Gold Price Tries $1500 Again as Trump Blames Fed for Strong Dollar

Bullion.Directory precious metals analysis 20 August, 2019

Bullion.Directory precious metals analysis 20 August, 2019

By Adrian Ash

Head of Research at Bullion Vault

“We’ve been skeptical that Fed easing by itself would doom the Dollar,” Bloomberg quotes currency strategist John Velis at Bank of New York Mellon.

“Other central banks [are] expected to ease by as much or even more than the Fed…[meaning a] lack of downward force on the Dollar from policy expectations.”

Consumer-price inflation across the 19-nation Eurozone slowed last month to just 1.0% new data said Monday – the weakest pace since November 2016, when the European Central Bank responded by extending its program of QE money-creation and asset purchases.

“Global conditions are weak,” said Federal Reserve member Eric Rosengren of the Boston Fed on Monday, “[but] I just want to see evidence that we are actually going into something that’s more of a slowdown [before voting to cut rates].”

Lower rates “could worsen the next downturn” Rosengren told Bloomberg, because it would “leave the Fed with little ammunition.”

The Dollar last night rose to fresh 2019 highs on Bloomberg’s measure of the currency, strength blamed yet again on the Fed by US President Donald Trump.

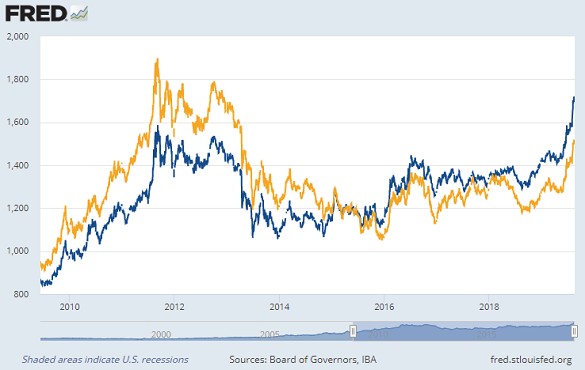

Adjusted by the US Fed’s own Dollar Index, the price of gold outside the world’s No.1 reserve currency closed last week at a record high of $1717 per ounce, some $200 higher than the metal’s USD price.

Betting on Fed rates now puts the likelihood of a 1/4-point cut at 95% for the September meeting, according to data from the CME derivatives exchange, up from 60% this time last month as betting on a 1/2-point cut has shrunk.

Betting on December’s meeting is however now more dovish, with nearly half of all speculative positions forecasting Fed rates of 1.5% or low by year’s end – more than double the proportion at this time in July.

“Gold is backing and filling,” said Monday’s precious metals note from brokerage INTL FC Stone’s Rhona O’Connell, pointing to last week’s small cut to bullish speculative bets on US Comex gold derivatives as the cause for gold’s drop from $1535.

The UK gold price in Pounds per ounce meantime rose back towards the last 2 weeks’ closing level of £1245 – an all-time record when first reached in early August – as Sterling fell after European Council president Donald Tusk rejected new UK prime minister Boris Johnson’s latest demand to delete the Irish back-stop from the EU withdrawal agreement reached with his predecesor Theresa May but rejected 3 times by the London parliament.

Britain’s Foreign Office also said it’s concerned about the welfare of a colleague from the UK’s Hong Kong consulate, now missing since 8 August after failing to return from the Chinese mainland.

With weekend protests against Beijing’s control of the city-state now running for 11 weeks, China’s Yuan today fell to new 11-year lows of ¥7.065 against the Dollar.

The Euro currency also fell against the Dollar, driving the gold price for French, German and Italian investors back up to €1360 per ounce – less than 2% below its all-time record high of September 2012.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply