Gold Trading in London pushed Dollar prices up to 1-month highs Monday

Bullion.Directory precious metals analysis 13 June, 2016

Bullion.Directory precious metals analysis 13 June, 2016

By Adrian Ash

Head of Research at Bullion Vault

Eurozone stock markets fell 1.5% as London’s FTSE dropped 1% with crude oil.

Gold priced in British Pounds hit new 32-month highs just shy of £910 per ounce, while Chinese dealers today returned from the long Dragon Boat holidays to find gold trading 2.8% higher from Wednesday’s close.

Hitting the highest Yuan price since spring 2013, Shanghai gold fixed at today’s key benchmark auction at a premium of $10 per ounce over spot London quotes.

“Chinese investors were aggressively on the offer,” says the Asian trading desk of Swiss refining group MKS, reporting heavy selling through Shanghai “which was not surprising.

“But as we have seen over the past week, Comex demand [for bullish gold futures and options] on dips was strong and happily absorbed the Chinese liquidation.”

“Asian physical demand has started to improve,” says a weekly note from Chinese-owned ICBC Standard Bank, “albeit from subdued levels.

“Western investors, meanwhile, remain consistent buyers.”

Last week saw exchange-traded trust funds backed by gold expand yet again, taking the SPDR Gold Trust (NYSEArca:GLD) to its largest holdings since late 2013.

Silver-backed ETFs led by the iShares vehicle (NYSEArca:SLV) expanded to a new all-time record size, beating the previous peak of 2014.

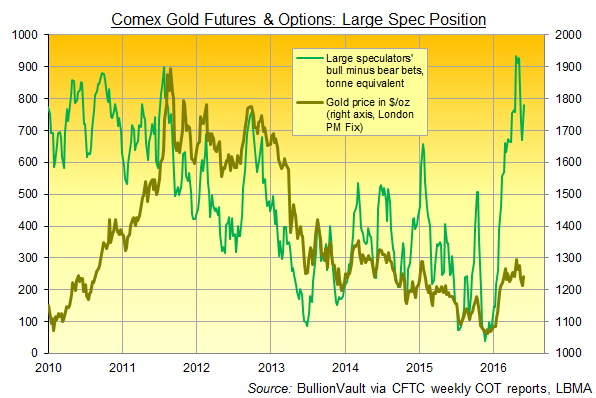

Speculative positioning in Comex futures and options meantime saw the number of bullish bets rise as bearish bets fell last week, according to data from US regulator the CFTC.

That drove the “net speculative position” of non-industry traders’ bullish minus bearish bets 16% higher.

Net speculation in Comex silver derivatives shrank in contrast, down to the smallest level in 2 months. But like gold, it remained around 275% of its average size over the last 20 years.

“Gold now has a window of opportunity to break into a higher range,” says ICBC Standard, as “falling [government bond] yields and the prospect of an unusually divisive US election campaign are supportive of higher gold prices.”

Looking at the Brexit referendum, “gold’s price-boost in January was accompanied by a sharp move towards the anti-Europe voters,” notes US financial services giant Citi, explaining that “for most of April and May, the vote trend was range-bound” as were gold prices.

“More recently…the June 2016 rally in gold [has] occurred at a time of a similar sharp move towards an anti-Europe outcome.”

“UK and German sovereign debt yields [last week] fell to record lows,” adds London bullion market maker HSBC, with “safe-haven and hedge-related trading ahead of the UK referendum…becoming more noticeable.

“A portion of this demand [is] being funneled into physical gold purchases in the EU.”

Silver prices meantime failed to follow gold higher on Monday, trading unchanged for the day even against the British Pound.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply