Precious Metals Market Report

Thursday 22 June, 2017

Fundamentals and News*

U.S. Stocks Drop on Brent Bear Slump, Gold Rises: Markets Wrap

Most U.S. stocks fell as oil’s worsening slump weighed on energy and industrial shares, overshadowing fresh rallies in high flying technology and biotech companies.

Brent crude slid beneath $45 a barrel to join West Texas Intermediate in a bear market as stockpiles in America remain above seasonal averages and Libya resumed some production. That sent energy shares in the S&P 500 Index to the lowest level in two months. The equity benchmark almost eked out a gain as chipmakers led a rally in its biggest component, tech shares. Treasuries were virtually unchanged after erasing losses, while the dollar slipped.

Oil’s slide into a bear market is showing some signs of spilling over into other assets, with energy junk bonds at the cheapest since November, though contagion remains largely contained. Persistently lower commodity prices raises the specter that inflation will have trouble rising toward levels central banks prefer even as the Federal Reserve reiterates its intention to tighten monetary policy.

The rebound in biotech comes on signs that the Trump administration has softened its stance on drug pricing and as breakthroughs such as Clovis Oncology Inc.’s cancer treatment renew investor interest.

Brent crude entered a bear market, plunging below $45 a barrel for the first time since November as skepticism that a supply glut will ease worsens. The world benchmark settled $1.20 lower at $44.82, down 22 percent from its January peak.

West Texas oil lost almost $1 to settle at $42.53. Futures tumbled more than 2 percent on Tuesday, touching the lowest since August.

Gold futures rose 0.2 percent to $1,245.96 an ounce after falling for five straight days.

Zinc rose the most in five months, leading other industrial metals higher amid signs of shrinking global supply.

(*source Bloomberg)

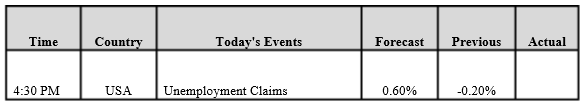

Data – Forthcoming Release

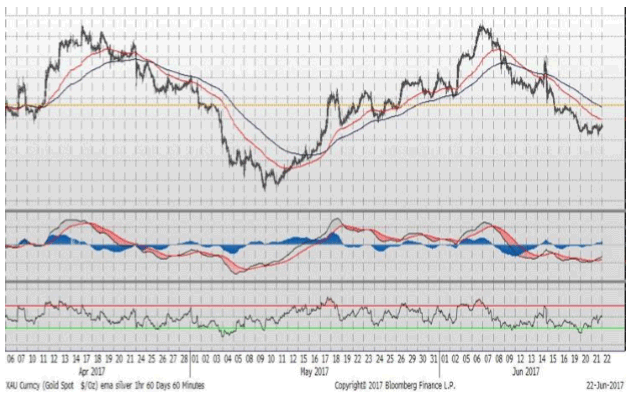

Technical Outlook and Commentary: Gold

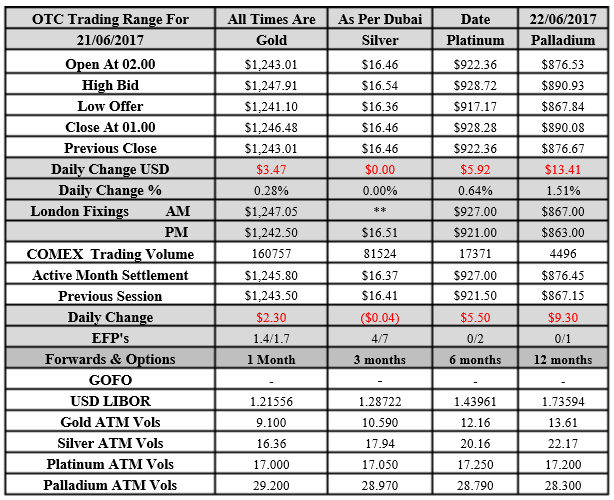

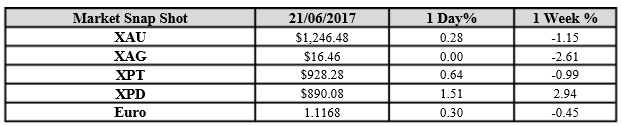

Gold for Spot delivery was closed at $1246.48 an ounce; with GAIN of $3.47 or 0.28 percent at 1.00 a.m. Dubai time closing, from its previous close of $1243.01

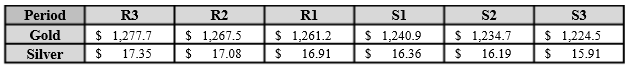

Spot Gold technically seems having resistance levels at 1261.2 and 1267.5 respectively, while the supports are seen at $1240.9 and 1234.70 respectively.

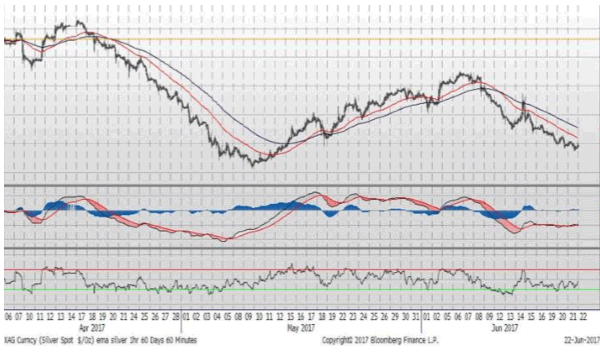

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.46 with no change of $0.00 or 0.00 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.46

The Fibonacci levels on chart are showing resistance at $16.91 and $17.08 while the supports are seen at $16.36 and $ 16.19 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply