Precious Metals Market Report

Friday 28 April, 2017

Fundamentals and News*

Bond Vigilantes Lie In Wait as Trump Tax Plan Seen Swelling Debt

The Trump administration’s tax plan — and its disregard for the effect it would have on the federal budget deficit — is certain to pique the interest of a long-dormant segment of bond investors.

So-called bond vigilantes, once feared for enforcing restraint on spendthrift governments, have struggled to flex their muscles in recent years as global central banks stepped in to buy a glut of sovereign debt. Now may be the time for a comeback, with the Federal Reserve talking about trimming its Treasury holdings while the administration’s tax plan could spur more borrowing to cover a shortfall (assuming the projected economic growth doesn’t materialize).

The notion of the bond market holding elected officials to task is of course met with skepticism, given Barack Obama more than doubled the U.S. marketable debt over his two terms as president, to almost $14 trillion. And that burden is poised to nearly double again over the next decade, according to estimates by the Congressional Budget Office that don’t factor in Donald Trump’s fiscal initiatives. His budget director said in a Bloomberg Television interview last week that “deficits are not driving the discussion.”

“While the White House appears likely to rely on optimistic growth assumptions to offset most of the fiscal effects of the proposed tax cut, Congress will not be able to do so,” Goldman Sachs Group Inc. strategists led by Jan Hatzius wrote in a note Thursday. “Indications of openness to a tax cut among congressional Republicans suggest that a tax cut is more likely than revenueneutral reform. We expect a long road ahead.”

Here are four indicators to monitor as the tax legislation progresses to gauge whether the bond vigilantes are back at it.

“Bond vigilantes are now clearly showing no signs of vigilantism,” said Edward Yardeni, president of Yardeni Research Inc. in New York, who’s been following the bond market since the 1970s. He coined the term “bond vigilantes” in the 1980s to describe investors who sell bonds to protest monetary or fiscal policies they consider inflationary.

(*source Bloomberg)

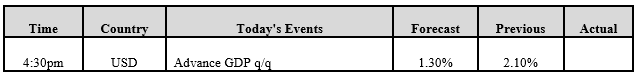

Data – Forthcoming Release

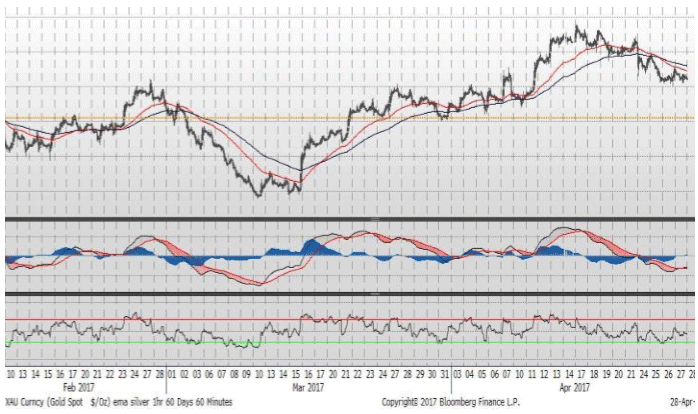

Technical Outlook and Commentary: Gold

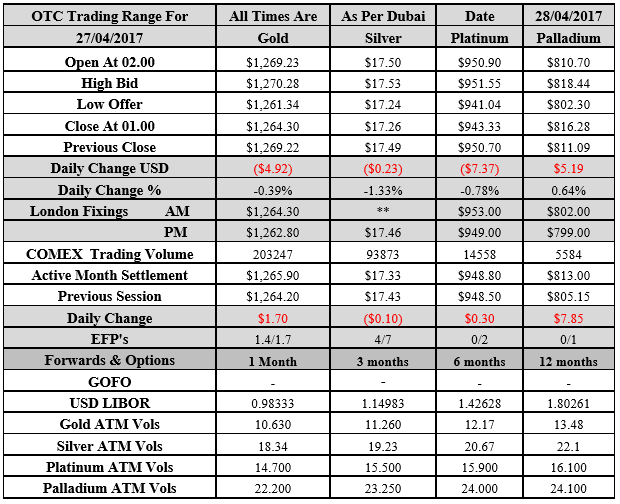

Gold for Spot delivery was closed at $1264.30 an ounce; with loss of $4.92 or 0.39 percent at 1.00 a.m. Dubai time, from its previous close of $1269.22

Spot Gold technically seems having resistance levels at 1281.7 and 1288.40 respectively, while the supports are seen at $1260.1 and 1253.4 respectively.

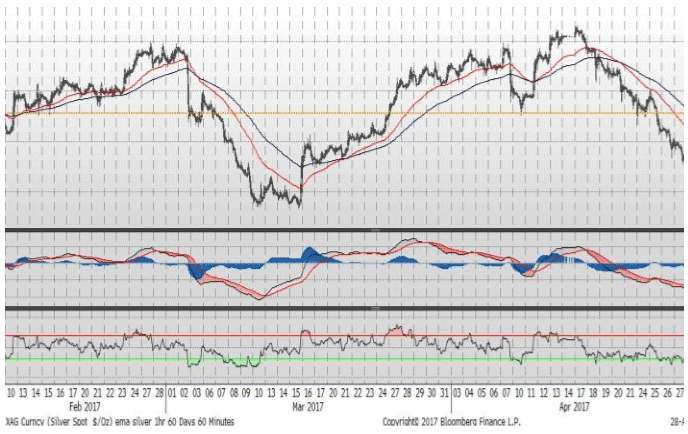

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.26 an ounce; with loss of 0.23 cent or -1.33 percent at 1.00 a.m. Dubai time, from its previous close of $17.49

The Fibonacci levels on chart are showing resistance at $17.82 and $18.01 while the supports are seen at $17.21 and $ 17.02 respectively.

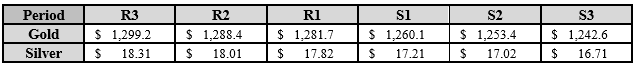

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply