Precious Metals Market Report

Friday 21 April, 2017

Fundamentals and News*

Downside Bund vs Depressed Upside Gold May Cover French Outcomes

Bund downside may increase with Melenchon unable to make further ground in French election polls, while depressed gold upside optionality could take care of tail risks, Bloomberg strategist Tanvir Sandhu writes.

Downside bund options may come into focus amid the coiling of risk with June 160.50 put equivalent to generic yield of about 40bp expiring May 26

Gold implieds trading at relatively low levels given depressed realized vols in both gold and U.S. real rates, even as geopolitical tensions in Syria and North Korea and risk of potential U.S. government shutdown remain; see chart here

Low entry point for OTM short-dated gold call options may offset downside costs on bunds in case of rise in political risks, with three-month 25-delta call at 14 vol, in the bottom quartile of 2year range

Cross vol gold spread with bunds may appeal given the low cost of optionality in gold and its attractiveness as a hedging tool against risk-off events relative to SPX

Conviction for outright bund shorts remains limited as French political risk stays fluid and with high number of undecided voters; extreme tail risk is that both Le Pen and Melenchon get through the first round o Implied probability of Le Pen victory based on betting odds is at the lows while the recent recovery of Fillon in the polls brings back the probability of Fillon vs Macron, which will see bund political risk premia collapse if realized

NOTE: Tanvir Sandhu is an interest-rate and derivatives strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

Franklin Gold and Precious Metals Fund added Asanko Gold Inc. to its investments and exited GResources Group Ltd. in the first quarter.

The fund, led by Fred Fromm and Stephen Land, boosted its investment in Alamos Gold Inc. and cut OceanaGold Corp., according to a quarterly update by the investment company analyzed by Bloomberg Global Data. Newcrest Mining Ltd. was the biggest holding, representing 5.3 percent of the fund.

(*source Bloomberg)

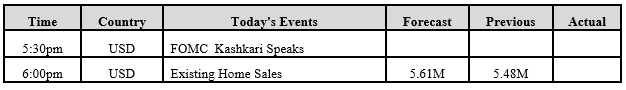

Data – Forthcoming Release

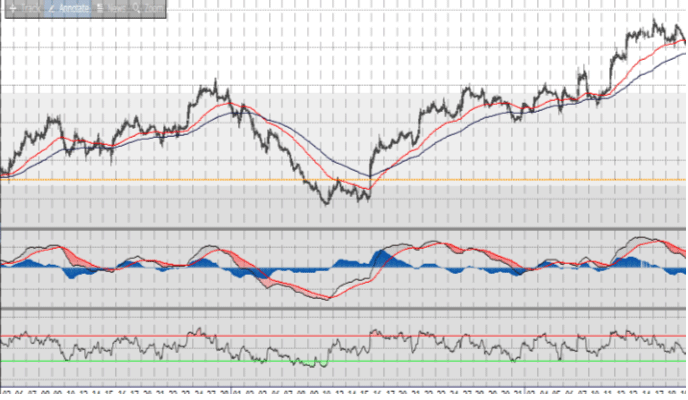

Technical Outlook and Commentary: Gold

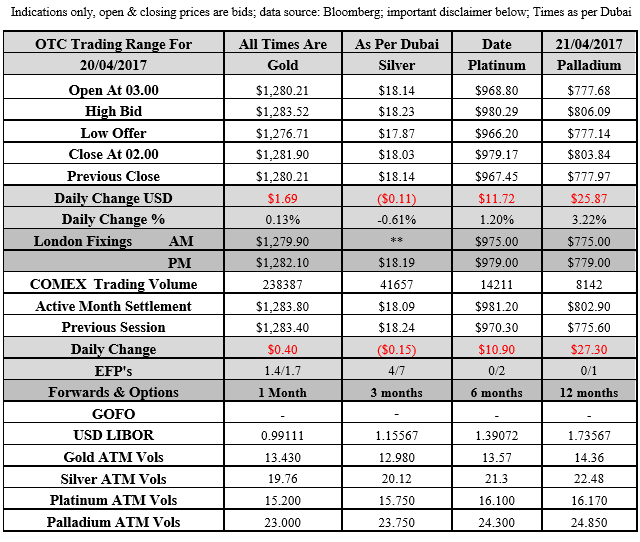

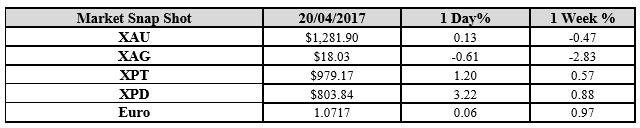

Gold for Spot delivery was closed at $1281.90 an ounce; with gain of $1.69 or 0.13 percent at 1.00 a.m. Dubai time, from its previous close of $1280.21

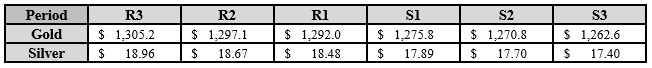

Spot Gold technically seems having resistance levels at 1292 and 1297.1 respectively, while the supports are seen at $1275.8 and 1270.8 respectively.

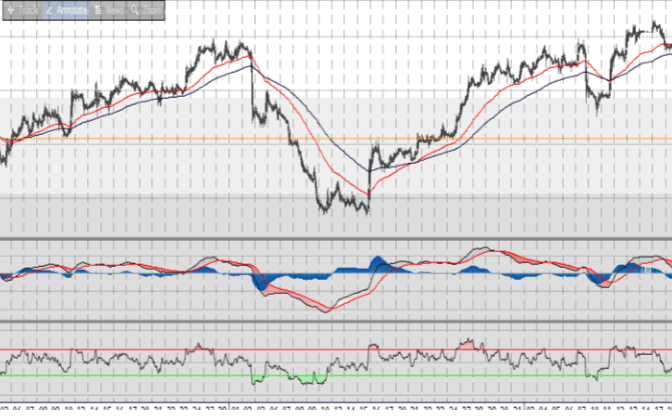

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.03 an ounce; with a loss of 0.11 cent or -0.61 percent at 1.00 a.m. Dubai time, from its previous close of $18.14

The Fibonacci levels on chart are showing resistance at $18.48 and $18.67 while the supports are seen at $17.89 and $ 17.70 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply