Precious Metals Market Report

Thursday 27 April, 2017

Fundamentals and News*

White House Unveils Opening Bid for ‘Biggest Tax Cut’

The White House made its opening bid for what officials called the “biggest tax cut” in U.S. history — with cuts that would benefit businesses, the middle class and certain high-earning individuals — but left unanswered questions about whether the plan would be paid for, or how.

A list of goals for the tax overhaul, unveiled by President Donald Trump’s top economic adviserGary Cohn and Treasury Secretary Steven MnuchinWednesday, calls for slashing the federal income-tax rate to 15 percent for corporations, small businesses and partnerships of all sizes. It alsoimposes a one-time tax on about $2.6 trillion in earnings that U.S. companies have parked overseas. The plan would end the taxation of corporations’ offshore income by moving to a territorial system, in which most foreign profits would be exempt from U.S. taxes. Currently, the U.S. taxes business income no matter where it’s earned.

On the individual side, it proposes condensing the existing seven income-tax rates to just three, cutting the individual top rate to 35 percent from 39.6 percent. It would also end a 3.8 percent net investment income tax that applies only to individuals who earn more than $200,000 a year, repeal the alternative minimum tax and eliminate the estate tax, which currently applies only to estates worth more than $5.49 million for individuals and $10.98 million for couples.

At the same time, the plan would eliminate the federal income-tax deductionallowed for state and local taxes — a provision that would hit high earners in high-tax states, including New York and New Jersey. The only itemized deductions that would be preserved under the plan would be for home mortgage interest and charitable contributions.

“We are determined to move as fast as we can and get this done this year,” Mnuchin said.

The move to tax partnerships, limited liability companies and other so-called “pass-throughs” at 15 percent would represent a major tax cut for many businesses — from mom-and-pop grocers to hedge funds — including Trump’s own business empire. Under current law, those companies pass their earnings and deductions through to their owners, who then are taxed at their individual income tax rates.

(*source Bloomberg)

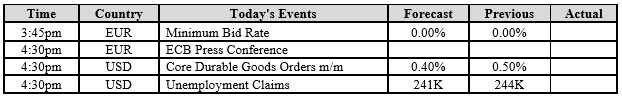

Data – Forthcoming Release

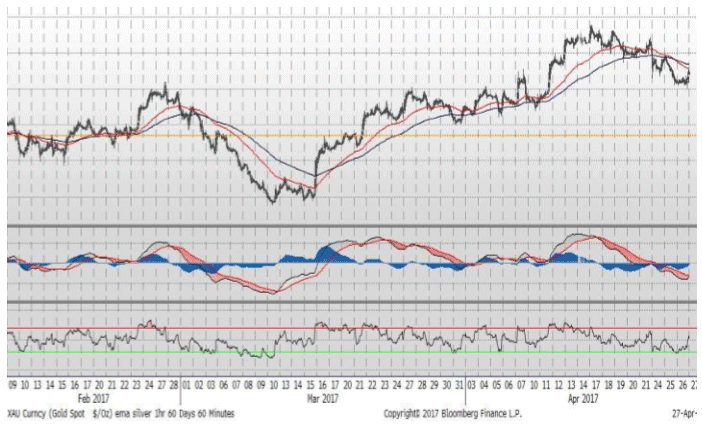

Technical Outlook and Commentary: Gold

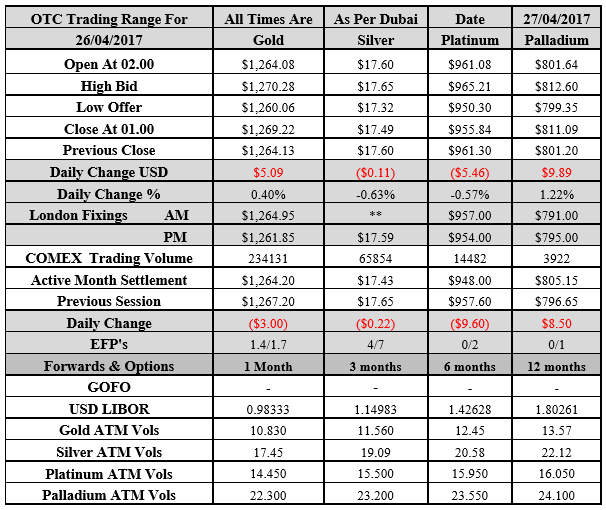

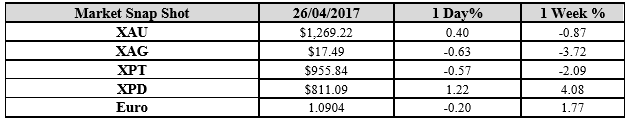

Gold for Spot delivery was closed at $1269.22 an ounce; with gain of $5.09 or 0.40 percent at 1.00 a.m. Dubai time, from its previous close of $1264.13

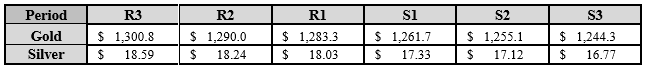

Spot Gold technically seems having resistance levels at 1283.3 and 1290 respectively, while the supports are seen at $1261.7 and 1255.10 respectively.

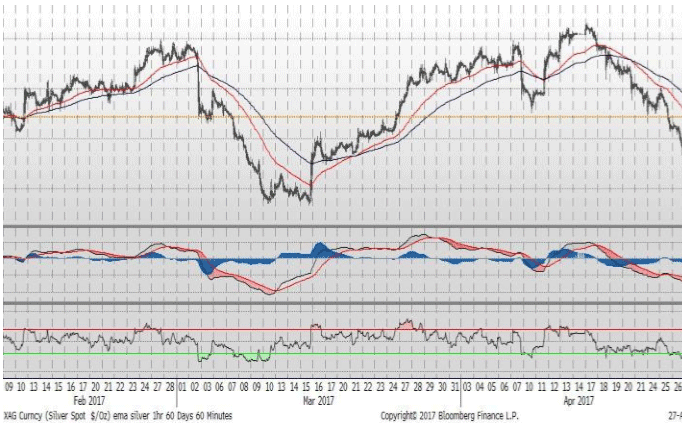

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.49 an ounce; with loss of 0.11 cent or -0.63 percent at 1.00 a.m. Dubai time, from its previous close of $17.60

The Fibonacci levels on chart are showing resistance at $18.03 and $18.24 while the supports are seen at $17.33 and $ 17.12 respectively

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply