Precious Metals Market Report

Friday 24 March, 2017

Fundamentals and News

Reviving King of Gold Means Getting Mine Workers Off Their Knees

(Bloomberg)

During his early years as a miner in South Africa, Joas Mahanuque spent six hours a day on his knees drilling for Impala Platinum Holdings Ltd. The dust-filled tunnels half a mile underground were too low for him to stand, and temperatures reached 105 degrees Fahrenheit (40 degrees Celsius).

Today, he has essentially the same job 2.5 kilometers (1.5 miles) beneath the surface for Gold Fields Ltd. But unlike most of the precious-metals miners in the country, Mahanuque sits comfortably atop a new 7-ton vehicle, using a joystick to control an 8-foot drill as ventilated air blows behind him.

“It’s not hard,” the 37-year-old said while taking a break under the bright tunnel lights of South Deep, the country’s only fully mechanized underground gold mine. “You just sit and operate and make money.”

If only it was that easy for the rest of the once dominant South African gold industry. After more than a century as the world’s top producer, the country has slipped to No. 7 over the past decade. Mines are deep, labor intensive and are being developed with mostly drill-and-blast methods little changed since the 1950s, which means costs have soared and output has dropped

Gold prices have visited the plus and minus columns so far Wednesday, in choppy, quieter trading. The marketplace is anxiously awaiting an expected U.S. House of Representatives vote later Thursday on the repeal of Obamacare. If that vote to repeal and replace the “Affordable Care Act” fails, the Trump Administration could be in trouble in the coming months, regarding its intended plans to lower taxes and eliminate government regulations. A failure by the House to repeal the act could also pressure the stock market, which in turn should benefit the safe-have gold market. April gold was last down $2.20 an ounce at $1,247.60

(*source Bloomberg)

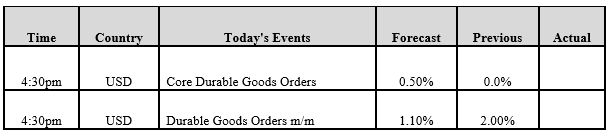

Data – Forthcoming Release

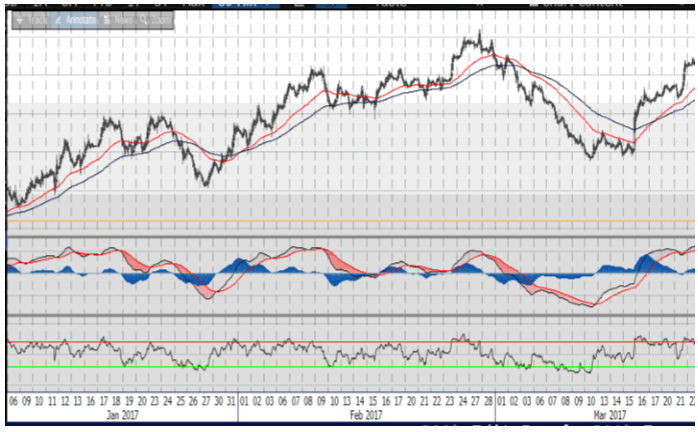

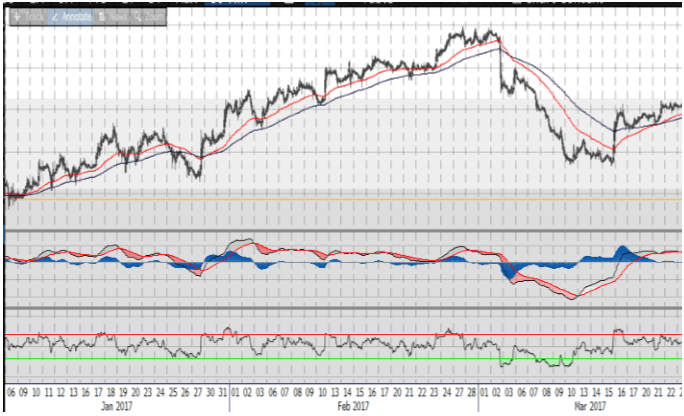

Technical Outlook and Commentary: Gold

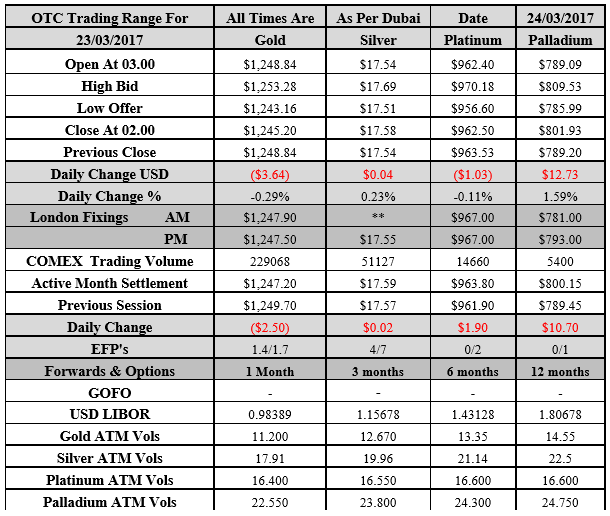

Gold for Spot delivery was closed at $1245.20 an ounce; with loss of $3.64 or -0.29 percent at 2.00 a.m. Dubai time closing, from its previous close of $1248

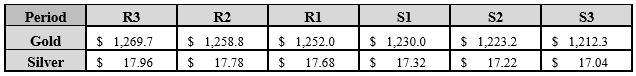

Spot Gold technically seems having resistance levels at 1252 and 1258.8 respectively, while the supports are seen at $1230 and 1223.20 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.58 an ounce; with loss of $0.04 or 0.23 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.54

The Fibonacci levels on chart are showing resistance at $17.68 and $17.78 while the supports are seen at $17.32 and $ 17.22 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply