Precious Metals Market Report

Wednesday 17 May, 2017

Fundamentals and News*

Yen Climb to Weigh on Japan Stocks; Gold Gains: Markets Wrap

U.S. dollar remains weak, trading at early-November low

Gold is up for a fifth day; S&P 500 remains close to record

The dollar held losses as investors assessed the political risk engulfing President Donald Trump’s administration. That looks set to weigh on shares in Tokyo, with the outlook for exporters being curbed by a stronger yen.

Equity-index futures in Japan pointed lower, with contracts on benchmark gauges in Australia and Hong Kong showing small gains. The greenback held onto losses triggered by a report the U.S. president shared terrorism intelligence with Russian officials, an action he has since defended. The euro traded at the strongest level since November.

Crude reversed gains for the first time in five days.

Weaker-than-anticipated U.S. housing starts added to concerns that growth in the world’s largest economy is fragile, while data from China earlier this week showed a slowdown in industrial production. Actions by Trump’s administration are adding to doubts about its ability to boost infrastructure spending and cut taxes.

Japanese machine orders and industrial production data is due Wednesday.

OPEC’s internal Economic Commission Board meets in Vienna on Wednesday to discuss the market in preparation for the group’s formal meeting on May 25. The U.S. Energy Information Administration is projected to report that crude stockpiles declined by 2.67 million barrels in the week ended May 12, according to a Bloomberg survey of analysts.

Singapore exports and Malaysia CPI for April are due on Wednesday, and the Australian jobs report comes a day later.

Wednesday’s U.K. labor report may reveal pay rose 2.1 percent, down from 2.2 percent.

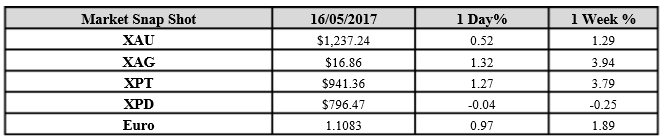

The euro traded at $1.1083, the strongest level since Nov. 9, after climbing 1 percent.

(*source Bloomberg)

Data – Forthcoming Release

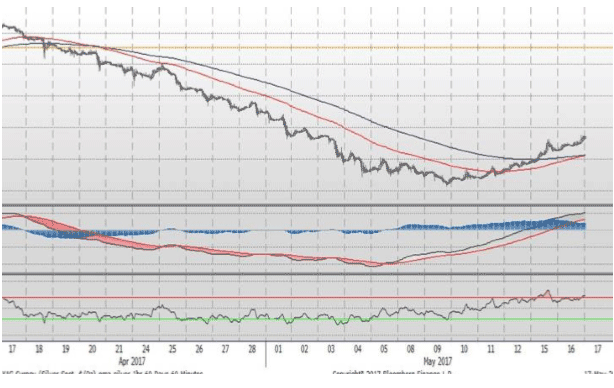

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1237.24 an ounce; with profit of $6.42 or 0.52 percent at 1.00 a.m. Dubai time closing, from its previous close of $1230.82

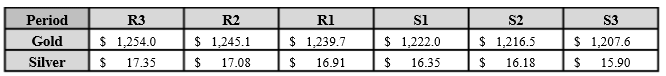

Spot Gold technically seems having resistance levels at $1239.7 and $1245.1 respectively, while the supports are seen at $1222.0 and $1216.5 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.86 with profit of $0.22 or 1.32percent at 1.00 a.m. Dubai time closing, from its previous close of $16.63

The Fibonacci levels on chart are showing resistance at $16.91 and $17.08 while the supports are seen at $16.35 and $ 16.18 respectively.

Resistance and Support Levels

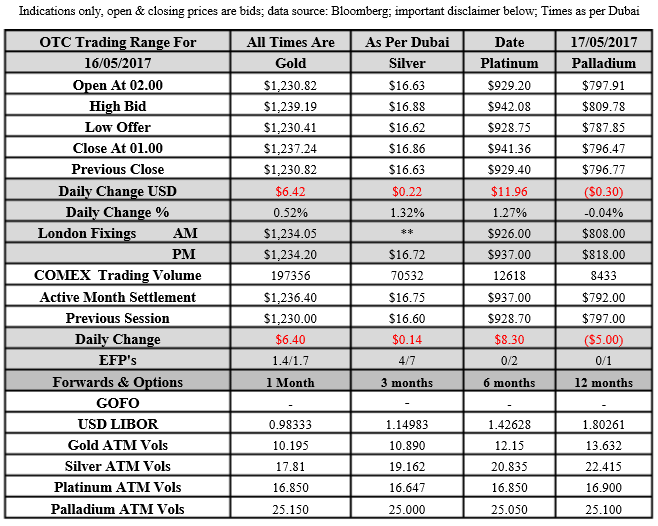

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply