Precious Metals Market Report

Monday 3 April, 2017

Fundamentals and News

Instability-Loving Gold Bulls Boost Price Bets Most in 11 Months

(Bloomberg)

“The gold markets loves instability,” said Jeffrey Sica, who helps oversee $1.5 billion in assets at Circle Squared Alternative Investments in Morristown, New Jersey. “It doesn’t do well with high levels of predictability, and now things seem much more unpredictable than they have in quite a while.”

Money managers boosted their gold net-long position, or the difference between bets on a price increase and wagers on a decline, by 50 percent to 99,150 futures and options contracts in the week ended March 28, according to U.S. Commodity Futures Trading Commission data released three days later. That was the biggest gain since the week ended Jan. 10. Long-only positions rose to the highest in four weeks.

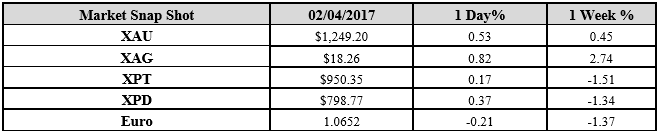

Gold futures, little changed last week, climbed 8.6 percent for the quarter to close March 31 at $1,251.20 an ounce on the Comex in New York. Prices have rebounded 11 percent since trading at a 10-month low in December.

The three rate increases most investors expect, the central bank may only need two, given the uncertainty of inflation and government spending, Fed Bank of Chicago President Charles Evans said.

Nervousness in Europe has also helped gold, with Euro-area economic confidence unexpectedly falling last month. There’s also mounting concern that the popularity of French presidential candidate Marine Le Pen, the leader of the anti-EU National Front party, could signal further discord that would damage the region’s economic recovery.

Government data on Thursday showed American gross domestic product grew faster in the fourth quarter than previously reported on higher consumer spending. Purchases of new homes increased in February to a seven-month high, showing the real estate market is holding up against higher borrowing costs.

Fed Boston President Eric Rosengren and the San Francisco Fed’s John Williamslast week signaled the possible need for a faster pace of interest-rate increases than currently mapped out by the central bank. The policy makers said the economy is moving toward the central bank’s goals for full employment and 2 percent inflation.

Some investors have already soured on the metal. Through Thursday, holdings in SPDR Gold Shares, the largest exchange-traded fund backed by bullion, fell in five of the past six months. Open interest, a tally of outstanding contracts in Comex futures, is also slumping, declining to the lowest since mid-February on Thursday.

“The positive economic data has rekindled interest in the more general equities space, so I think interest in gold is shoved to the back burner,” said Alan Gayle, a senior strategist who helps oversee $40 billion in assets at RidgeWorth Investments in Atlanta. “The defeat of the health care bill was more of a psychological blow than an economic blow, given that the attention appears to be shifting back towards tax reform, which the market would prefer to see.”

(*source Bloomberg)

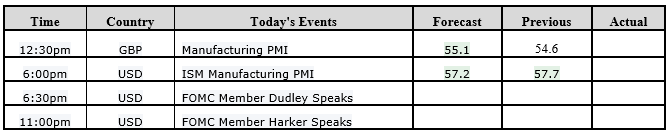

Data – Forthcoming Release

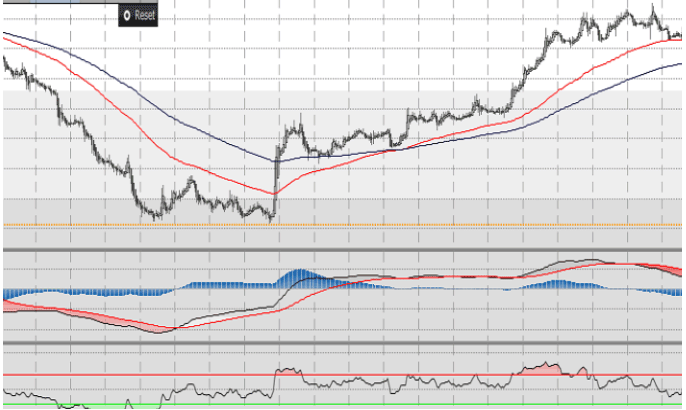

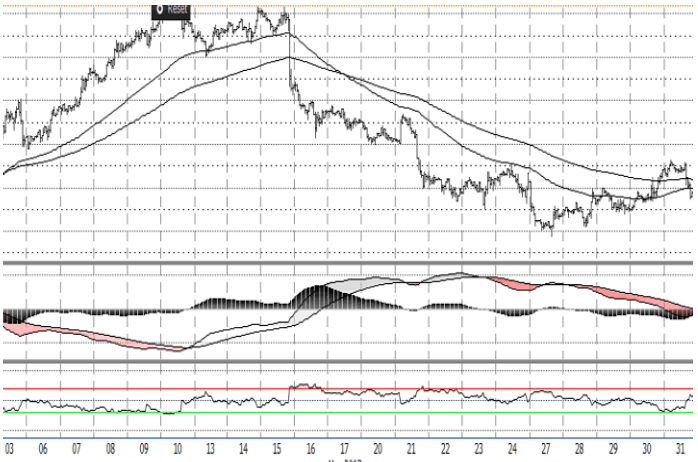

Technical Outlook and Commentary: Gold

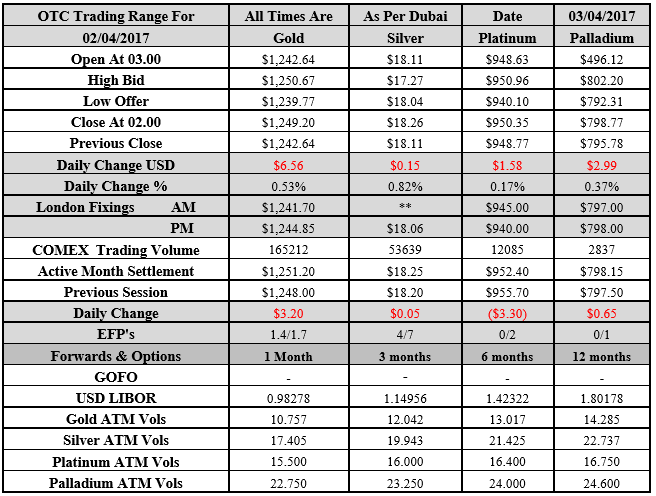

Gold for Spot delivery was closed at $1249.2 an ounce; with gain of $6.56 or 0.53 percent at 1.00 a.m. Dubai time closing, from its previous close of $1242.64

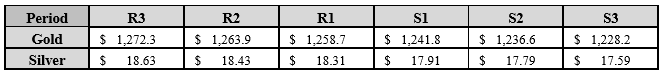

Spot Gold technically seems having resistance levels at 1258.7 and 1263.9 respectively, while the supports are seen at $1241.8 and 1236.6 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.26 an ounce; with gain of $0.15 or 0.53 percent at 1.00 a.m. Dubai time closing, from its previous close of $18.11

The Fibonacci levels on chart are showing resistance at $18.31 and $17.43 while the supports are seen at $17.91 and $ 17.79 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply