Precious Metals Market Report

Monday 22 May, 2017

Fundamentals and News*

Wild Commodity Markets Hurt Gold Bears While Crop Bets Pay Off

The turbulence that’s rocked commodity markets caused headaches for gold investors, while funds betting on crops were able to get ahead of price declines.

A measure of historical volatility rebounded for the Bloomberg Commodity Index, which tracks returns for 22 components. Turmoil has reigned across raw materials as Brazil’s latest political crisis sparked steep declines for the real, raising prospects of increased farm exports. At the same time, deepening controversy over U.S. President Donald Trump’s connections with Russia sent investors hunting for haven assets, giving a surprise boost to gold. Hedge funds were well-positioned for the drop in agriculture, getting more bearish on soybeans and coffee. Still, the money managers miscalculated ongold.

Here’s a closer look at some of the biggest moves for commodity holdings:

Soybean Payoff

July soybean futures fell to a one-month low on May 18 as another political scandal in Brazil spurred the real’s biggest slide since 1999. The currency drop sparked the nation’s farmers to sell the oilseed at a “once in a decade” pace, according to Vitor Minella, who works in Mato Grosso state at Meneguetti, a brokerage. A weaker real prompts growers to offer more crops that are priced in dollars globally.

Hedge funds were able to anticipate the price losses. As of May 16, money managers held a soybean net-short position, or the difference between bets on a price decline and wagers on a rise, of 36,523 futures and options, according to U.S. Commodity Futures Trading Commission data released three days later. That compares with 34,335 a week earlier.

Gold Wagers

The metal posted its best week in more than a month on Friday as political turmoil in the U.S. and Brazil spurred gyrations in stocks and currencies. Unfortunately for money managers, they lowered their bullion net-long positionby 30 percent, meaning that some of them missed out on the rally. The holdings fell to 69,923 contracts, an eight-week low, the CFTC data shows.

(*source Bloomberg)

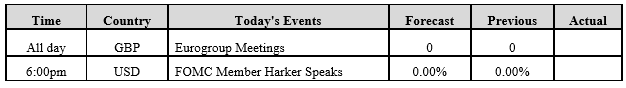

Data – Forthcoming Release

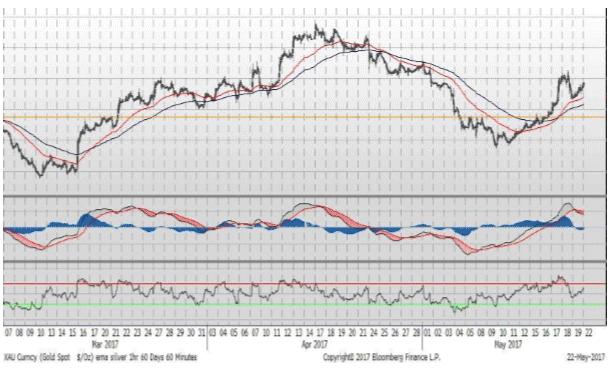

Technical Outlook and Commentary: Gold

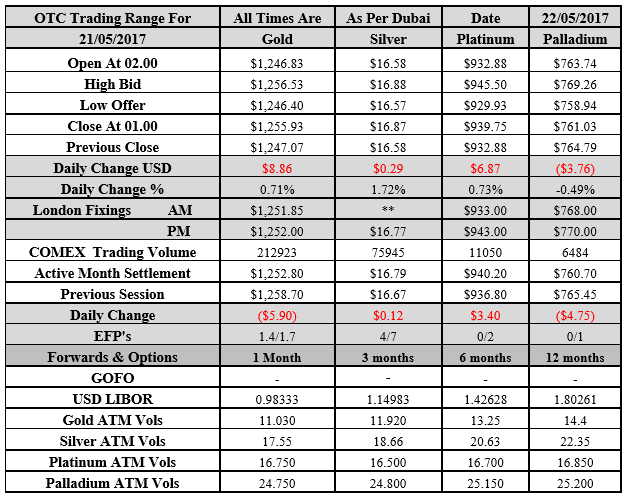

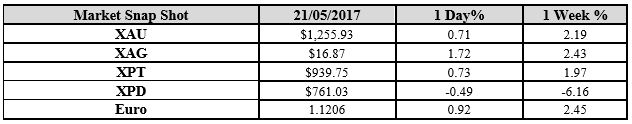

Gold for Spot delivery was closed at $1255.93 an ounce; with little gain of $8.87 or 0.71 percent at 1.00 a.m. Dubai time closing, from its previous close of $1247.07

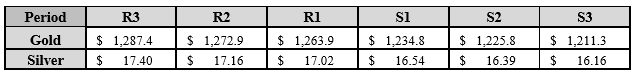

Spot Gold technically seems having resistance levels at 1263.9 and 1272.9 respectively, while the supports are seen at $1234.80 and 1225.8 respectively.

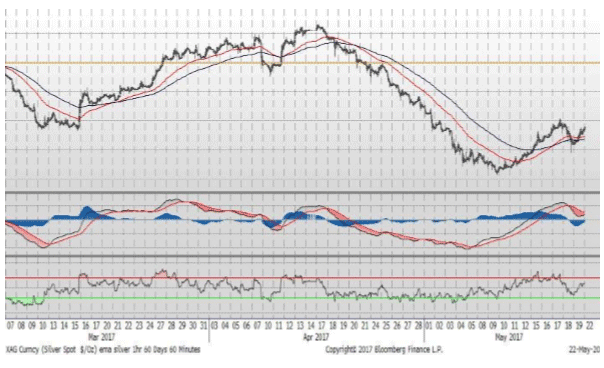

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.87 with gain of $0.29 or 1.72 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.58

The Fibonacci levels on chart are showing resistance at $17.02 and $17.16 while the supports are seen at $16.54 and $ 16.39 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply