And China Sees Bullion Premium $20 Over London Quotes

Bullion.Directory precious metals analysis 25 November, 2016

Bullion.Directory precious metals analysis 25 November, 2016

By Adrian Ash

Head of Research at Bullion Vault

The metal then rallied $15 in London gold trading to cut its weekly loss to 1.9%, heading for the lowest Friday finish since early February.

With US trading expected quiet as dealers extended yesterday’s Thanksgiving holiday to the weekend, European stock markets failed to follow Asian equities higher

But commodities slipped with government bond prices, edging 10-year US Treasury bond yields up to 2.37%, the highest level in almost 18 months.

Outside the US “we see a lot of uncertainty,” says George Cheveley, portfolio manager at Investec Asset Management in London to Bloomberg – ” partly caused by Trump’s election.

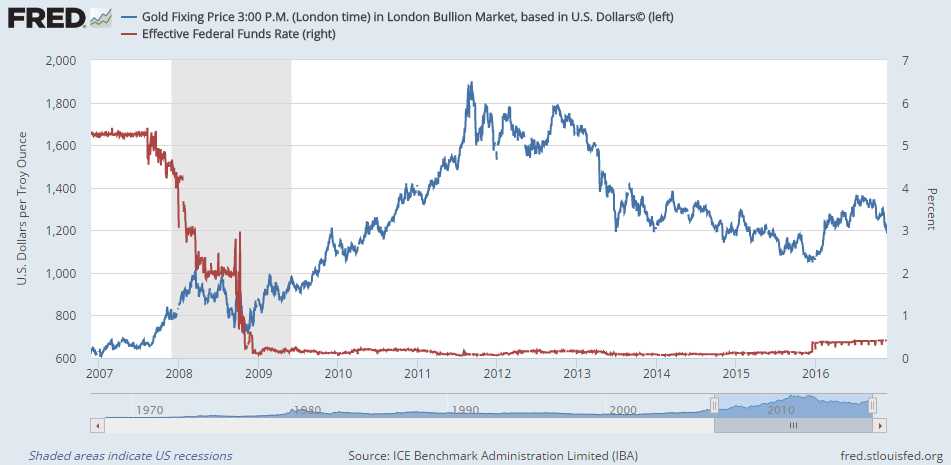

“It seems a lot like last year. We saw gold trade softly [ie, down] into the rate rise, and then saw gold take off again in January.”

Only 1-in-15 bets on US interest-rate futures now see the Federal Reserve holding at a ceiling of 0.50% when it meets to decide policy in December.

The overnight drop in Dollar gold prices to $1172 saw strong trading volumes on China’s Shanghai Gold Exchange, with the city’s official benchmark price fixing at the equivalent of a $20 per ounce premium above global quotes.

“SGE premium remains at an extreme over loco London,” says Swiss refining and finance group MKS’s Asian desk.

“The last time we saw these levels was back in 2013. [But] despite the stunning premium, the Chinese had very little interest” on Friday.

Several major news-sources meantime quoted Indian agency Newsrise quoting an un-named “ministry official” as saying the Government – currently under attack from opponents, economists and business leaders for its shock ‘demonetisation’ of the country’s largest banknotes – is weighing the idea of “curbs on domestic holdings of gold as Prime Minister Narendra Modi intensifies a fight against ‘black money’.”

Repeating earlier rumors spread within India’s gold industry – employing some 4 million people – “A potential ban on import of gold into India [would be] the biggest bombshell for gold investors in 45 years since Nixon announcement” that the US abandoning the Gold Standard, claims Indian tipsheet The Arora Report.

“If this happens, there is a high probability of a one-day drop in gold that could reach $200.”

India effectively shut legal imports in mid-2013 by imposing the complex and confusing gold 80:20 rule. That coincided however with global prices stabilizing after the Spring 2013 gold crash.

Gold prices then fell heavily in contrast when India abolished the 80:20 rules some 18 months later.

“Post-demonetisation” and with consumers unable to spend the 500 or 1000 Rupee notes reprsenting 86% of cash in circulation, “Mumbai’s bustling and glittering Zaveri Bazar, the national bullion and jewellery market, wears a forlorn, deserted look,” reports the Financial Express today.

Gold exports to refining center Switzerland from Vietnam, formerly one of Asia’s strongest gold investment markets, have meantime surged in 2016 to date, new data show, jumping over 20-fold from 2015 on tax changes which have driven domestic prices below world quotes for the first time, according to Vietnam Net.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply