Gold Trading Slips in London as ETFs Shrink, US Fed Rate-Hike Vote ‘Can’t Come Soon Enough’

Bullion.Directory precious metals analysis 10 September, 2015

Bullion.Directory precious metals analysis 10 September, 2015

By Adrian Ash

Head of Research at Bullion Vault

Silver was again firmer and spiked harder than gold, touching $14.88 per ounce before trading back 20 cents to stand 0.8% higher for the week so far.

Commodity indices rallied further from last week’s new multi-year lows, and US Treasury bond yields held steady near 1-month highs.

“The Fed should wait until inflation is closer to target before raising rates,” advises the latest edition of The Economist magazine.

“Next Thursday cannot come soon enough,” says the daily commodities note from ICBC Standard Bank’s London office.

“The regular [US Fed] guessing game is a necessary but increasingly tiresome feature of [current precious metals] markets.”

The Bank of England voted 8-1 to keep the UK central bank’s QE bond holdings unchanged at £375 billion for the 38th month running, and to keep its key interest rate unchanged at a record low of 0.5% for the 79th month running.

Bullion held to back the giant SPDR Gold Trust (NYSEArca:GLD) yesterday shrank almost 5 tonnes – its largest outflow in 6 weeks – to close Wednesday at 679 tonnes, a new 7-year low when first reached at the end of July and 14% smaller from this point in 2014.

Holdings in the iShares Silver Trust (NYSEArca:SLV) ended Wednesday at 10,017 tonnes, the lowest quantity needed to back its stock since mid-June and 3% below the level of this time last year.

Over in China – the world’s No.1 consumer market – the Shanghai Gold Exchange says it will from the end of this month let trading members post precious metals, foreign currency and share certificates as collateral for new positions.

The move, says a statement published overnight and relaying a notice to members from late August, is intended to “boost market services” from what is currently the only legal route for any gold bullion to enter private circulation in China.

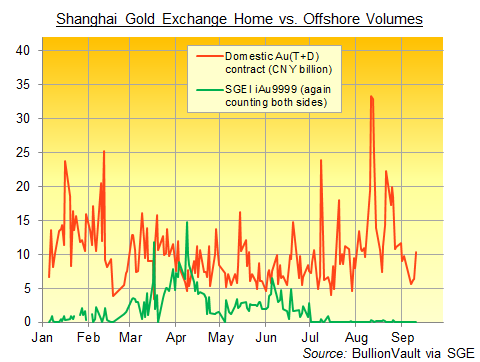

Trading volume in the SGE‘s main gold contract increased today as prices fell, rising near its 12-month average.

Shanghai’s new international contracts, in contrast – launched 12 months ago for foreign insitutions to trade using Yuan held in offshore accounts – saw next-to-no business once again.

“There is no listed derivative in precious metals in London,” said base metals trading specialist London Metals Exchange CEO Garry Jones to reporters at a conference in Mumbai on Thursday.

“We really want to be able to clear gold, silver and other precious metals. As an exchange…we want to partner with the market.”

Trading volumes through the LBMA Gold Price auction – the electronic benchmark platform administered by LME competitor Intercontinental Exchange (ICE) and now regulated by UK law – fell this afternoon below 35,000 ounces, barely one-fifth of the daily average between April and July.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply