Gold has been very technical, and the hot PPI figure helps, too.

Bullion.Directory precious metals analysis 18 November, 2014

Bullion.Directory precious metals analysis 18 November, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

In “Gold Hits Key Resistance, Trades Low on Equity Highs,” gold was lingering near key resistance at $1,179 per troy ounce with the S&P 500 hitting another all-time high. In this analysis, I forecasted a climb in gold prices once this resistance level was closed upon to $1,195 to $1,200 per troy ounce on November 10.

This morning, gold was bid higher to these levels after trading in the $1,180 level for a couple of sessions.

Gold is probably the most hated financial instrument among the Wall Street elite. Higher gold prices would assume that this so-called economic recovery was not as real as they thought. Given the bearish all-out attack on gold and the well-sought after $1,000 mark, gold has been resilient and rallied quite nicely.

There are a few factors for gold’s rally. Technically, gold prices have been able to find pricing support in the futures market at important support levels because a break below these levels would have caused significant technical selling, and that $1,000 per toz. level could have been triggered.

Gold traded above $1,200 this morning, and a close above this level would give way to further appreciation to $1,215 and $1,224 per toz. The first near-term target would correspond with price action resistance meeting the 50-day EMA. There are several minor descending trend lines that could hinder gold’s progress higher as it trades through ascending channel created at the bottom.

The bullish DMI crossover suggests that price action is now entering bullish territory and the first time it has happened in a month.

There has, also, been speculation that the European Central Bank (ECB) will eventually act on expanding their balance sheet as the eurozone creeps towards deflation.

ECB President Mario Draghi said during a press conference that the central bank could buy a verity of assets in an attempt to stimulate the eurozone. ECB official Yves Mersche said that gold bullion good be an asset of choice, he made it clear that asset buying is not something to rush into.

The ECB has been rather conservative opposed to the Fed, and certainly, the Bank of Japan. It is likely that nothing significant will happen until market participants grow tired of their rhetoric.

And, this goes for all central banks. It is the confidence that something will be done that is keeping the “system” together.

Demand has been big as both retail investors and central banks continue to buy at discounted prices. Several of the world’s largest mints are recording record sales in both silver and gold, as the smaller investor looks to buy protection with equities hitting new all-time highs every week.

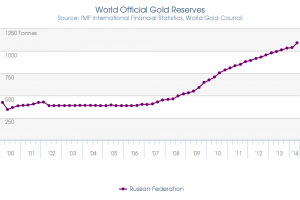

Russia has been a big player this year in terms of central banks. President Vladimir Putin is trying to defend the ruble’s utter crash with gold reserves, as well as developing a safety-net against sanctions placed by the US and the European Union. Russia has increased their gold reserves by 115 tons this year, with 37.5 tons bought in September alone. Central bank demand has increased significantly in emerging markets of late.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply