Precious Metals Market Report

Wednesday 19 April, 2017

Fundamentals and News*

Venezuela Lawmakers Ask Wall Street to Stop Aiding Maduro

Venezuela’s opposition is reaching out to Wall Street banks to dissuade them from helping the country monetize its $7.7 billion in gold reserves.

Venezuela is going to try to stave off default by seeking to swap its gold reserves into cash, and any investment bank that helps will be effectively “supporting a government recognized by the international community as dictatorial,” according to a letter the opposition-led congress sent Monday to top banks. Lawmakers also approved a measure today that they say would nullify any government debt issuance, as well as any debt swaps and pledges of gold as collateral, not explicitly approved by congress.

“The national government, through the central bank, is going to try to swap gold held as reserves for dollars to stay in power unconstitutionally,” according to the letter signed by National Assembly President Julio Borges. “I have the obligation to warn you that by supporting such a gold swap you would be taking actions favoring a government that’s been recognized as dictatorial by the international community.”

Venezuelan President Nicolas Maduro has been battling lawmakers for control over the nation’s finances since the opposition won control of the National Assembly in December 2015 elections, riding a wave of anger over triple-digitinflation and chronic shortages of basic staples. Investors are left trying to gauge the likelihood that the country will continue servicing its debt amid a dollar shortage worsened by the collapse in oil prices.

Lawmaker Angel Alvarado, a member of the National Assembly’s Finance Committee, said the letter has gone to banks including Citigroup Inc., Goldman Sachs Group Inc. and Bank of America Corp.

(*source Bloomberg)

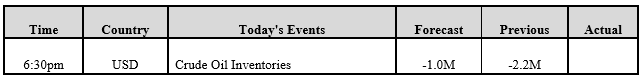

Data – Forthcoming Release

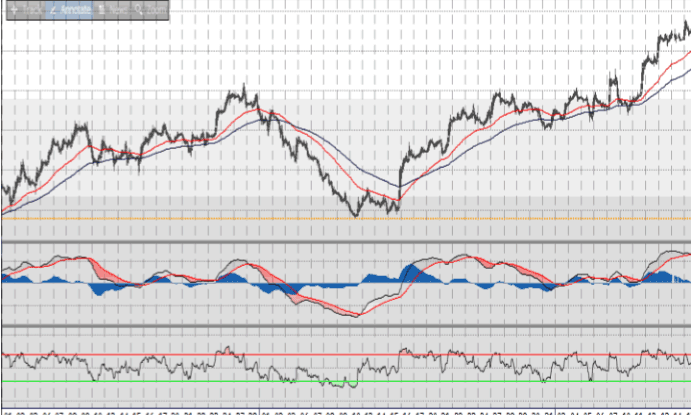

Technical Outlook and Commentary: Gold

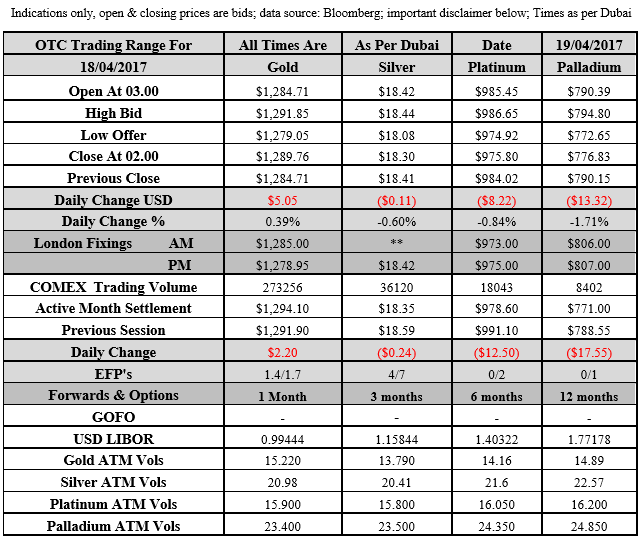

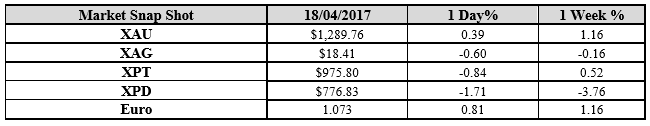

Gold for Spot delivery was closed at $1289.76 an ounce; with gain of $5.05 or 0.39 percent at 1.00 a.m. Dubai time, from its previous close of $1284.71

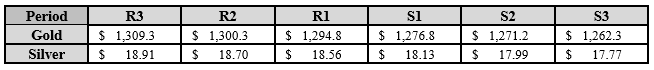

Spot Gold technically seems having resistance levels at 1294.8 and 1300.3 respectively, while the supports are seen at $1276.8 and 1271.2 respectively.

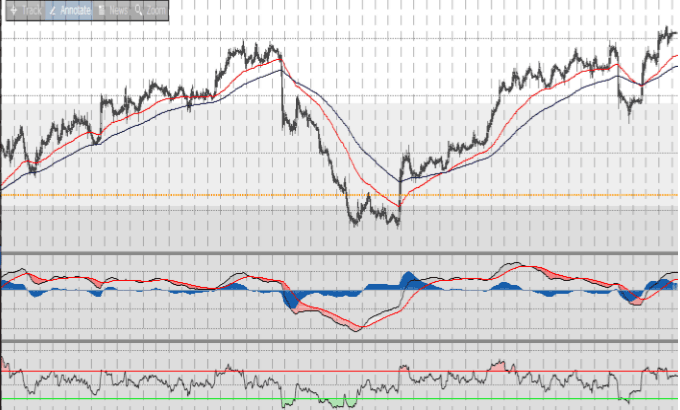

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.30 an ounce; with loss of 0.11cent or -0.60 percent at 1.00 a.m. Dubai time, from its previous close of $18.41

The Fibonacci levels on chart are showing resistance at $18.56 and $18.70 while the supports are seen at $18.13 and $ 17.99 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply