Precious Metals Market Report

Wednesday 28 June, 2017

Fundamentals and News*

More Precious than Gold? Copper a Better Hedge Against Inflation

For centuries, gold has been a go-to asset among investors worried about all sorts of financial risks. In the past decade, exchange-traded funds backed by the metal drew more money than any other commodity. Even the world’s biggest central banks hoard bullion as a reserve asset.

But when it comes to inflation, which can erode the value of portfolios that don’t keep pace with rising consumer prices, anyone who bought gold as a hedge over the past 25 years missed out on a much better deal — copper. While data show that broad commodity indexes provided the best bang for the buck during periods of rising costs in the U.S., the red metal stands out.

For every 1 percent annual increases in the consumer price index since 1992, copper jumped almost 18 percent, more than three times the 5.2 percent gain logged by gold, according to a correlation analysis of total return commodity indexes compiled by Bloomberg. Only a broader index of energy commodities, which includes oil and natural gas, performed better than copper.

Copper is “more sensitive to inflation and the dollar because of its uses and its growth with the economy,” Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices, said in an interview June 15. “Investors are more comfortable with gold. When you run the numbers, gold has relatively low sensitivity to inflation.”

Measuring that sensitivity is something called “inflation beta.” The correlation of any one commodity to rising consumer prices can be volatile. For example, copper fell in 2011 even as inflation accelerated. But over time, there are patterns to the relationship that make holding raw materials a good bet when inflation is accelerating, said Mike McGlone, analyst at Bloomberg Intelligence in New York.

“The traditional reason to hold commodities is for inflation,” because as the economy heats up, consumption increases for everything from cars and homes to appliances and travel, McGlone said in a June 19 telephone interview.

Analysts have dubbed copper “the metal with a Ph.D. in economics” because it’s been a reliable bellwether. When construction and manufacturing are growing, so do sales of wire and pipe. While inflation has been relatively tame since the financial crisis almost a decade ago, there are signs it may start to accelerate again.

Federal Reserve Chair Janet Yellen this month pledged more interest-rateincreases in 2017 to keep the economy from overheating. On Tuesday in London, she reaffirmed her commitment to “price stability” and a 2 percent inflation target.

The Fed and other global central banks have held interest rates near zero for a record period to stimulate growth, which has taken years to gain traction. Even with signs of a pickup in the U.S. economy, inflation remains below historical rates.

2008, prices rose on average just 1.4 percent, including some periods of deflation in 2009 and 2015.

Still, gold has been the preferred metal to use for hedging. While investors can buy physical metal or futures and options, among the most popular method is holding exchange-traded funds that trade like stocks. The SPDR Gold TrustHoldings, the largest ETF backed by bullion, has about $34.5 billion invested in the precious metal. The ETFS Copper ETF has $270 million, and other funds linked to the metal tend to be small and illiquid.

(*source Bloomberg)

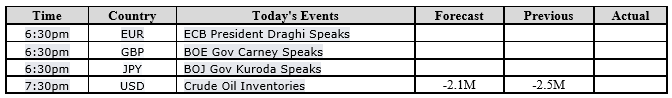

Data – Forthcoming Release

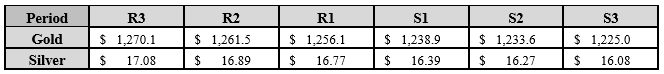

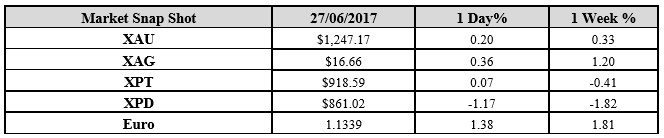

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1247.17 an ounce; with gain of $2.45 or 0.20 percent at 1.00 a.m. Dubai time closing, from its previous close of $1244.72

Spot Gold technically seems having resistance levels at 1256.1 and 1261.5 respectively, while the supports are seen at $1238.9 and 1233.6 respectively.

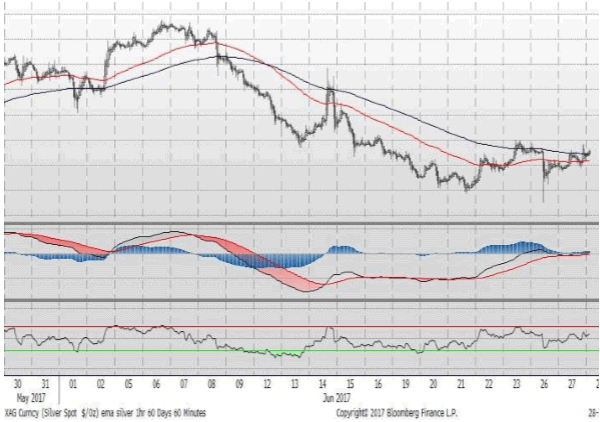

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.66 with gain of $0.06 or 0.36 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.60

The Fibonacci levels on chart are showing resistance at $16.77 and $16.89 while the supports are seen at $16.39 and $ 16.27 respectively.

Resistance and Support Levels

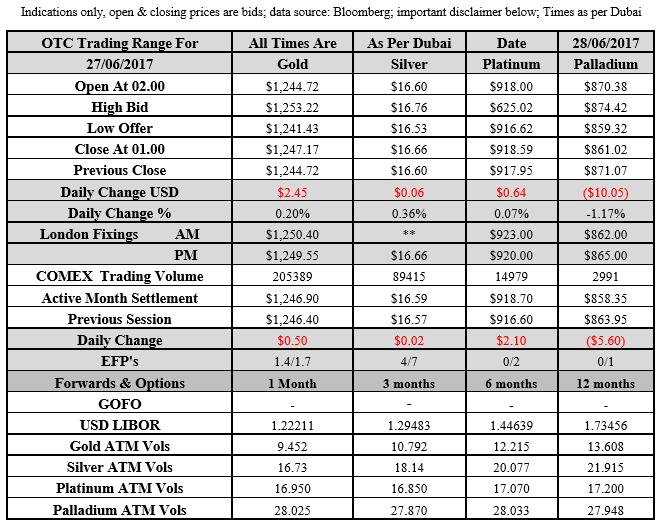

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply