Precious Metals Market Report

Monday 5 June, 2017

Fundamentals and News*

Gold Rallies as Jobs Shortfall Eases Angst on Pace of Tightening

Traders now worried about rate hikes after June, RBC says

Index of gold-mining companies rises first time in five days

Gold futures rebounded after the U.S. economy added fewer jobs than expected last month, weakening the case for the Federal Reserve to move aggressively in raising interest rates.

Payrolls rose by 138,000 in May, short of the 182,000 median estimate in a Bloomberg survey of economists, a government report showed Friday. The figure for the prior month was revised lower. An index of 15 senior gold-mining companies tracked by Bloomberg Intelligence headed for the first gain in five days.

The jobs data come after reports this week showing a rise in U.S personal spending and gains in manufacturing helped diminish demand for gold as a store of value. Fed Bank of Dallas President Robert Kaplan said he’s sticking to his outlook for two more interest-rate increases this year, while Fed GovernorJerome Powell is calling for gradual rate increases.

“The unemployment report was weak across the board,” said Tai Wong, a director of commodity products trading at BMO Capital Markets. “This has given gold a short-term reprieve. This hike is done, but the next one will probably be a battle,” he said, referring to the outlook after the Fed’s June meeting.

Gold futures for August delivery rose 0.8 percent to settle at $1,280.20 an ounce at 1:42 p.m. on the Comex in New York, after falling as much as 0.7 percent earlier. The metal posted a fourth straight weekly gain.

A gauge of the dollar fell along with yields on two-year Treasury notes. Odds of a June rate hike remained about 88 percent after the jobs report, based on fed funds futures.

Traders are “now worried about Fed hikes continuing after June,” George Gero, a New Yorkbased managing director at RBC Wealth Management, wrote in a note to clients. That’s “helping gold rally,” he said.

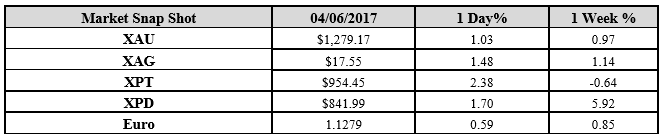

In other precious metals:

Silver futures for July delivery on the Comex rose 1.4 percent to $17.525 an ounce.

Platinum futures for July delivery climbed 2.6 percent on the New York Mercantile Exchange while palladium for September delivery rose 1.3 percent.

(*source Bloomberg)

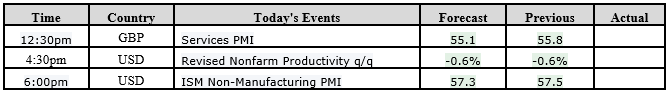

Data – Forthcoming Release

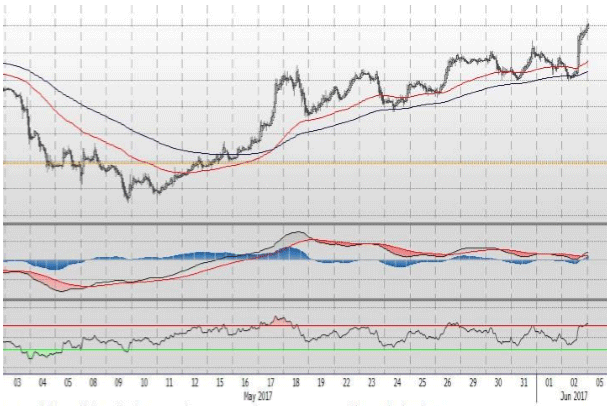

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1279.17 an ounce; with gain of $13.21 or 1.03 percent at 1.00 a.m. Dubai time closing, from its previous close of $1265.96

Spot Gold technically seems having resistance levels at 1280.5 and 1285.3 respectively, while the supports are seen at $1264.8 and 1260.0 respectively.

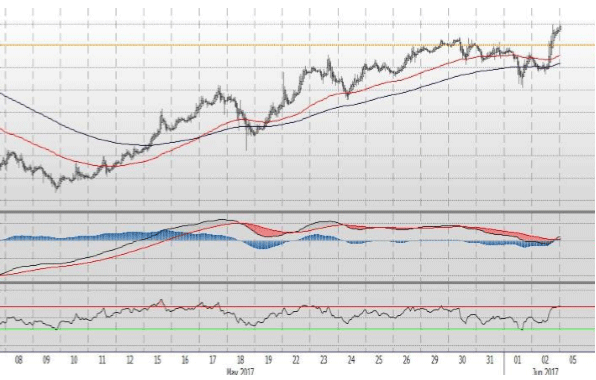

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.55 with gain of $0.26 or 1.48 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.29

The Fibonacci levels on chart are showing resistance at $17.60 and $17.73 while the supports are seen at $17.16 and $ 17.03 respectively.

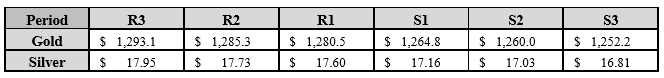

Resistance and Support Levels

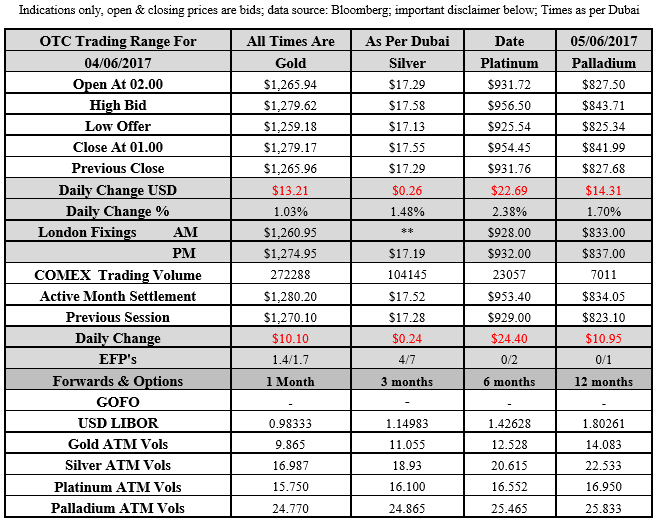

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply