Precious Metals Market Report

Wednesday 5 April, 2017

Fundamentals and News

U.S. Stocks Mixed, Dollar Strengthens With Gold: Markets Wrap

(Bloomberg)

U.S. stocks slipped in afternoon trading as optimism eased that the world’s largest economy is poised to accelerate. The dollar strengthened with the yen and gold amid haven demand.

The S&P 500 Index retreated a second day after data showed a decline in factory orders in February and banks fell. Emerging-market equities slumped. Treasury 10-year notes were little changed, while the dollar advanced versus all major peers except the yen. Selling in South Africa’s rand abated after six days of losses as Moody’s Investors Service delayed a review of the nation’s credit rating. Gold rose.

Investors are taking stock ahead of a key U.S. payrolls report on Friday and minutes from the Federal Reserve’s latest meeting on Wednesday. After the best quarter for U.S. equities since 2013, traders are starting to question whether optimism about U.S. President Donald Trump’s pro-growth policies has gone too far. Veteran money manager Bob Doll wrote in an April 3 letter to clients that sentiment on the economy may be too high, leaving investors vulnerable to negative surprises.

“The hard data is beginning to wobble and that’s going to cause some of the Trump trades to come under pressure,” Tim Haywood, investment director at GAM (UK) Ltd. said in an interview with Bloomberg TV. “Dents in car sales are perhaps an early warning of a little bit of weakness in the U.S. economy.”

Fed speakers include William Dudley, president of the New York Fed, and Governor Daniel Tarullo. Minutes from the March meeting, which are scheduled to be released April 5, should put their recent public comments into perspective. Minutes are also due from the European Central Bank’s latest gathering.

France’s presidential candidates assemble for another TV debate Tuesday.

China’s President Xi Jinping will meet U.S. President Donald Trump for two days starting April 6.

U.S. non-farm payrolls are due April 7.

The S&P 500 Index fell 0.1 percent to 2,355.58 at 12:57 pm. in New York, headed for a second day of losses.

The Stoxx Europe 600 Index added 0.2 percent, while emerging market equities dropped 0.2 percent.

Currencies:

The yen rose 0.2 percent to 110.668 per dollar, after climbing at least 0.4 percent in each of the previous two sessions.

The Bloomberg Dollar Spot Index added 0.2 percent.

The South African rand dropped 0.1 percent against the dollar. The currency has tumbled 11 percent over the past seven days, the longest streak since August, amid a cabinet purge by President Jacob Zuma.

Russia’s ruble and the Mexican peso dropped more than 0.7 percent versus the dollar.

Commodities:

Oil climbed 0.6 percent to $50.52 per barrel, after dropping 0.7 percent on Monday. U.S. crude inventories were forecast to drop and traders focused on the likelihood of OPEC extending its supply deal.

Gold rose 0.4 percent to $1,259.30 an ounce, heading for the highest close since Nov. 10. Silver reached highest in a month.

(*source Bloomberg)

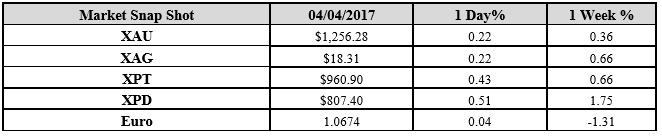

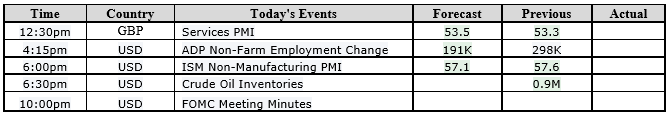

Data – Forthcoming Release

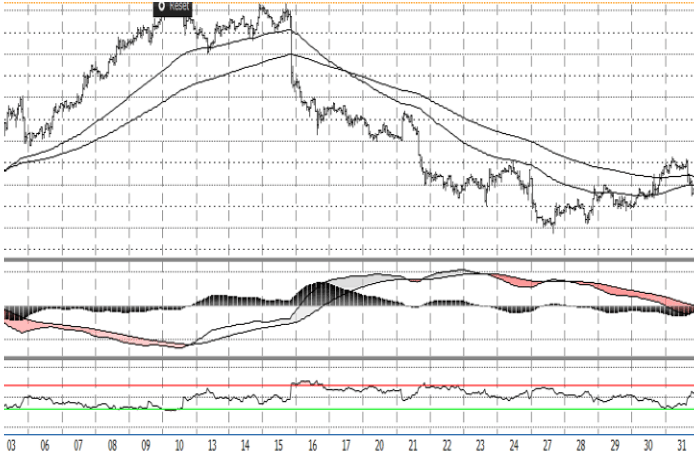

Technical Outlook and Commentary: Gold

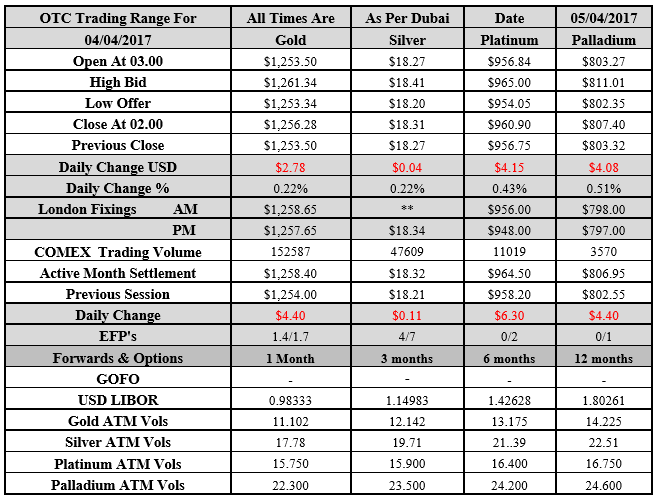

Gold for Spot delivery was closed at $1256.28 an ounce; with gain of $2.78 or 0.22 percent at 1.00 a.m. Dubai time closing, from its previous close of $1253.5

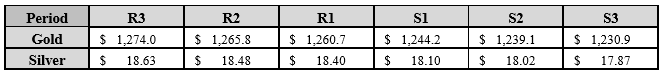

Spot Gold technically seems having resistance levels at 1260.7 and 1265.8 respectively, while the supports are seen at $1244.2 and 1239.1 respectively.

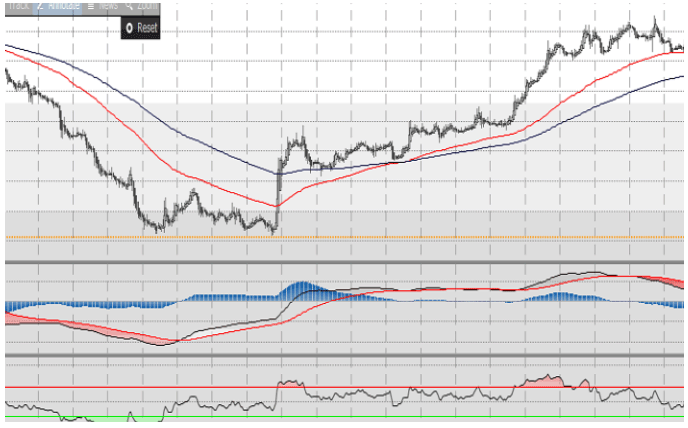

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.31 an ounce; with gain of $0.04 or 0.22 percent at 1.00 a.m. Dubai time closing, from its previous close of $18.27

The Fibonacci levels on chart are showing resistance at $18.40 and $18.48 while the supports are seen at $18.10 and $ 18.02 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply