Precious Metals Market Report

Thursday 6 April, 2017

Fundamentals and News

Gold Pares Losses as Fed Minutes Show Plan to Trim Balance Sheet

(Bloomberg)

Gold pared losses after minutes of the Fed’s policy meeting in mid-March showed officials plan to start shrinking the balance sheet, which traders said suggests a less aggressive tightening path.

Most Federal Reserve officials said they backed a policy change that would begin shrinking the central bank’s $4.5 trillion balance sheet later this year, as they reiterated their outlook for gradual interest-rate increases.

“Many participants emphasized that reducing the size of the balance sheet should be conducted in a passive and predictable manner,” the minutes showed.

The record provides an outline of the discussion U.S. central bankers held before approving a quarter-point increase in their benchmark lending rate.

The minutes hew closely to Chair Janet Yellen’s account of the monetary-policy discussion laid out at her news conference after the rate-hike announcement. Yellen emphasized at the time the hike in rates didn’t reflect a “reassessment of the economic outlook or of the appropriate course for monetary policy.”

In materials released with the FOMC statement, officials stuck to a median projection for three total rate increases in 2017.

The minutes showed nearly all of the officials judged the economy was at or near full employment, and nearly all voting members believed inflation was still short of the Fed’s 2 percent target.

Unemployment stood at 4.7 percent in February, at or near most economists’ estimates of its lowest sustainable level. The Fed’s preferred measure of prices rose 2.1 percent in the 12 months through February, the first time it’s topped the central bank’s 2 percent target in almost five years.

As part of their discussion of the economy, many Fed officials observed a rise in equity prices in recent months as contributing to an easing in financial conditions.

“Some participants viewed equity prices as quite high relative to standard valuation measures,” the minutes said. It was also observed that “prices of other risk assets, such as emerging market stocks, high-yield corporate bonds, and commercial real estate, had also risen significantly in recent months.”

Regarding the balance sheet, “participants generally preferred to phase out or cease reinvestments of both Treasury securities” and agency mortgage-backed securities at the same time.

“It wouldn’t surprise me if sometime later this year or sometime in 2018, should the economy perform in line with our expectations, that we’ll start to gradually let securities mature rather than reinvesting them,” Dudley said Friday in a Bloomberg Television interview with Michael McKee in Sarasota, Florida.

“If we start to normalize the balance sheet, that’s a substitute for short-term rate hikes,” and “we might actually decide at the same time to take a little pause in terms of raising short-term interest rates,” he added.

Three rounds of bond purchases from 2008 to 2014 aimed at pressing down long-term lending rates bloated the Fed’s balance sheet from less than $1 trillion before the financial crisis.

The target range for the benchmark federal funds rate is 0.75 percent to 1 percent. The FOMC schedules eight meetings a year with the next set for May 2-3 in Washington.

Spot gold little changed at 3:40 p.m. in New York, after dropping as much as 1% earlier

A gauge of the U.S. dollar was little changed; earlier climbed as much as 0.2%

Stocks dropped, Treasury yields declined

“The broad consensus that reinvestments should diminish by the end of the year was stock-market negative,” says Tai Wong at BMO Capital Markets

That “lifted gold from the lows of the day”

“Some participants viewed equity prices as quite high relative to standard valuation measures,” according to Fed minutes released Wednesday

(*source Bloomberg)

Data – Forthcoming Release

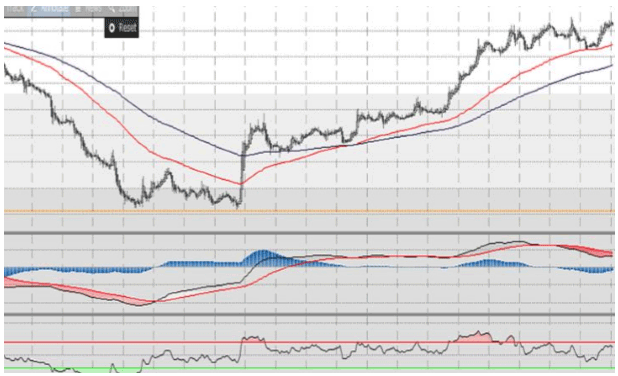

Technical Outlook and Commentary: Gold

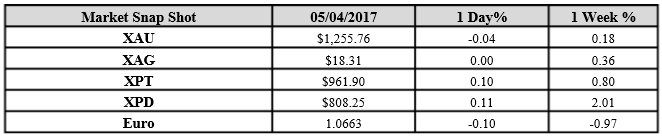

Gold for Spot delivery was closed at $1255.76 an ounce; with loss of $0.52 or 0.04 percent at 1.00 a.m. Dubai time closing, from its previous close of $1256.28

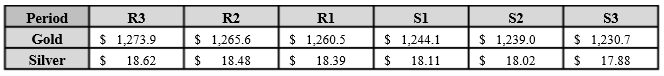

Spot Gold technically seems having resistance levels at 1260.5 and 1265.6 respectively, while the supports are seen at $1244.1 and 1239.0 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.31 unchanged at 1.00 a.m. Dubai time closing, from its previous close of $18.31

The Fibonacci levels on chart are showing resistance at $18.39 and $18.48 while the supports are seen at $18.11 and $ 14.02 respectively.

Resistance and Support Levels

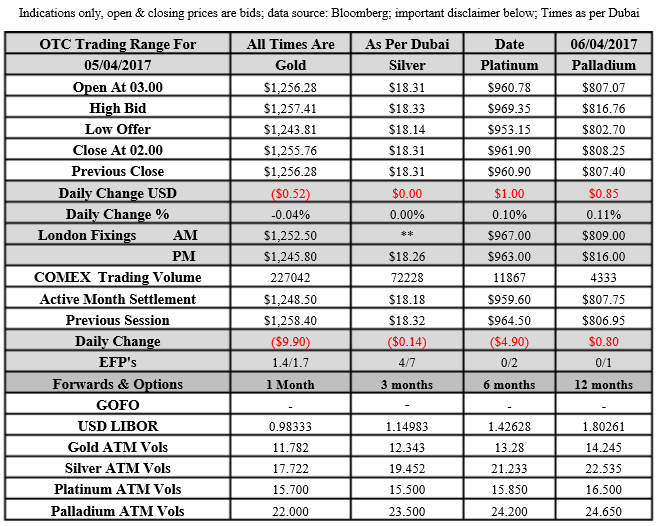

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply