Precious Metals Market Report

Friday 4 August, 2017

Fundamentals and News*

Gold Demand Hits Two-Year Low as ETF Buying Slows From High

Global gold demand dropped to a two-year low in the second quarter as reduced investment in exchange-traded products outweighed higher jewelry and bar purchases. Bullion futures fell.

Total demand slipped 10 percent from a year earlier to 953.4 metric tons, the lowest since the second quarter of 2015, the World Gold Council said in a report Thursday. The decline was almost entirely due to ETF investors, who cut buying by 76 percent from last year’s high level

“It was always going to be hard to match last year’s demand, simply because ETF buying was so strong,” said Alistair Hewitt, head of market intelligence at the London-based council. “Demand was more balanced in this quarter, and spread across several sectors including ETFs, the jewelry market and central-bank buying.”

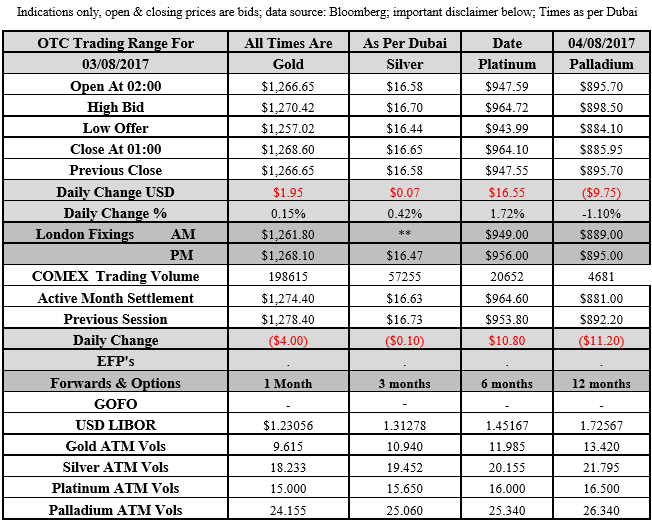

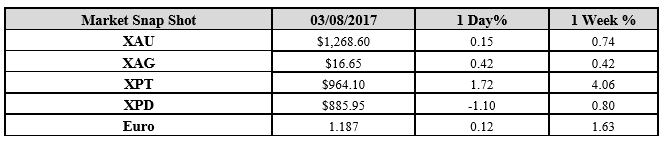

Gold futures for December delivery slipped 0.3 percent to settle at $1,274.40 an ounce at 1:36 p.m. on the Comex in New York. Bullion for immediate delivery added 0.2 percent $1,268.60 This year’s slowdown in bullion-backed funds contrasts with improved demand for other gold products, which has helped push prices up by 11 percent. ETF sentiment soured further in July, with holdings falling for the first time in seven months, data compiled by Bloomberg show. Looking ahead, the council said U.S. monetary policy and the monsoon’s impact on Indian gold demand will be among the metal’s key drivers.

Global consumption may total 4,200 to 4,300 tons this year, down as much as 3 percent from last year, Hewitt said. China will buy 850 to 950 tons, 50 tons less than previously forecast, while Indian purchases will be at the upper end of the council’s 650 to 750 ton range.

Second-quarter figures from the report include:

Jewelry demand +8% to 480.8 tons. o 41% increase in India offset declines in China.

Bar and coin purchases +13% to 240.8 tons.

ETF investment -76% to 56 tons.

Central-bank buying +20% to 94.5 tons.

Total supply -8% to 1,065.9 tons on lower recycling.

The increase in bar and coin demand was driven by India, China and Turkey, while consumption was flat in Europe and slumped by almost two-thirds in the U.S.

“U.S. bar and coin demand was extremely weak,” Hewitt said. “A range-boundgold market just didn’t compare with the excitement in equities.”

Silver futures also fell on the Comex

Platinum futures gained on the New York Mercantile Exchange, while palladium slipped

(*source Bloomberg)

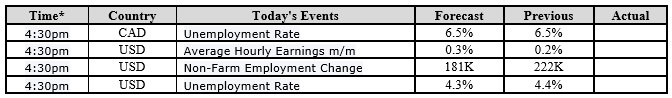

Data – Forthcoming Release

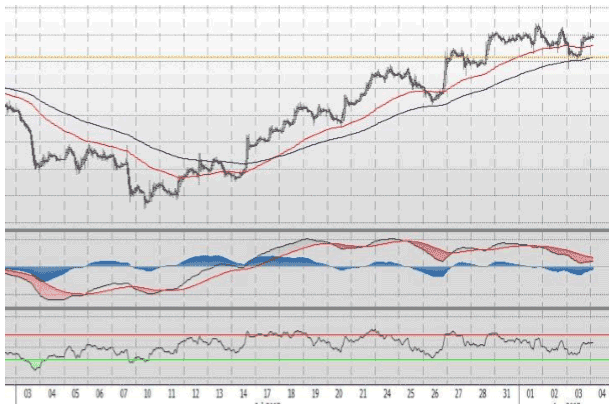

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1268.6 an ounce; with little change of $1.95 or 0.15percent at 1.00 a.m. Dubai time closing, from its previous close of $1266.65

Spot Gold technically seems having resistance levels at 1273.1 and 1277.2 respectively, while the supports are seen at $1260.0 and 1256 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.65 with the gain of $0.07 or 0.42 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.58

The Fibonacci levels on chart are showing resistance at $16.87 and $16.99 while the supports are seen at $16.49and $ 16.37 respectively.

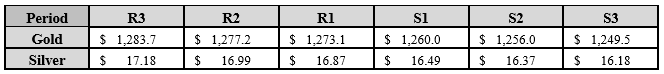

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply