Precious Metals Market Report

Thursday 29 June, 2017

Fundamentals and News*

U.S. Dollar Continues To Drive Gold Higher

Gold is still attempting a recovery from the dramatic price drop on Monday when a single sell order of 1.8 million ounces rattled the markets. Trading fractionally higher over the last two days, gold prices have slowly moved up from the intraday lows of $1236.00 achieved during that single sell order placed at the opening of trading in London on Monday morning.

Given the more hawkish tone of the Federal Reserve during this month’s FOMC meeting, and the more hawkish tone by Mario Draghi of the European Central Bank yesterday, gold prices have had to overcome market sentiment looking for higher interest rates in the future.

If not for the weak U.S. dollar, gold prices, in fact, would have traded lower over the last two days. As of 4 o’clock EDT, physical gold is trading $3.20 higher, currently fixed at $1249.90. However, just as yesterday, on closer examination it is dollar weakness which provided the upside move in gold today. Dollar weakness has added $6.10 of value per ounce of gold, and selling pressure has resulted in a -$2.90 drawdown.

Gold also had to compete with U.S. equities, which today staged a rally ending the lower pricing exhibited on Monday and Tuesday of this week. This, along with higher treasury yields, seemed to dampen any major upside move in the precious metals.

Given the outside forces currently in play, globally gold prices have held current support levels. In an interview with MarketWatch, Lukman Otunuga, research analyst at FXTM, said, “Gold is likely to remain supported “with the ongoing uncertainty of Brexit [the U.K.’s split with the European Union trading bloc], political risk in Washington and jitters from depressed oil accelerating the flight to safety.”

There are obviously multiple market forces creating a “tug-of-war” scenario for gold pricing. According to Georgette Boele, a currency and precious metals analyst at ABN Amro, “On the one hand, a lower U.S. dollar and lower equity markets are supportive for gold prices. On the other hand, the modest rise in U.S. real yields and expectations of less accommodative monetary policies ahead are negative forces for gold, as investors will find gold less attractive as investment asset because gold does not pay interest.”

In an interview with Bloomberg News, Bob Iaccino of Path Trading Partners relayed his conviction that given the strength of the global economy and global equities markets gold pricing is holding up rather well and should, in fact, be trading lower than it currently is. He believes current bullish sentiment is a reflection of the underlying concern for the “undertones of the White House,” as well as current geopolitical time bombs (Syria and North Korea).

Regardless of the underlying pressures that intrinsically exist in gold pricing, market participants continue to be supportive of the precious yellow metal, with a net result of stable gold prices, which are still recovering from Monday’s large sell order.

(*source Bloomberg)

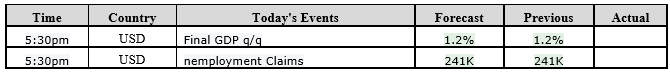

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

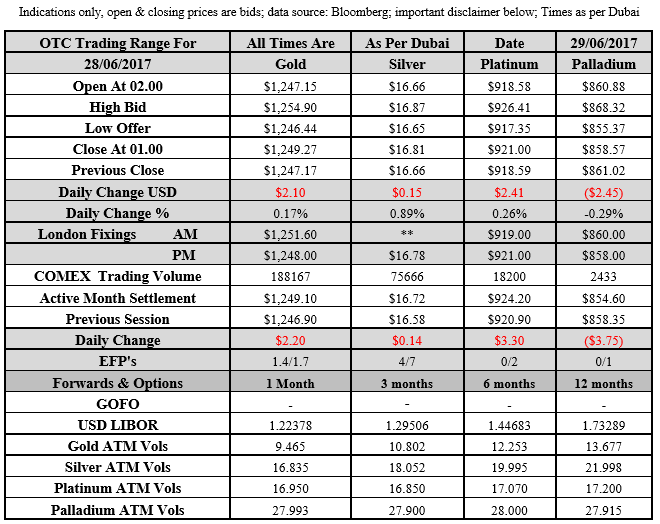

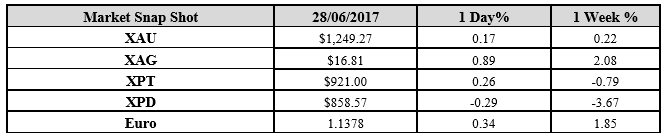

Gold for Spot delivery was closed at $1249.27 an ounce; with gain of $2.10 or 0.17 percent at 1.00 a.m. Dubai time closing, from its previous close of $1247.17

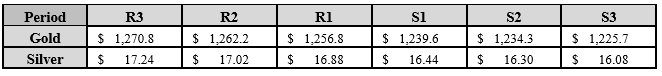

Spot Gold technically seems having resistance levels at 1256.8 and 1262.2 respectively, while the supports are seen at $1239.6 and 134.3 respectively.

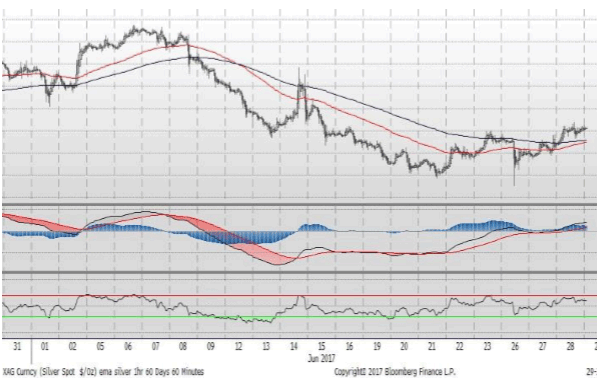

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.81 with gain of $0.15 or 0.89 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.66

The Fibonacci levels on chart are showing resistance at $16.88 and $17.02 while the supports are seen at $16.44 and $ 16.30 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply