Precious Metals Market Report

Wednesday 26 July, 2017

Fundamentals and News*

Stocks Extend Global Rally on Earnings, Bonds Fall

Positive corporate earnings and improving business confidence in Germany, Europe’s largest economy, spurred a rally in global equities and dragged bonds lower as the Federal Reserve prepares to conclude its policy meeting.

Equity-index futures indicated an advance in U.S. and European stocks will extend to Asia on Wednesday after earnings from Caterpillar Inc. and McDonald’s Corp. led to outsize gains in the Dow Jones Industrial Average. The euro held near the highest in almost two years after German business confidence data beat expectations. Oil rose above $48 a barrel for the first time since early June.

More than 80 percent of S&P 500 companies have delivered earnings that have beaten forecasts so far this reporting period, helping to support optimism in the global economy and bringing down volatility levels to fresh record lows. Investors are looking for clues from the Fed on how it plans to reduce the balance sheet, with policy makers seen keeping interest rates on hold as the U.S. central bank meeting concludes on Wednesday. Inflation data in Australia will be closely watched ahead of a speech by the central bank chief there.

June quarter inflation data is due in Australia followed by a lunchtime speech on the labor market and monetary policy from central bank Governor Philip Lowe.

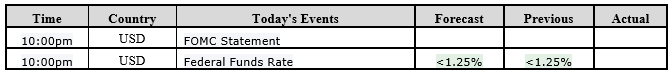

Fed policy makers will deliver their rate decision on Wednesday. The central bank will unveil the timing of its balance sheet unwind in September and wait until December to raise interest rates again, according to a Bloomberg survey of 41 economists. More on that here.

Donald Trump’s son and former Trump campaign Chairman Paul Manafort will go before Senate committees on Wednesday.

The U.S. economy probably gained traction in the second quarter as spending by American consumers picked up after a lull early this year.

Here are the main moves in markets:

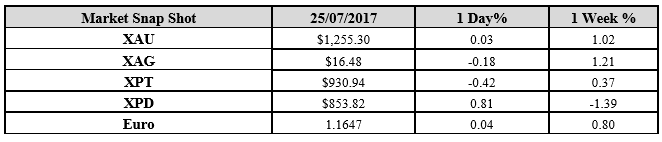

The euro held at $1.1647.

The Bloomberg Dollar Spot Index rose 0.2 percent on Tuesday.

The yen traded at 111.87 per dollar after declining 0.7 percent on Tuesday in its first retreat in more than a week.

West Texas Intermediate crude rose 1.3 percent in early trading, extending a 3.3 percent surge, its largest jump since November. Crude inventories declined by 10.2 million barrels last week in an American Petroleum Institute report released Tuesday, people familiar with the data said.

Copper posted its highest close in more than two years on Tuesday. The metal for three-month delivery rose 3.3 percent to settle at $6,225 a metric ton in London

(*source Bloomberg)

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

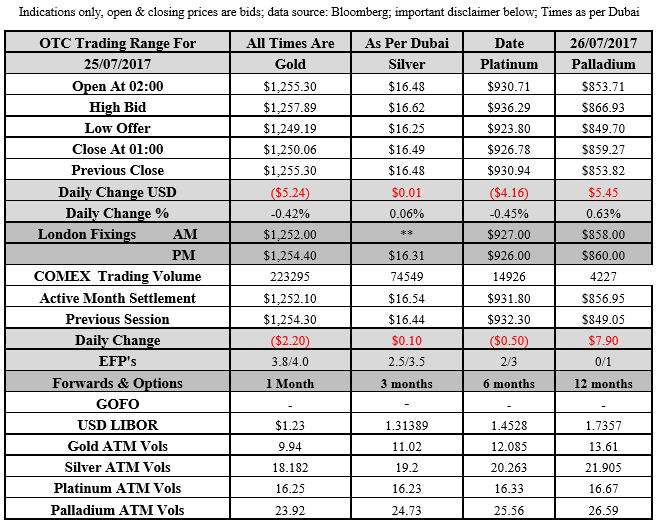

Gold for Spot delivery was closed at $1250.03 an ounce; with a loss of $5.24 or 0.42 percent at 1.00 a.m. Dubai time closing, from its previous close of $1255.30

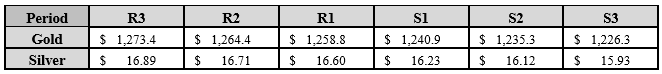

Spot Gold technically seems having resistance levels at 1258.8 and 1264.4 respectively, while the supports are seen at $1240.9 and 1235.3 respectively.

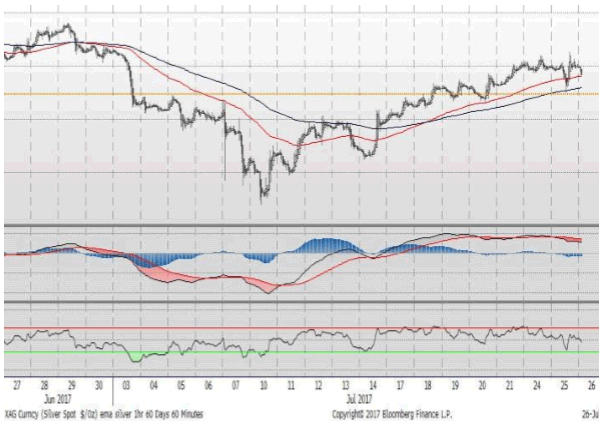

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.49 with the gain of $0.01 or 0.06 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.48

The Fibonacci levels on chart are showing resistance at $16.60 and $16.71 while the supports are seen at $16.23and $ 16.12 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply