Precious Metals Market Report

Tuesday 8 August, 2017

Fundamentals and News*

Holdings in Biggest Gold ETF Decline to 17-Month Low

Holdings in SPDR Gold Shares, the largest ETF backed by the metal, shrank to lowest since March 2016 amid speculation that stellar U.S. jobs market will bolster Fed’s case for more rate hikes this year.

Holdings dropped to 787.14 metric tons as of Friday; 5th straight week of declines

Money managers boosted net-long position by 64% to 122,773 contracts in gold futures & options in week ended Aug. 1, three days before the jobs report was released

Gain in dollar after jobs report Friday caused traders to think positions may be “a little overextended,” Phil Streible, senior market strategist at RJO Futures in Chicago, says in telephone interview

Traders speculate “the Fed will go on with interest-rate hike action, as well as reduce the balance sheet”

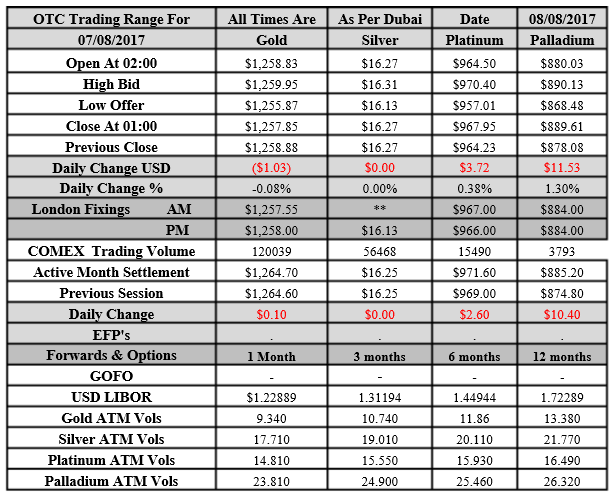

Gold futures for Dec. delivery climbed less than 0.1% Monday to settle at $1,264.70/oz by 1:38pm on the Comex in N.Y.

Metal settled traded near lowest since July 26

NOTE: On Friday, U.S. government said payrolls rose 209k, vs est. 180k

Avg. hourly earnings +2.5% from year earlier, faster than +2.4% est.

Fed “is likely to view the data as good reason to further normalize its monetary policy,” Commerzbank analysts including Eugen Weinberg say in note

China Central bank kept gold reserves unchanged for ninth month – Holdings at 59.24m oz by end-July, at same level since end-Oct.: People’s Bank of China data

Other precious metals: Silver futures for Sept. delivery slip on Comex, Platinum futures rise on the Nymex, along with Palladium futures

(*source Bloomberg)

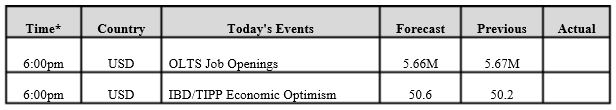

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

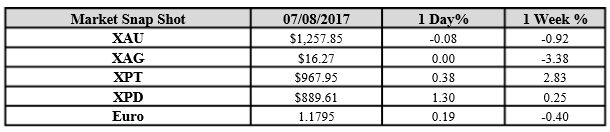

Gold for Spot delivery was closed at $1257.85 an ounce; with loss of $1.03 or -0.08 percent at 1.00 a.m. Dubai time closing, from its previous close of $1258.88

Spot Gold technically seems having resistance levels at 1269.7 and 1274.4 respectively, while the supports are seen at $1254.5 and 1249.8 respectively.

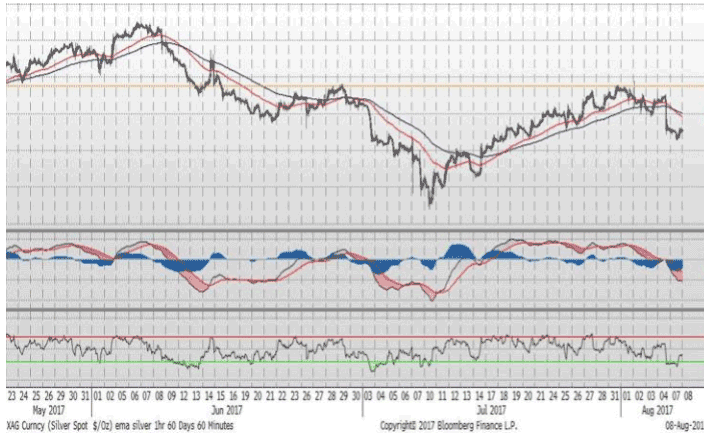

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.27 with theno change of $0.0 or 0 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.27

The Fibonacci levels on chart are showing resistance at $16.76 and $16.95 while the supports are seen at $16.14 and $ 15.95 respectively.

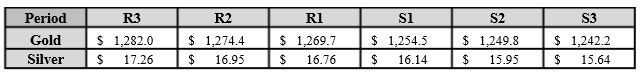

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply