Precious Metals Market Report

Thursday 3 August, 2017

Fundamentals and News*

Gold dips in Asia as dollar fortunes eyed ahead of US jobs data

Gold prices dipped in Asia on Thursday with the dollar in focus ahead of US nonfarm payrolls at the end of the week.

Gold futures for August delivery on the Comex division of the New York Mercantile Exchange fell 0.76% to $1,262.16 a troy ounce.

Overnight, gold prices fell but remained near seven-week highs on Wednesday, after ADP data missed expectations, pressuring the dollar to sink to its lowest level for the year, making gold attractive to buyers holding other currencies.

Investor sentiment soured on nonfarm payrolls due Friday after private sector job creation – which often serves as precursor to nonfarm payrolls – missed forecasts.

ADP and Moody’s Analytics said U.S. private employers added just 178,000 jobs for the month, short of analysts’ forecasts of 185,000.

Gains in gold, however, were limited as investors digested comments from Cleveland Fed President Loretta Mester suggesting the central bank can stick to its gradual approach to monetary tightening, as it could help prolong economic expansion.

“I see benefits to this consistency: it removes some ambiguity and it underscores the fact that we set monetary policy systematically, with a focus on the medium-run outlook and risks around the outlook and their implications for our policy goals,” Mester said in remarks to the Community Bankers Association of Ohio in Cincinnati.

Also weighing on gold future this week, was data showing a drop in physical demand for the yellow metal.

Gold prices in India last week recorded the biggest discount in seven months as a rebound in prices hurt retail demand while imports of the precious metal are expected to come under pressure amid a seasonal slowdown.

According to Thomson Reuters GFMS “With imports in the first half already near the whole of 2016 volumes, it is less likely in our view that imports will cross 250 tonnes in the second half.”

(*source Bloomberg)

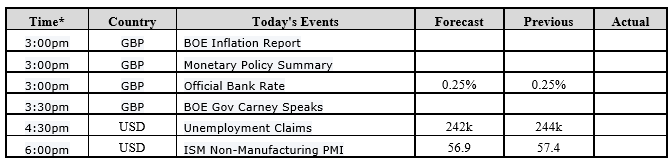

Data – Forthcoming Release

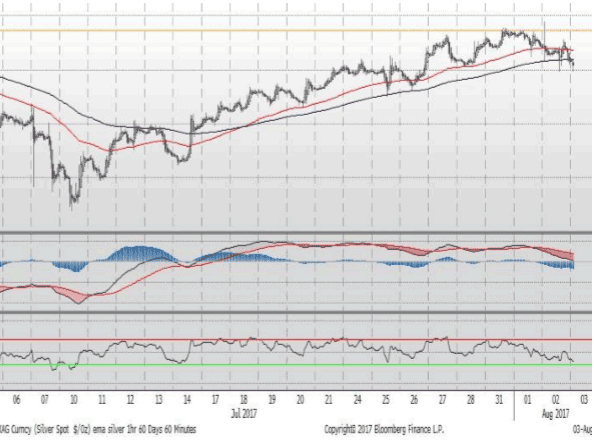

Technical Outlook and Commentary: Gold

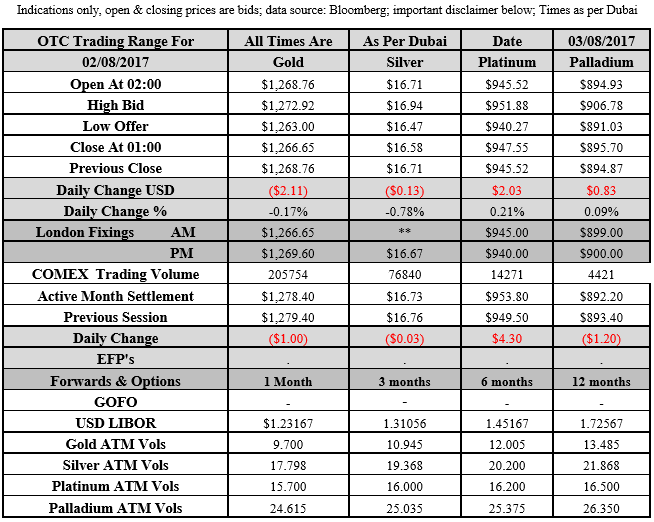

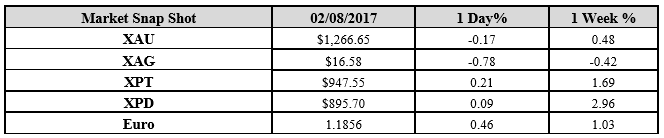

Gold for Spot delivery was closed at $1266.65 an ounce; with little change of $-2.11 or -0.17 percent at 1.00 a.m. Dubai time closing, from its previous close of $1268.76

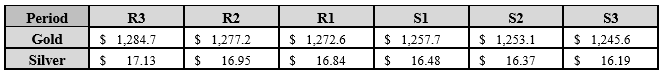

Spot Gold technically seems having resistance levels at 1272.6 and 1277.20 respectively, while the supports are seen at $1257.7 and 1253.1 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.58 with the loss of $0.13 or- 0.78 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.71

The Fibonacci levels on chart are showing resistance at $16.84 and $16.95while the supports are seen at $16.48 and $ 16.37 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply