gold market’s usual method of closing up any location price-differentials through traders exploiting those gaps and shipping metal from one location to another.

But with air freight dramatically reduced by the UK and US lockdowns and the collapse of passenger traffic, “Fewer players are willing to do this arb [between London and New York prices] any more,” he believes, because of the sudden and unknowable risk of being unable to ship bullion easily across the Atlantic.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply