Precious Metals Market Report

Thursday 27 July, 2017

Fundamentals and News*

Spot Gold Advances as Fed Holds Rates Steady, Assesses Inflation

The dollar sank and Treasuries climbed after the Federal Reserve signaled that inflation remains persistently below its target even as the economy picks up steam.

The Bloomberg Dollar Spot Index held at the lowest in more than a year, while the 10-year Treasury yield extended losses after the Fed held rates steady and indicated it would start unwinding its balance sheet “relatively soon.” Stock markets in Asia rose after the Dow Jones Industrial Average closed at a record high, while Korean shares were boosted by earnings at Samsung Electronics Co. Faster-than-expected sales growth at Facebook Inc. spurred a surge in its shares, buoying Nasdaq 100 Index futures.

The Fed said inflation remains below the central bank’s 2 percent target even as near-term risks to the economic outlook appear balanced, signaling it intends to kick off the long-awaited reduction in its $4.5 trillion balance sheet in September and fueling speculation the central bank won’t rush to raise rates.

Spot gold touched a session high after the Federal Reserve left its benchmark policy rate unchanged and said it’s “monitoring inflation developments closely.”

“Near-term risks to the economic outlook appear roughly balanced,” the Federal Open Market Committee said in a statement Wednesday following a two-day meeting in Washington. The statement highlighted that a period of weak inflation continues. “On a 12-month basis, overall inflation and the measure excluding food and energy prices have declined and are running below 2 percent.”

Fed fund futures are pricing in a 39 chance of an interest rate increase by year-end, down from 45 percent before the Fed’s statement. Gold has been little changed this month as traders await clues from the central bank on the course of monetary policy.

“The gold price is firmly in the green territory as traders believe that the Fed is not going to increase the interest rate,” Naeem Aslam, chief market analyst at Think Markets U.K. Ltd., said in an email. “The main reason is that inflation is so low.”

Bullion for immediate delivery rose 0.5 percent to $1,256.19 an ounce at 2:27 p.m. New York time.

(*source Bloomberg)

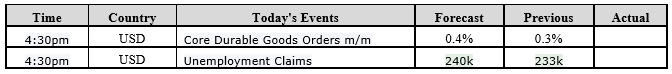

Data – Forthcoming Release

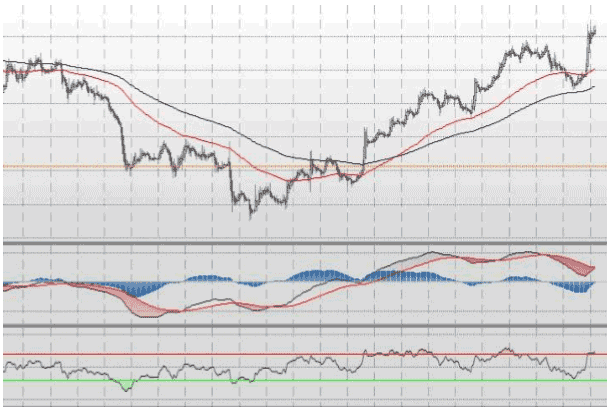

Technical Outlook and Commentary: Gold

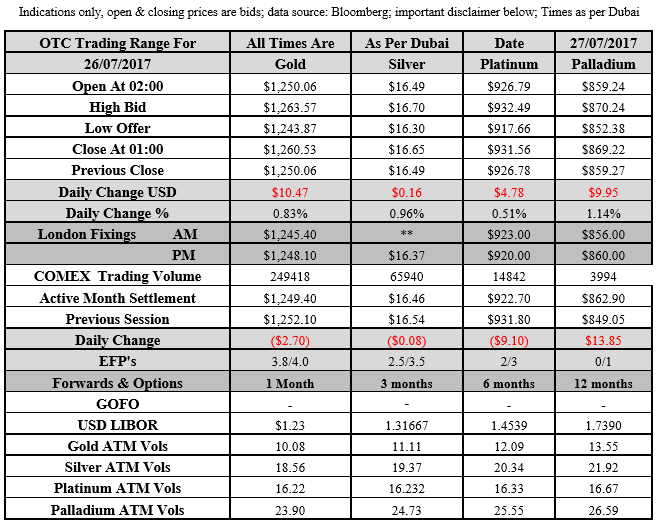

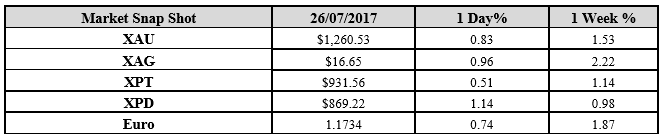

Gold for Spot delivery was closed at $1260.53 an ounce; with gain of $10.47 or0.83 percent at 1.00 a.m. Dubai time closing, from its previous close of $1250.06

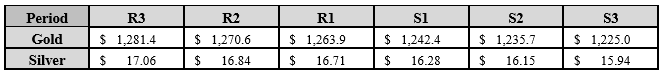

Spot Gold technically seems having resistance levels at 1263.9 and 1270.6 respectively, while the supports are seen at $1242.4 and 1235.7 respectively.

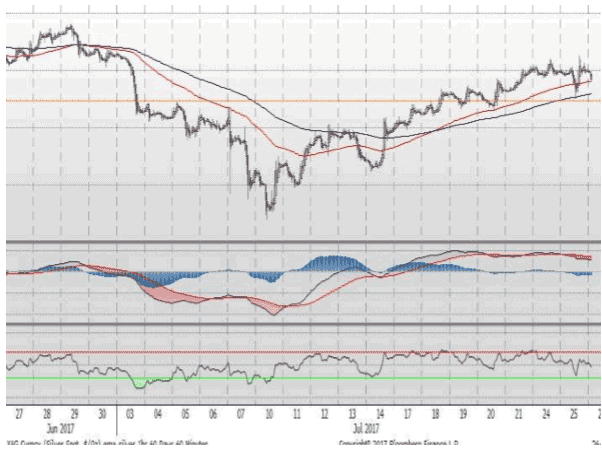

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.65 with the gain of $0.16 or 0.96 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.49

The Fibonacci levels on chart are showing resistance at $16.71 and $16.84 while the supports are seen at $16.28and $ 16.15 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply